Nordic Electricity Market – Q2 2025

The Nordic electricity market entered the second quarter of 2025 still adjusting to the new operational landscape brought by the go-live of the mFRR Energy Activation Market (EAM) on 4 March 2025. The introduction of EAM has left a clear footprint on market behaviour, price patterns, and reserve activations across the region.

The Nordic electricity market entered the second quarter of 2025 still adjusting to the new operational landscape brought by the go-live of the mFRR Energy Activation Market (EAM) on 4 March 2025. The introduction of EAM has left a clear footprint on market behaviour, price patterns, and reserve activations across the region.

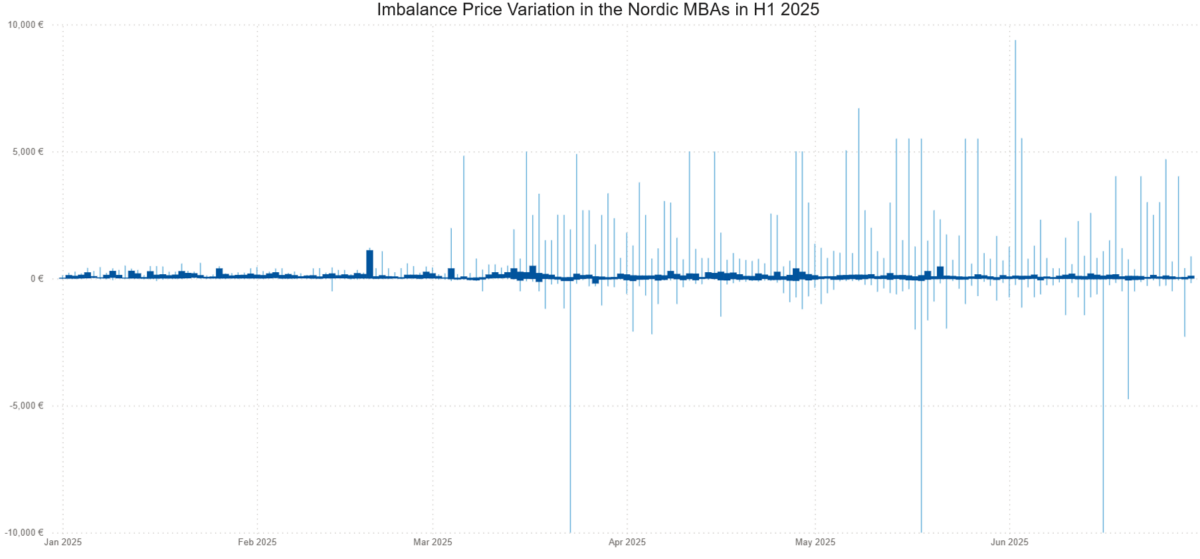

Volatility and Price Trends

Price volatility remained a defining feature of the market in Q2, mirroring the turbulence seen immediately after the EAM launch. 90 % of the 15-minute prices in all Nordic MBAs (blue bar) were still within reasonable boundaries. However, the top and bottom 5 % (light blue lines) of the imbalance prices have consistently shown significantly higher and lower prices starting from the 4 March 2025.

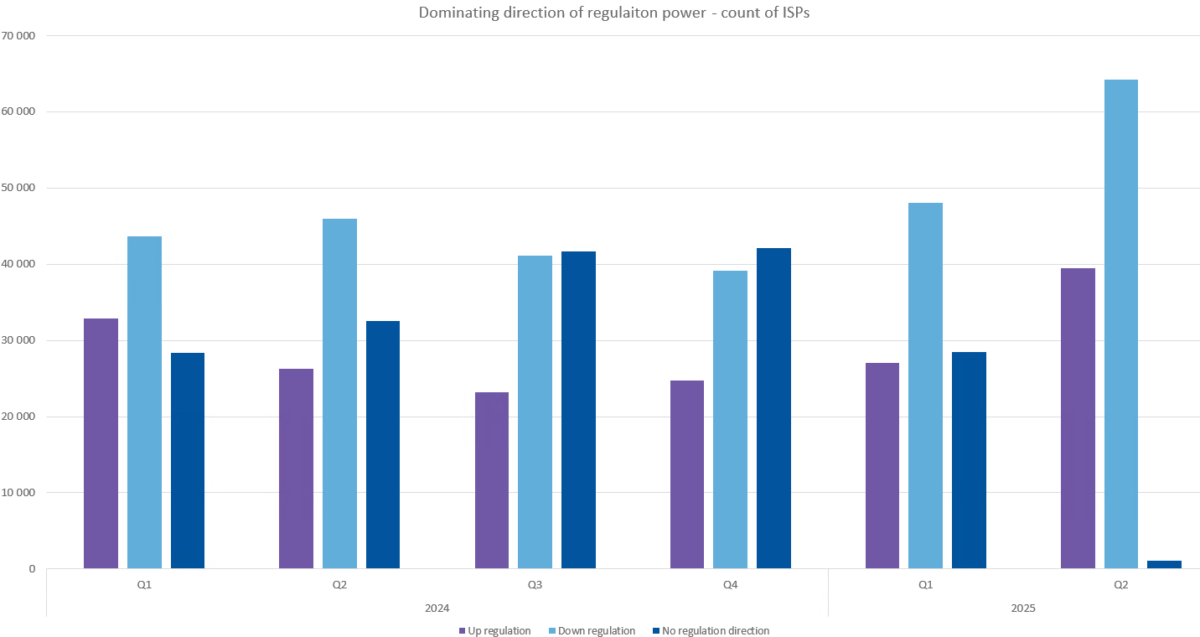

One of the most visible changes is the near disappearance of imbalance settlement periods (ISPs) without a defined regulation direction. Since the implementation of the new mFRR EAM, almost all ISPs now have a dominating regulation direction. Consequently, imbalance prices can be driven by very small volumes of activated reserves.

In order to reduce price spikes caused by small reserve volumes, Energinet took into use a tolerance band of 25 MW in Denmark on June 2nd, meaning any mFRR demand for up- or downregulation below this threshold are rounded down to a demand of 0 MW. Hence small activation volumes are not setting the imbalance price. Since the introduction the number of ISPs without a regulation direction in both DK1 and DK2 have again increased. Market observers are watching closely to see if other Nordic TSOs follow suit.

Negative imbalance prices have also become significantly more common this year. In both Denmark and Sweden, the number of ISPs with negative prices recorded in just the first half of 2025 has already surpassed the entire total for 2024. This shift underlines the growing frequency of market conditions where downward regulation is applied.

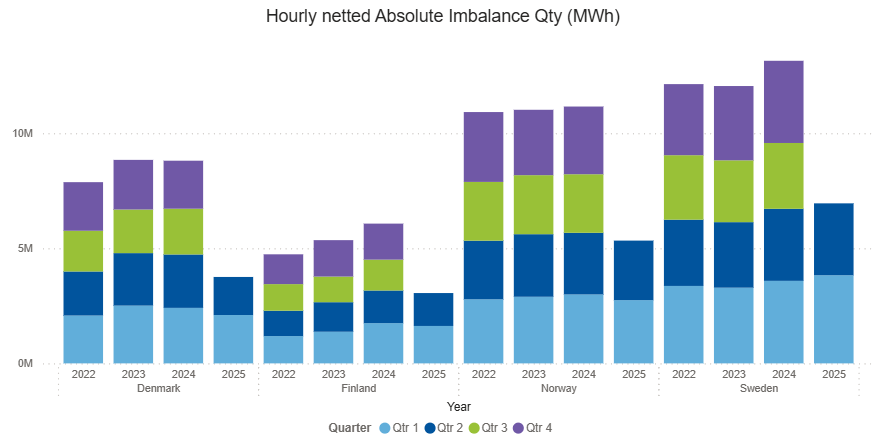

Imbalance Volumes

Over the past four years, H1 absolute imbalance volumes in the Nordic countries have shown diverging trends. Denmark peaked in 2023 before dropping sharply to its lowest level in the period, while Sweden has steadily increased since 2023, reaching a new high in 2025. Finland’s volumes remain elevated compared to earlier years despite a slight decline from 2024, and Norway’s levels have been largely stable, with 2025 matching those of 2022.

Focusing on Q2 2025 compared to Q2 2024, imbalance volumes fell in all countries except Sweden, where they were essentially unchanged. Sweden’s Q2 stability, however, contrasts with its higher H1 total, which was driven by elevated volumes earlier in the year. Denmark posted the largest year-on-year decrease (−29%), followed by Norway (−3%) and Finland (−1%), suggesting improved short-term balancing performance in much of the region.

Market participant adaptation

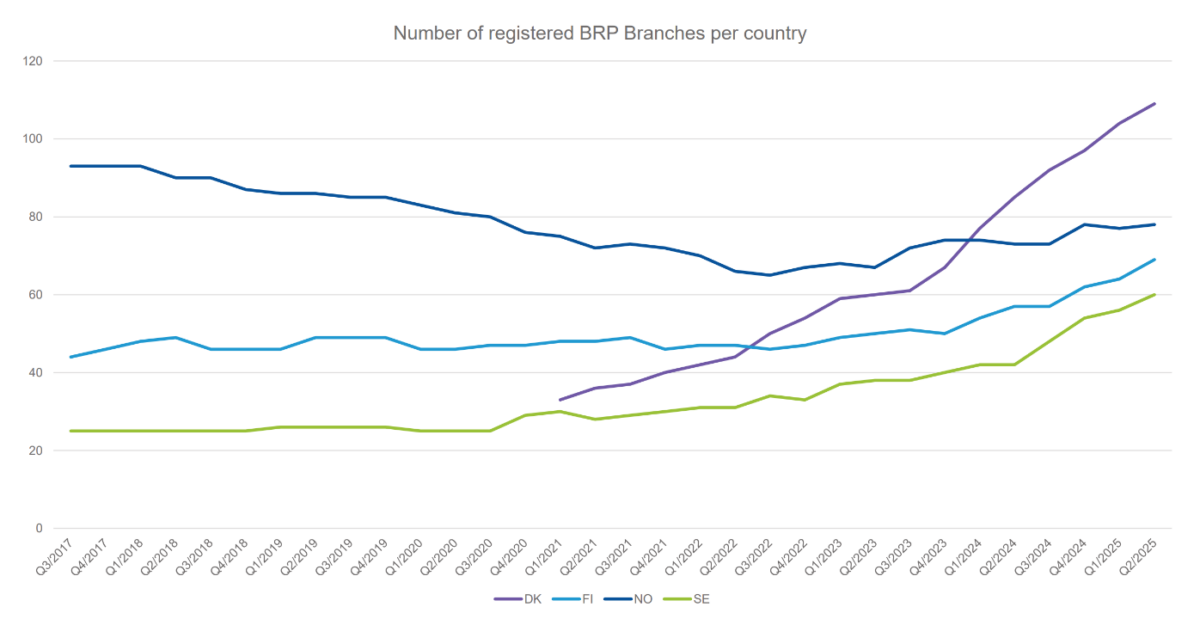

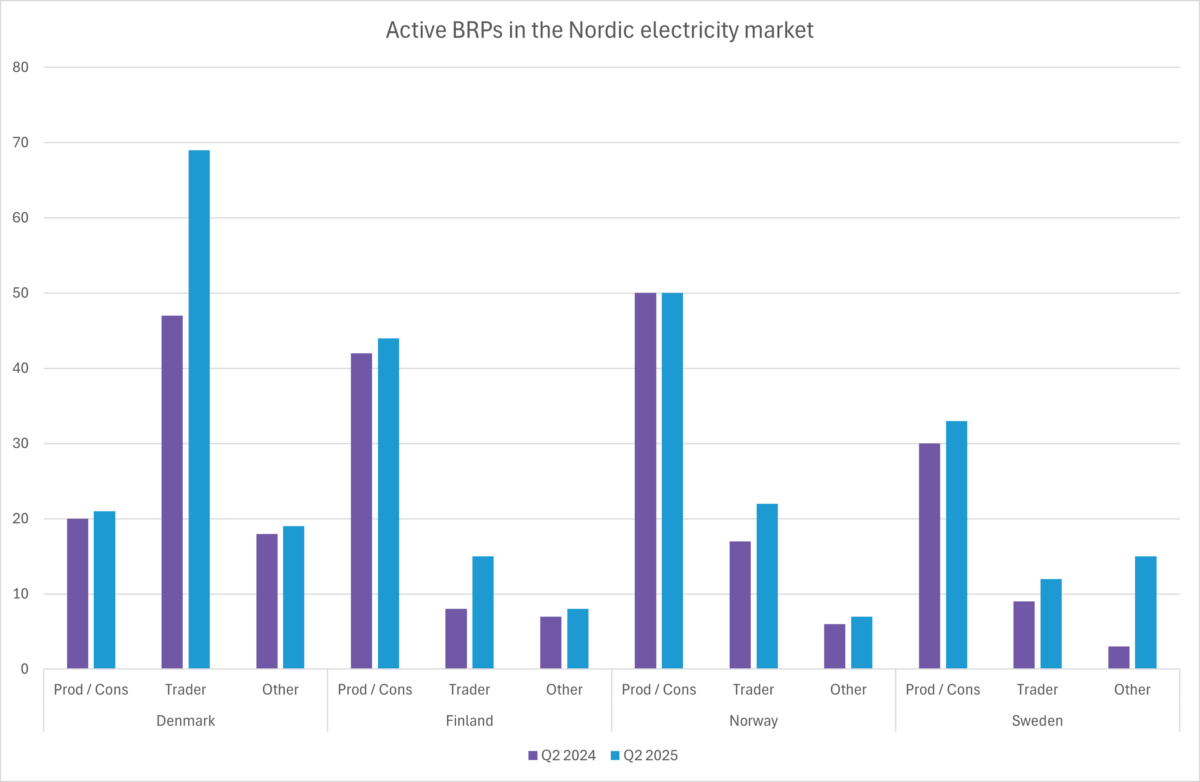

Q2 also marked continued growth in the number of Balance Responsible Parties (BRPs). Denmark led the way, accounting for most new market entrants.

The graph below divides BRPs crudely into categories based on their portfolio: Most of the new BRPs are traders without physical generation or consumption assets. Their activity is concentrated in the power exchange (PX) market, contributing to liquidity but not directly impacting physical balancing. This trader-heavy growth pattern is consistent across all four Nordic countries.

Year-on-year, the total number of BRP branches in the Nordic market grew by 63, while number of traders increased by 37, underscoring its ongoing attractiveness to trading-focused participants. Also, the number of BRPs with consumption and/or production in their portfolio grew slightly, as well as the Other category (BRPs with no settlement data for the period or only acting in the reserve market).

- Denmark saw the largest increase, mainly driven by Trader entities (+22).

- Finland more than doubled its trader BRPs (from 8 to 15)

- Norway had small gains, mostly from Traders (+5).

- Sweden had a notable rise in Other entities (+12), suggesting an increase in market parties inactive in the market.

Looking Ahead

The Nordic power market in 2025 has been shaped by regulatory changes and evolving operational realities following the EAM go-live. The persistence of high volatility, the sharp rise in negative price events, and the growing role of traders will all remain important themes to watch in the second half of the year.

From 1 October 2025, day-ahead trading will transition from hourly to 15-minute resolution. The change is set to improve market efficiency and sharpen price signals, supporting more accurate balancing of volatile generation and demand.