Handbook

Our handbook provides a comprehensive overview to the Nordic Imbalance Settlement Model from the market participant’s perspective. There are also available the unofficial translations of Handbook in Finnish, Norwegian and Swedish

Downloadables

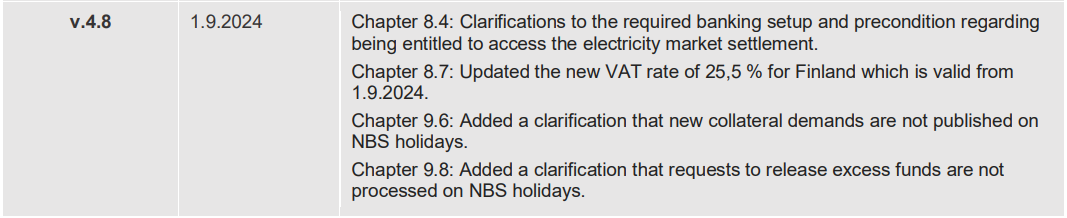

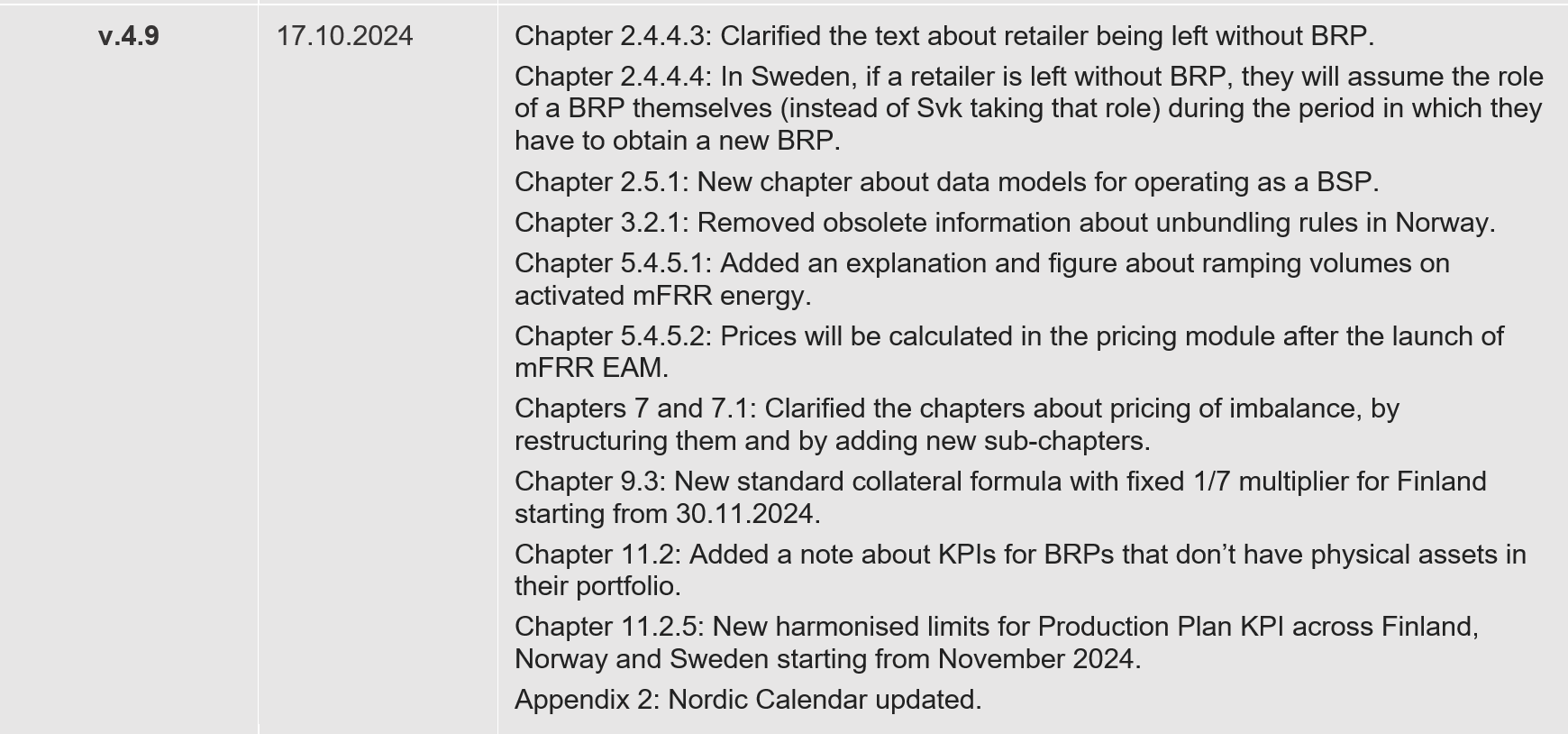

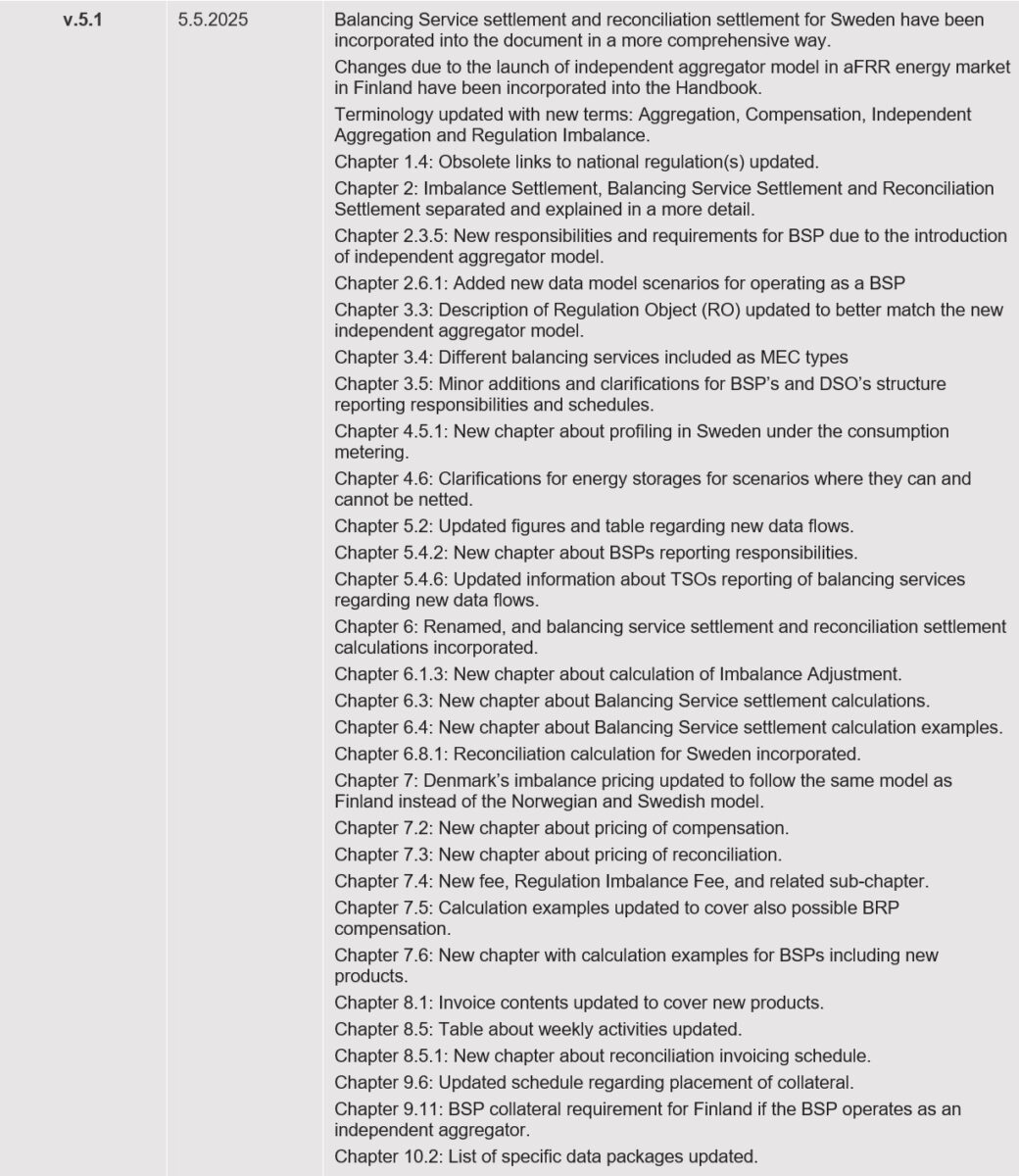

The newest version of the NBS Handbook (version 5.1) has been updated in May 2025.

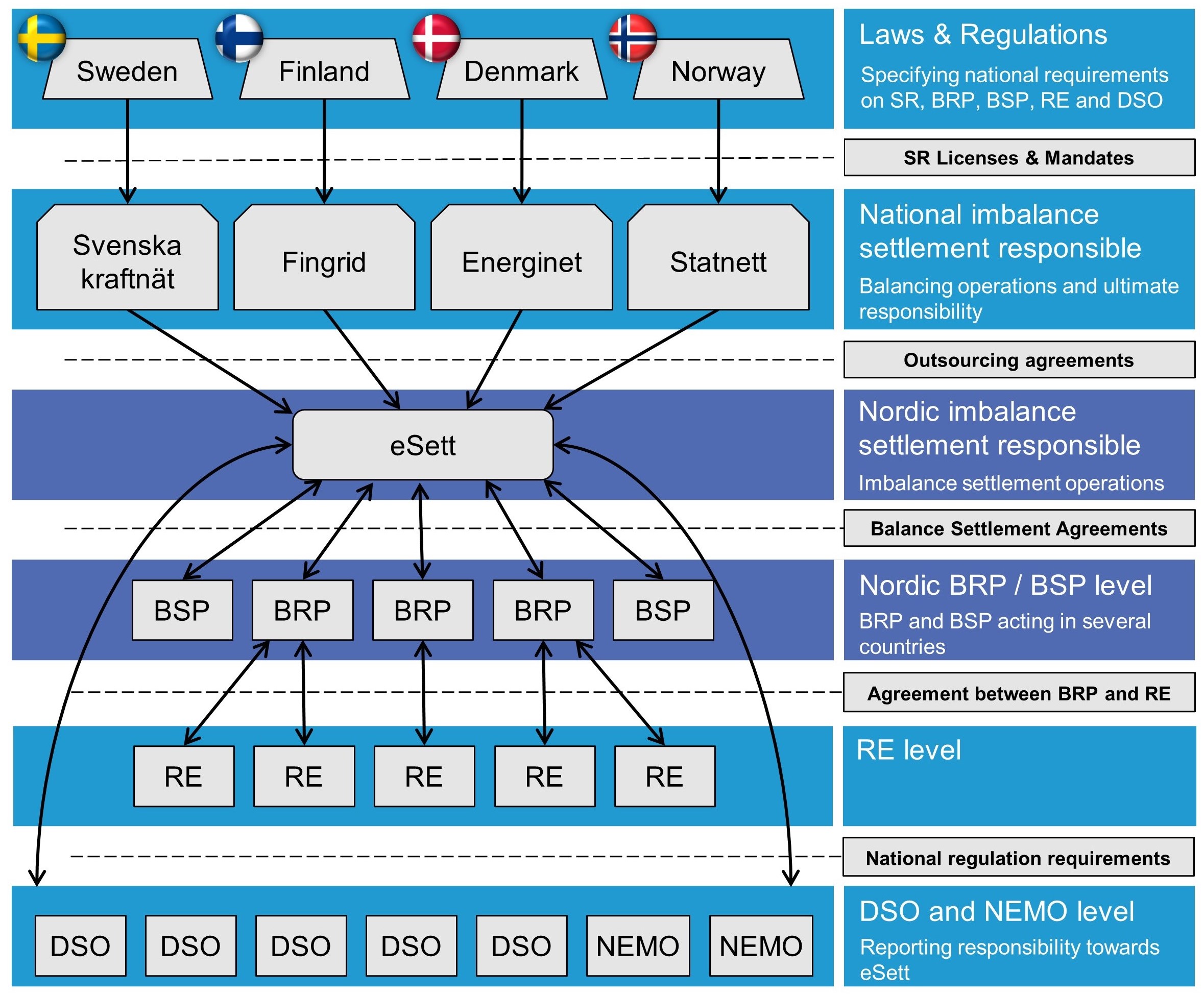

There must always be a balance between supply and consumption of electricity. To achieve this, the Transmission system operators (TSOs) use balancing power procured from the balancing power market. Imbalances arise from uncertainties in plans and from failures in generation, consumption and the grid. Imbalance settlement is therefore a necessary function in a commercial electricity market. Historically, Fingrid, Svenska kraftnät, Statnett and Energinet each have been operating their own imbalance settlement and been responsible for supervising the balance of the electricity systems in Finland, Sweden, Norway and Denmark respectively.

Today eSett Oy (Imbalance Settlement Responsible, ISR) organisation is responsible for performing imbalance settlement and invoicing BRPs for imbalances and BSPs for balancing services. eSett Oy (eSett) is owned by the four TSOs; Energinet, Fingrid, Statnett and Svenska kraftnät with an equal share.

Each TSO is still responsible for national settlement in accordance with the national regulations and for verifying that the Imbalance Settlement Model and eSett fulfil such regulations.

The model provides harmonised operational preconditions for all Nordic balance responsible parties, regardless of the country or market balance area. Nordic-level business processes for reporting, performing settlement, invoicing and collateral management are established. Consequently, similar rules and standards for information exchange are created.

This Nordic Imbalance Settlement Handbook compiles all the Instructions and Rules into one easily accessible source. It is the main source of information needed for each market participant to understand their role and responsibility in the settlement process. A market participant can have several roles in the Imbalance Settlement Model (e.g. a TSO can have roles as a BRP, BSP, RE and DSO).

One of the most important goals of the Handbook is to provide information about the Imbalance Settlement Model in a structured and understandable way so that all market participants can work equally in the electricity market in all Nordic countries. Inevitably, some national differences will remain, and it may not be possible to harmonise these in the short term. Therefore, the national regulations are an important source of information, in addition to this Handbook. This Handbook also includes references to the information sources to national regulations.

New versions of the Handbook will be published on a regular basis. The market participants will be informed about the updated Handbook on the web site and by newsletter that the market participants can subscribe to on www.eSett.com.

A Customer Committee is established to provide a dialogue between eSett and stakeholders. The Customer Committee consists of market representatives and a TSO representative from each NBS Country. In addition, the energy market authorities responsible for regulation approval and execution from all NBS countries can participate in the meetings. All the major changes to the NBS model will be discussed in the Customer Committee before they are implemented. Therefore, the Customer Committee has an important role in the development of the NBS model. The changes and updates to the NBS model will be recorded in the NBS Handbook.

The normal update cycle of Handbook will be twice a year, once in the spring and once in the autumn. However, eSett reserves the right to carry out small updates and clarifications to the NBS Handbook when these changes have an urgent nature and they are clearly seen to be beneficial to the market and/or when the update adds clarity to the processes described in the Handbook. All change will be summarised in the change log available at the end of this document (see Chapter 12).

In addition to the Handbook the following sources include information which is to be taken into account by the market participants are:

- Common rules in the electricity law and secondary legislations in Denmark, Finland, Norway and Sweden as referred to in Chapter 1.4 Regulation

- User Guide for XML documents for NBS; a detailed user guide for the ENTSO-E and ebIX® XML documents used in the Nordic Balancing System, available at https://ediel.org/

- BRS (Business Requirement Specification for Data Exchange in Nordic Balance Settlement); a technical specification for the ENTSO-E and ebIX® XML documents used in the Nordic Balancing System, available at https://ediel.org/

- NBS XML schemas and examples on https://ediel.org/

- NBS related acknowledgements are according to NEG UserGuide Acknowledgements at https://ediel.org

- Communication guidelines for the Imbalance Settlement System at https://www.esett.com/customers/data-communications/

- BRP Agreements at https://www.esett.com/customers/agreements/

The main function of the Nordic Imbalance Settlement Model is the common imbalance settlement. eSett performs imbalance settlement and manages invoicing and collaterals towards the Balance Responsible Parties (BRP) and Balance Service Providers (BSP) on behalf of the Transmission System Operator (TSO) in each country. All matters directly related to system operations, for example procurement of balancing services, are outside the scope of the Imbalance Settlement Model. The Imbalance Settlement Model will take all necessary volumes into account when calculating the imbalance and furthermore, eSett is responsible for invoicing of the balancing services as part of imbalance settlement.

The model includes several benefits for the electricity market. The Nordic Imbalance Settlement is the platform for common imbalance settlement in Denmark, Finland, Norway and Sweden. This means that a BRP always has a single interface (eSett) and one set of rules when settling its imbalances in the Nordic electricity market. The main reason for establishing a common imbalance settlement solution is the creation of a competitive end user market. Increased competition and reduced margins for the electricity providers will give rise to socioeconomic efficiency gain.

Competition through a common Nordic retail market is considered essential in order to ensure high quality services at the lowest price, to stimulate innovation and to maximise social welfare in the Nordic region.

In general, the Nordic Imbalance Settlement Model will lower the threshold of acting as a BRP since the model enables common access to all four countries. In addition, the operational procedures of a BRP are simplified. It makes it easier for a retailer to enter the market. It also reduces costs as more BRPs are competing and the price for handling an RE’s balance could therefore be lower. Besides, a RE can more easily choose to act as a BRP rather than an RE.

The Nordic Imbalance Settlement Model gives an incentive to improve the quality of meter data as the DSOs must notify and be responsible for data errors after the imbalance settlement period is closed. Improved data quality will not only improve the quality of imbalance settlement but, also the settlement and invoicing of end customers as both BRPs and REs get access to the same meter data.

A larger market with a common set of rules will make it more attractive to invest in innovation. BRPs, BSPs and REs will face a larger potential for innovative solutions, especially for the core IT systems and new payment and credit management solutions. This will also make the vendor market more attractive as the offers from various service providers will cover a larger market.

A common Nordic approach to imbalance settlement procedures will have more influence on EU development than if there were several different Nordic solutions. NBS will, in the long run, lower the operational costs of imbalance settlement because one organisation with one common IT solution will be more efficient than several separate ones. NBS will also make the related costs more transparent as these will be separated from cost elements at each respective TSO. Such transparency is a condition for operational cost efficiency.

The national legislation and regulations per each respective country are presented in this chapter.

The Nordic Imbalance Settlement model follows the settlement principles as per Title V of Commission Regulation (EU) 2017/2195 of 23 November 2017 establishing a guideline on electricity balancing.

https://eur-lex.europa.eu/legal-content/EN/TXT/?uri=CELEX%3A32017R2195

In Finland, the following laws and secondary regulations guide the electricity market:

- Electricity market act (EMA) (588/2013) (Finnish version) Common rules in the electricity law and secondary legislations in the Nordic countries provide additional https://finlex.fi/fi/lainsaadanto/2013/588

- Decrees of the Finnish government and decrees of the ministry of the employment and the economy:

- The Finnish Government decree of electricity deliveries settlement and measurement (767/2021) (dated 2021-08-12) https://finlex.fi/fi/lainsaadanto/2021/767

- The Ministry of the Employment and the Economy decree of the information exchange concerning electricity deliveries settlement (839/2021) (dated 2021-09-24) https://finlex.fi/fi/lainsaadanto/saadoskokoelma/2021/839

National terms and conditions for BRP concerning balance management and imbalance settlement: https://www.fingrid.fi/en/electricity-market/balance-service/

National terms and conditions for BSP concerning reserves and balancing power (separate for each balancing service): https://www.fingrid.fi/en/electricity-market/reserves_and_balancing/

In Norway the following laws and secondary regulations guide the electricity market:

- Primary act: LOV 1990-06-29 nr 50: Lov om produksjon, omforming, overføring, omsetning, fordeling og bruk av energi m.m. (energiloven) – ”The Energy Act”

https://lovdata.no/dokument/NL/lov/1990-06-29-50 - Secondary Legislation: FOR 1999-03-11 nr 301: Forskrift om måling, avregning og samordnet opptreden ved kraftomsetning og fakturering av nettjenester – ”MAF”

https://lovdata.no/dokument/SF/forskrift/1999-03-11-301

National terms and conditions for BRP concerning balance management and imbalance settlement: https://www.statnett.no/for-aktorer-i-kraftbransjen/systemansvaret/kraftmarkedet/avregningsansvaret/balanseavregning/

National terms and conditions and agreement for BSP concerning reserves and balancing power: https://www.statnett.no/for-aktorer-i-kraftbransjen/systemansvaret/kraftmarkedet/reservemarkeder/leverandor-av-balansetjenester-bsp/

In Sweden the following laws and secondary regulations guide the electricity market:

- Energy market act: SFS 1997:857 ”Ellag” http://www.riksdagen.se/sv/dokument-lagar/dokument/svenskforfattningssamling/ellag-1997857_sfs-1997-857

- Power regulation: ”Förordning om mätning, beräkning och rapportering av överförd el” regeringen.se

- Secondary legislation: EIFS 2023:1 https://ei.se/download/18.575c50c318602a42957643/1675150192171/EIFS-om-m%C3%A4tning-ber%C3%A4kning-och-rapportering-av-%C3%B6verf%C3%B6rd-el-EIFS-2023-1.pdf

National balance responsibility agreements for BRP: https://www.svk.se/en/stakeholders-portal/electricity-market/balance-responsibility/balance-responsibility-agreement/

National balance responsibility agreements for BSP: https://www.svk.se/en/stakeholders-portal/electricity-market/balancing-service-provider-bsp/bsp-agreement/

In Denmark the following laws and secondary regulations guide the electricity market:

- The electricity Supply Act (Lov om elforsyning, LBK nr 1248 af 24/10/2023):

https://www.retsinformation.dk/eli/lta/2023/1248 - Executive order on the system operator and use of the electricity transmission network (Systemansvarsbekendtgørelsen, BEK nr 1358 af 24/11/2023)

https://www.retsinformation.dk/eli/lta/2023/1358 - Secondary legislation in the Danish electricity market regulations (approved by the Danish Utility Regulator):

https://energinet.dk/regler/el/elmarked/

eSett is owned by Energinet, Fingrid, Svenska kraftnät and Statnett. The company will act and operate in the role of Imbalance Settlement Responsible. It must be noted that the national regulations stipulate that each national TSO is still ultimately responsible for balancing operations and imbalance settlement.

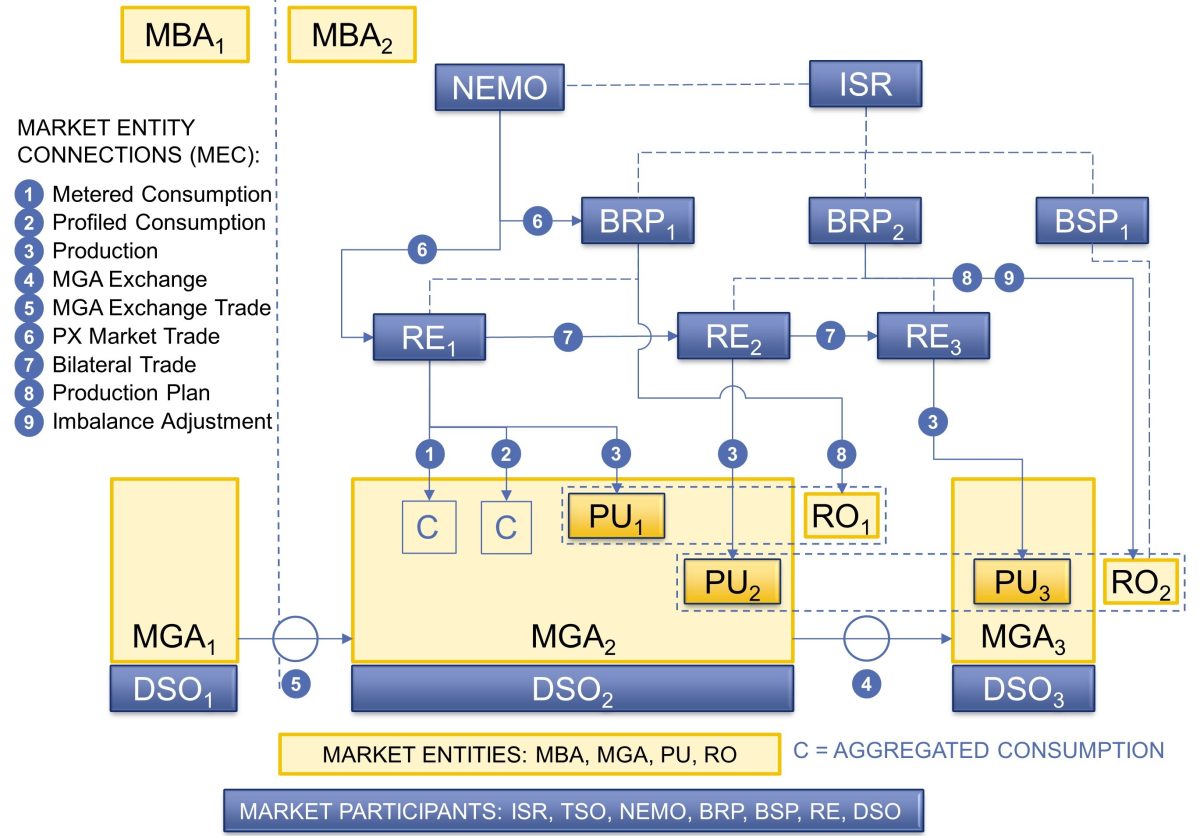

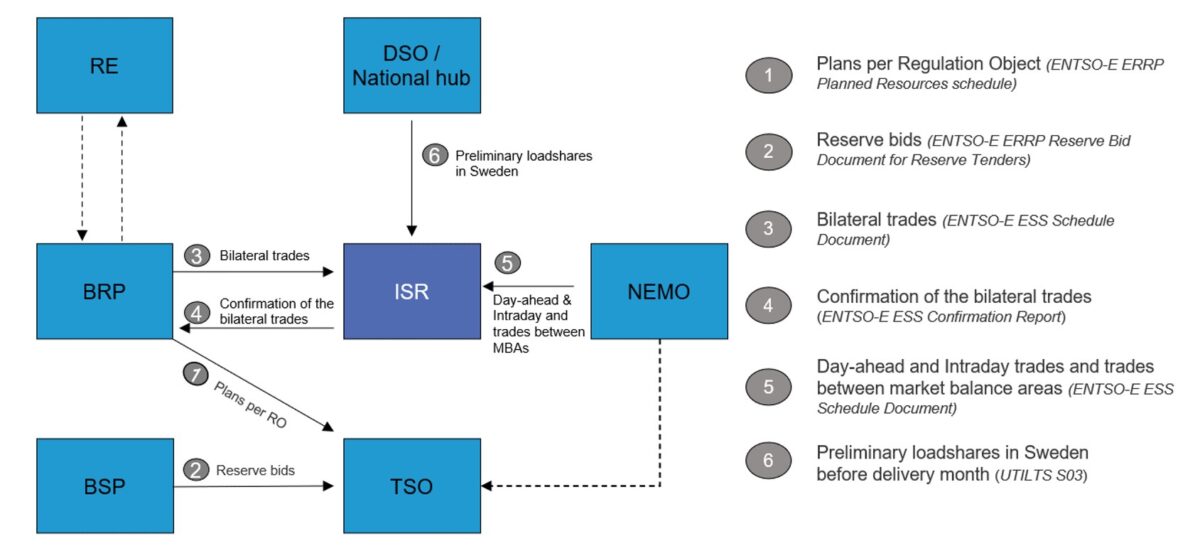

The company’s working language is English but customer service is also provided in Swedish, Norwegian and Finnish. eSett’s relations to the market participants are illustrated in Figure 1.

Figure 1. Relations between eSett and the market participants.

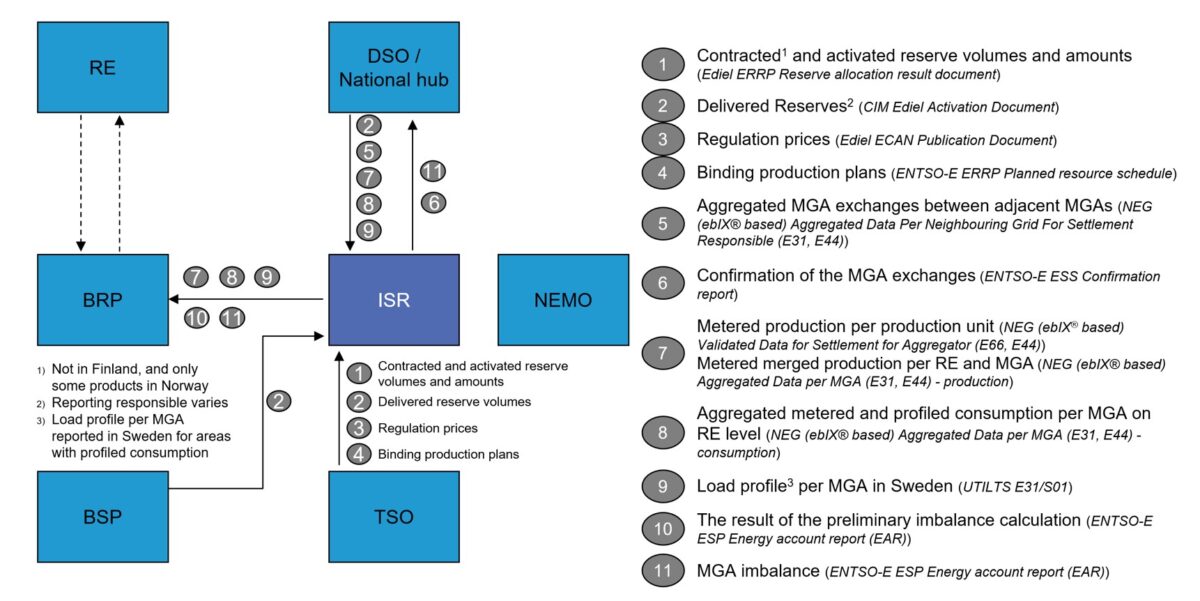

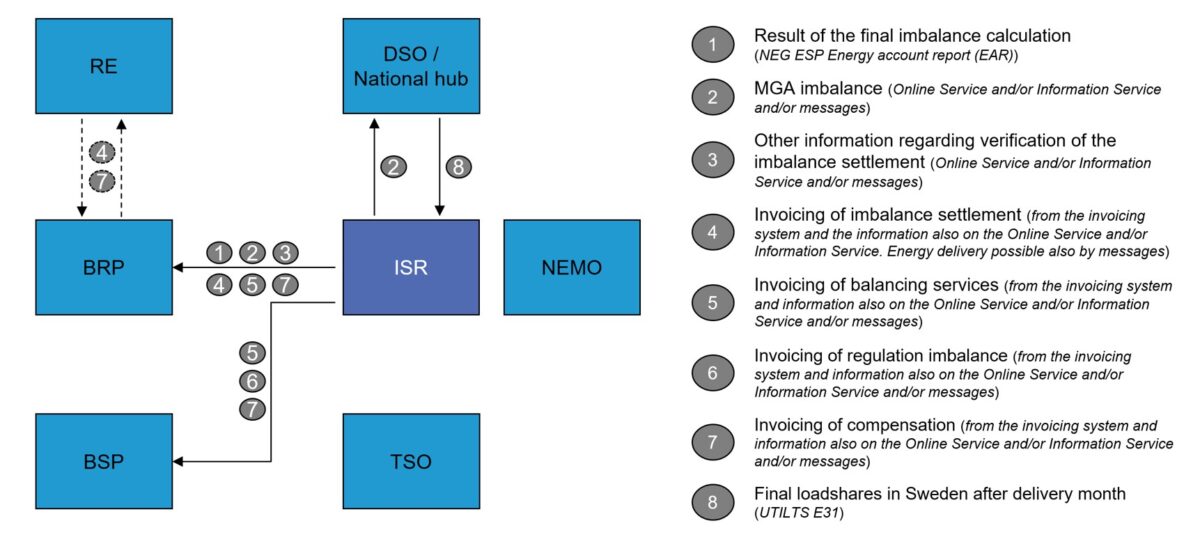

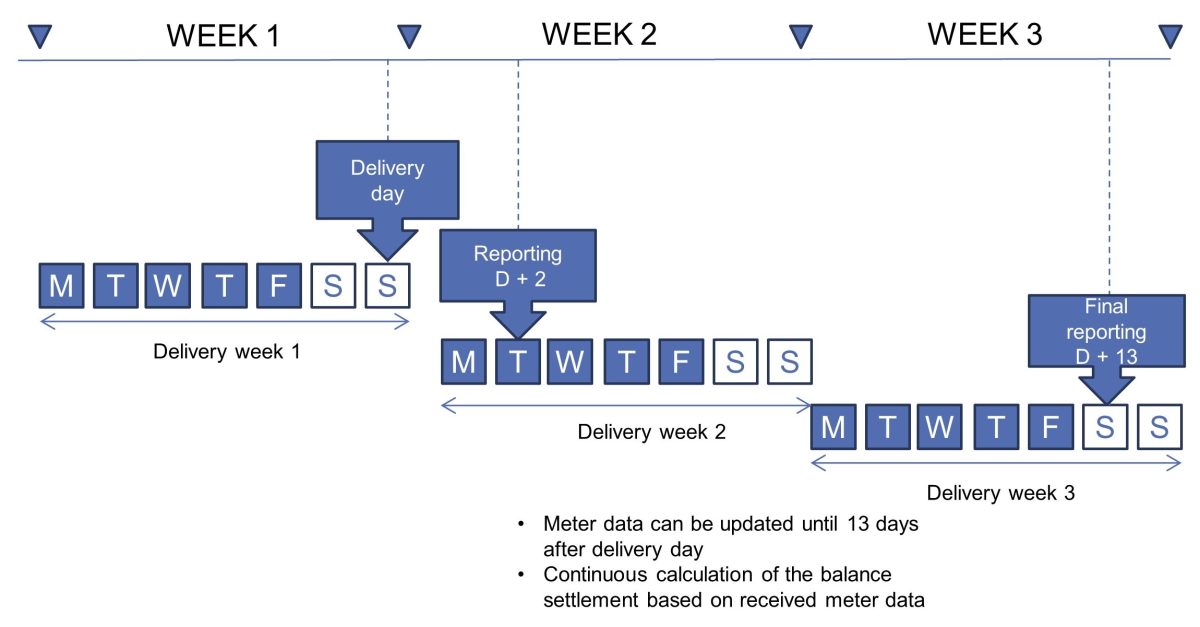

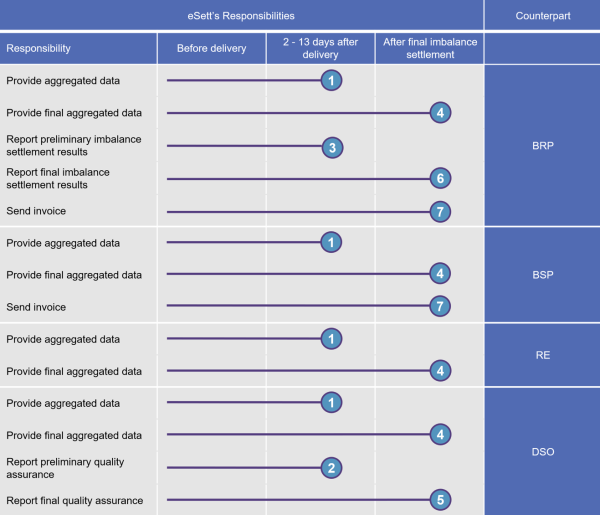

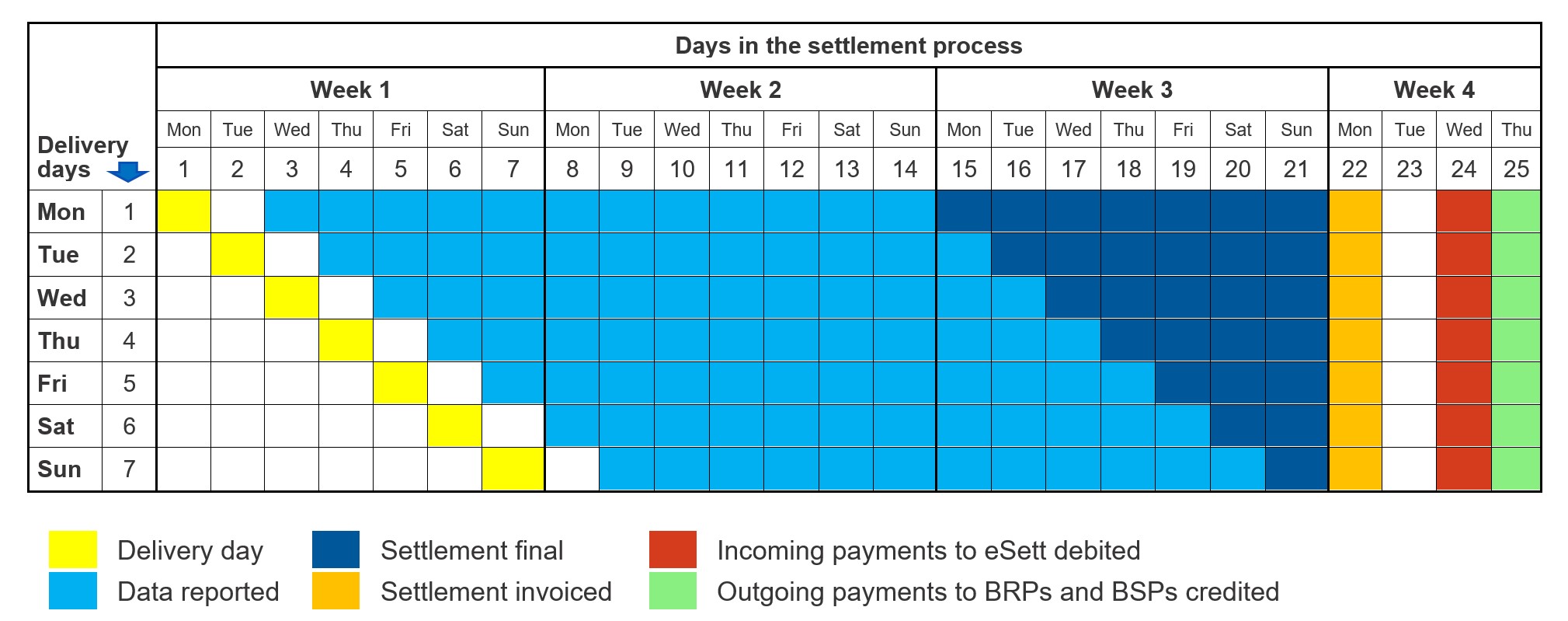

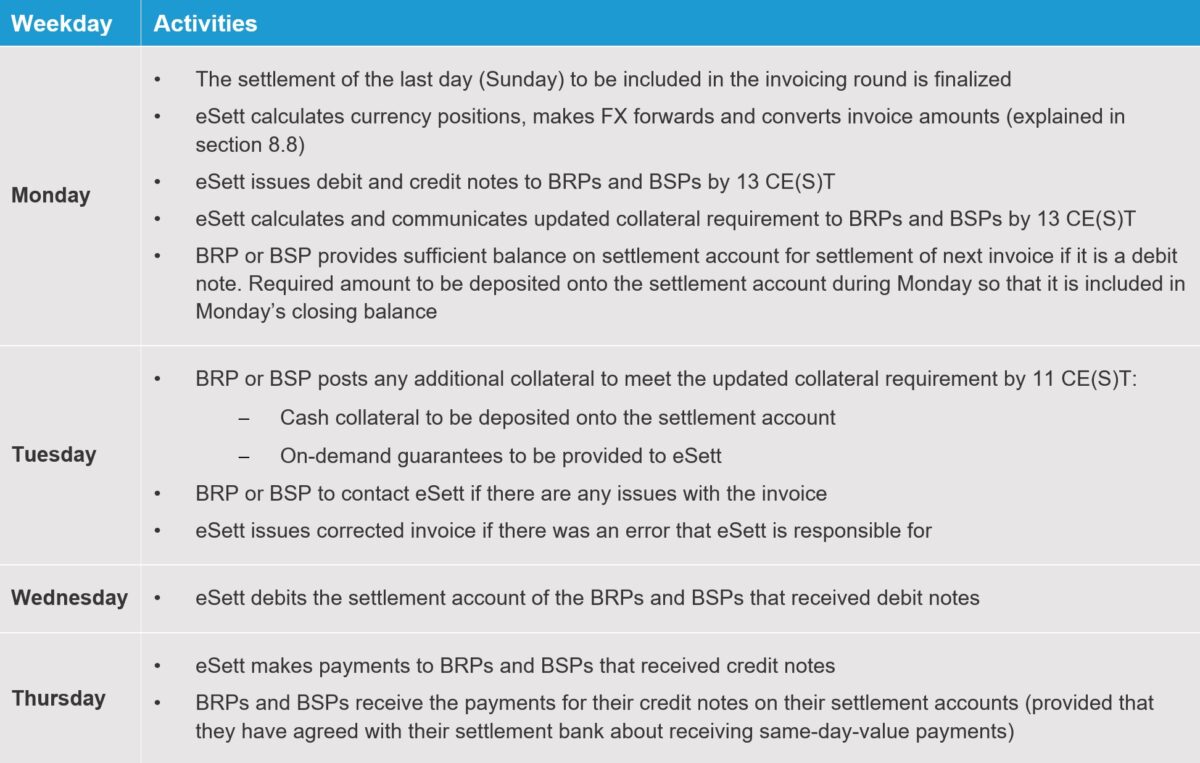

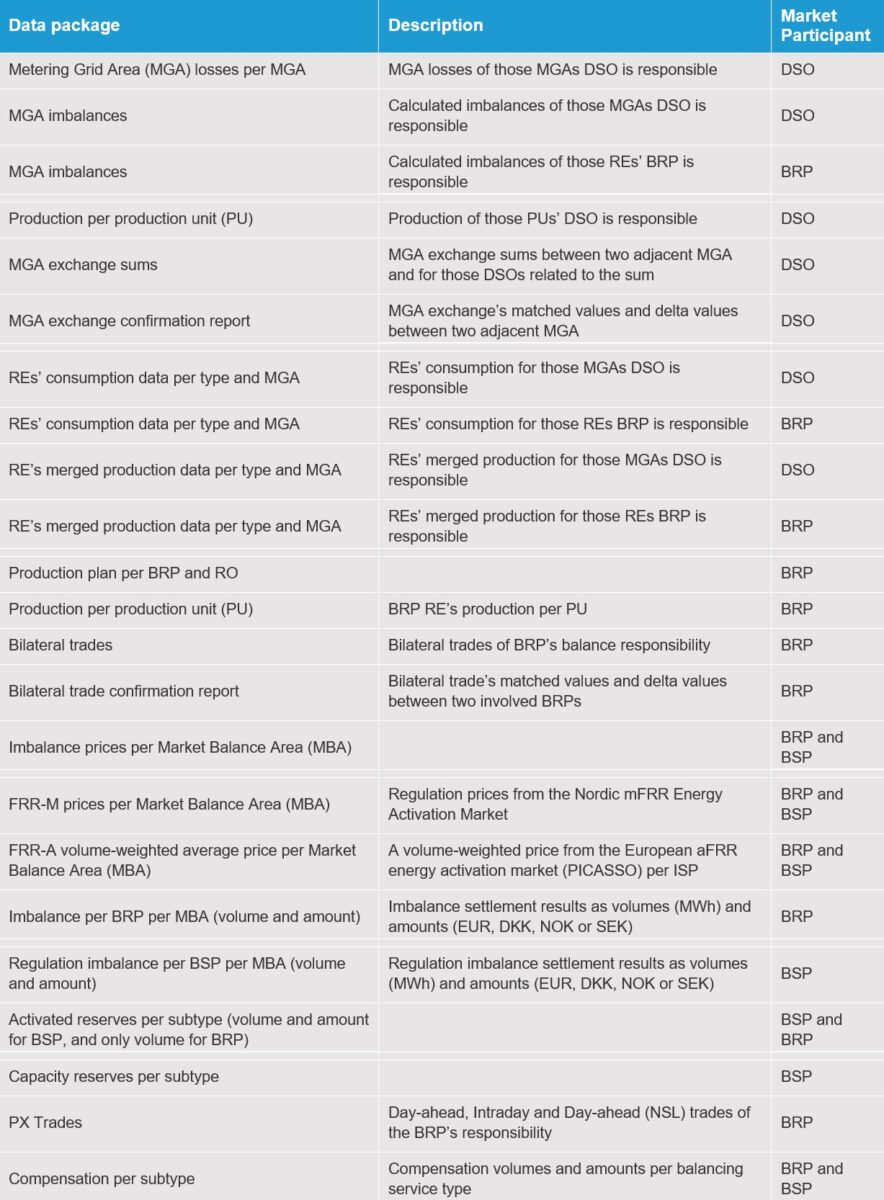

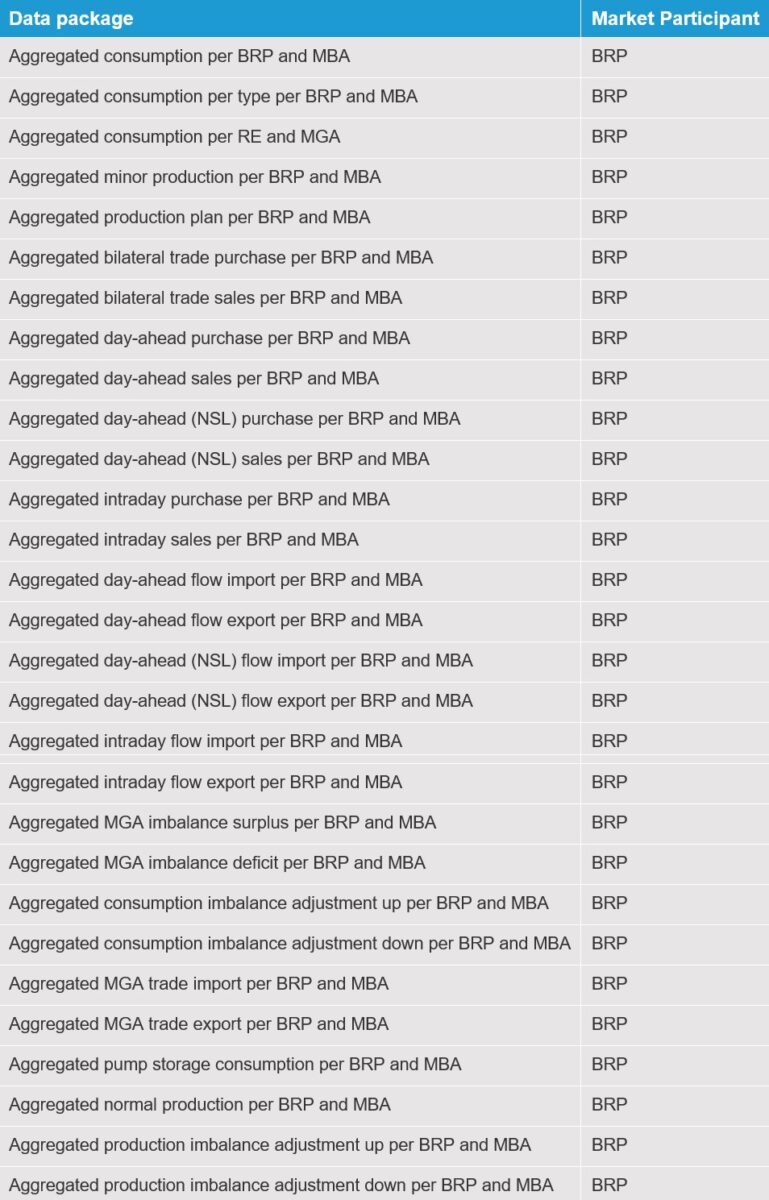

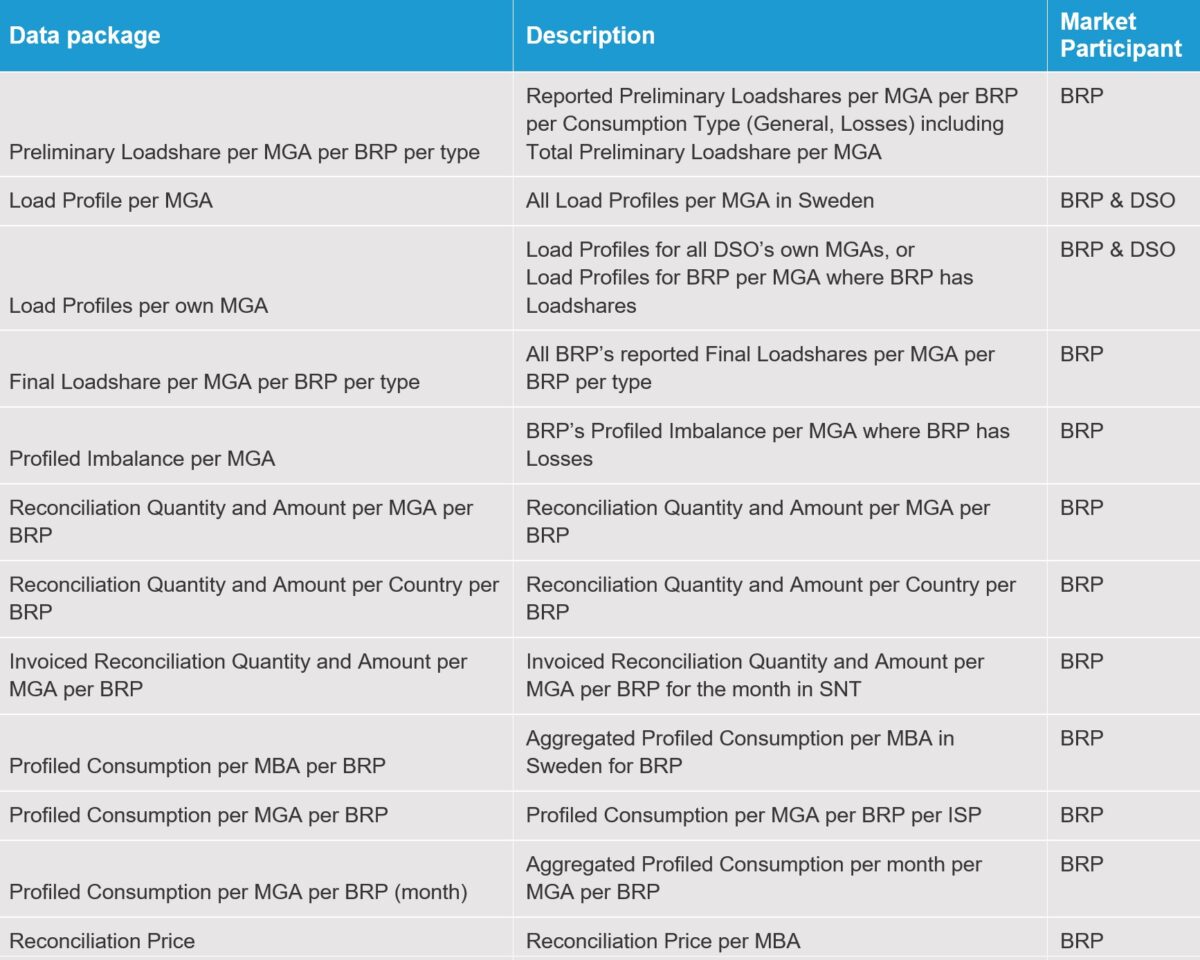

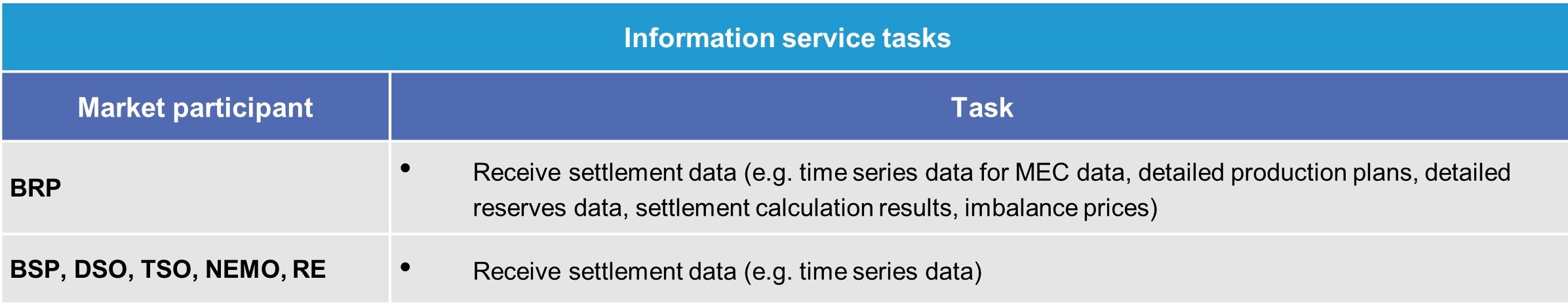

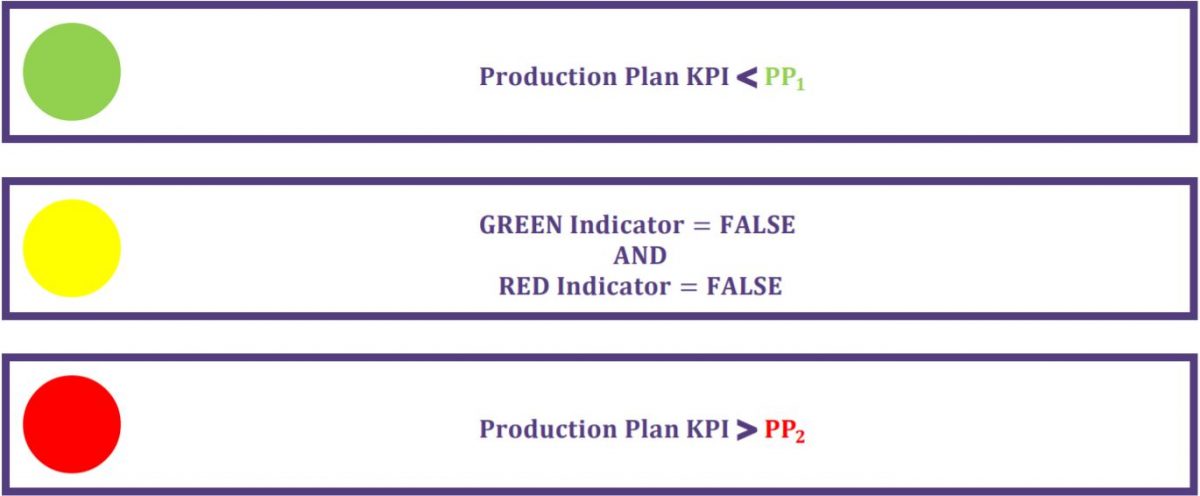

eSett has many operational tasks. Its daily processes include collecting, validating and managing data related to imbalance settlement, making the collected data available for market participants, conducting preliminary imbalance settlement, following up reported data and performing final imbalance settlement. Weekly duties for eSett consist of performing the imbalance settlement related invoicing, invoicing of other fees on behalf of TSOs, controlling BRPs’ and BSPs’ collaterals and follow-up them in relation to risk and collaterals, and cash management. On a regular basis eSett will monitor, publish and follow-up Key Performance Indicator (KPIs) of the imbalance settlement process. eSett does market monitoring, customer support, reporting, and publishing of settlement results (including input data) continuously.

The purpose of imbalance settlement is to establish a financial balance in the electricity market after the operation hour. Imbalances are calculated for each BRP based on the PX market trades, bilateral trades and on realised consumption and production. Each BRP is financially liable for the imbalances under its responsibility, balanced by the balancing power procured from the balancing power market operated by the TSOs.

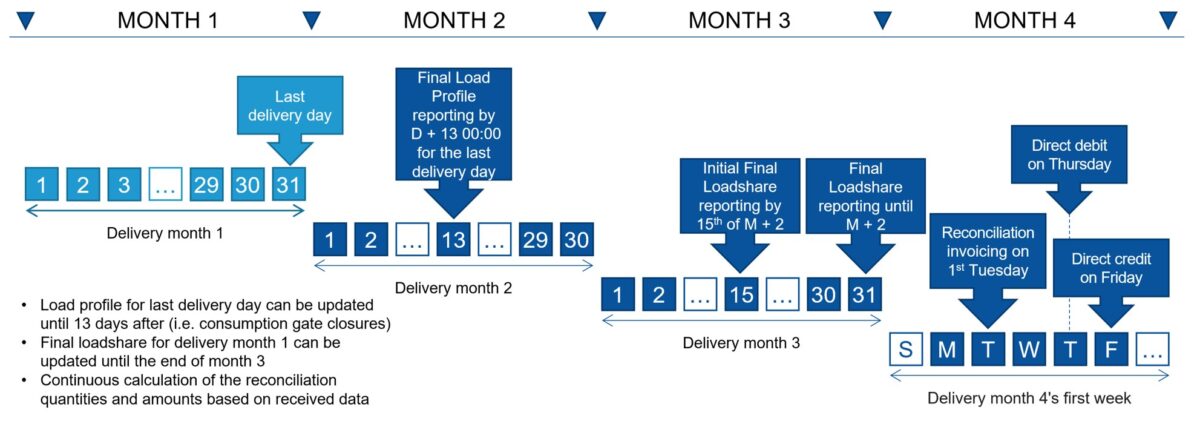

In the imbalance settlement, estimates for the profiled consumption are used. In the reconciliation settlement, the difference between preliminary and final profiled consumption is settled using day-ahead market prices for the MBA. In this way, the error in the imbalance settlement due to incorrect estimates of the profiled consumption is corrected.

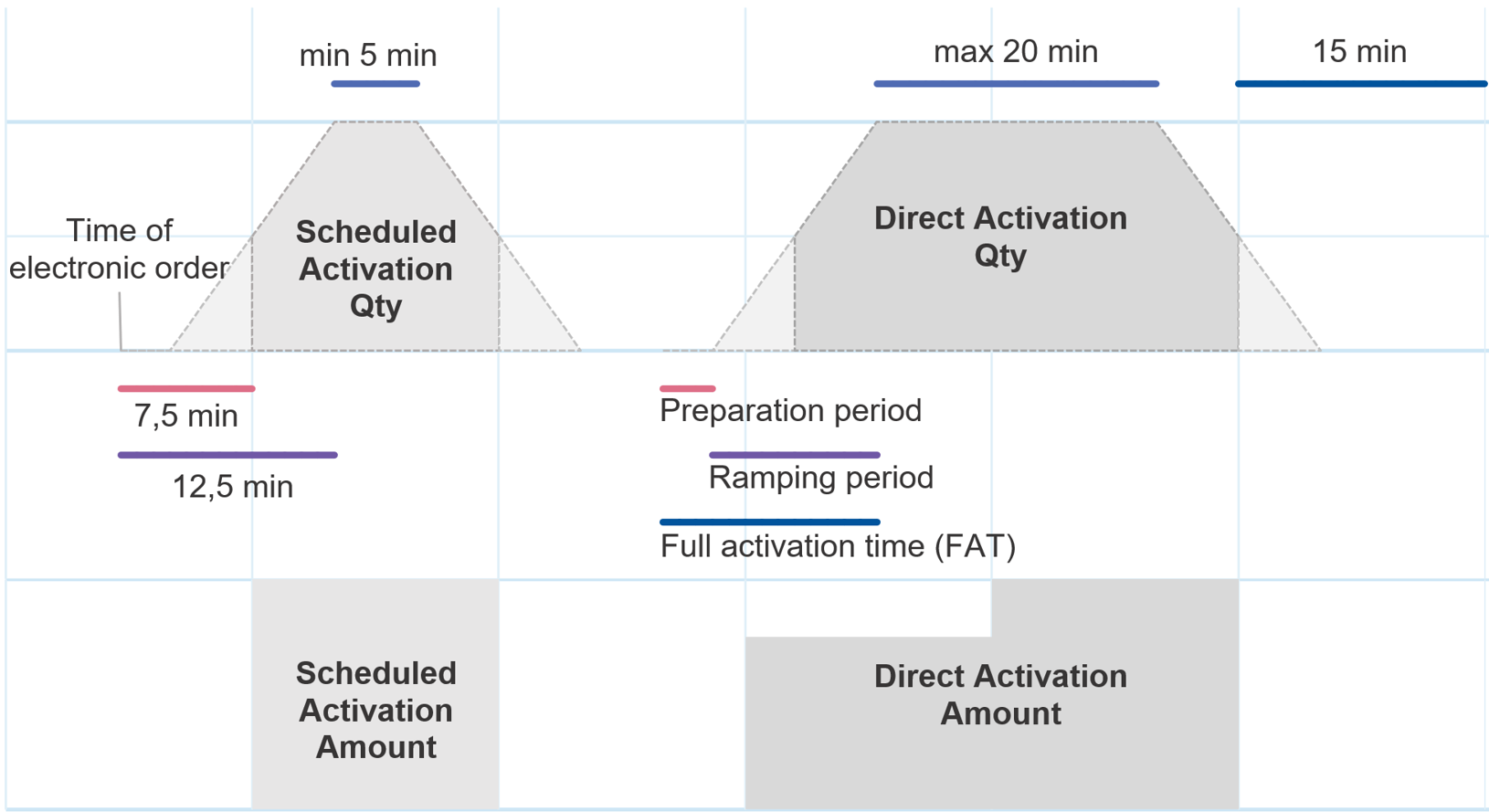

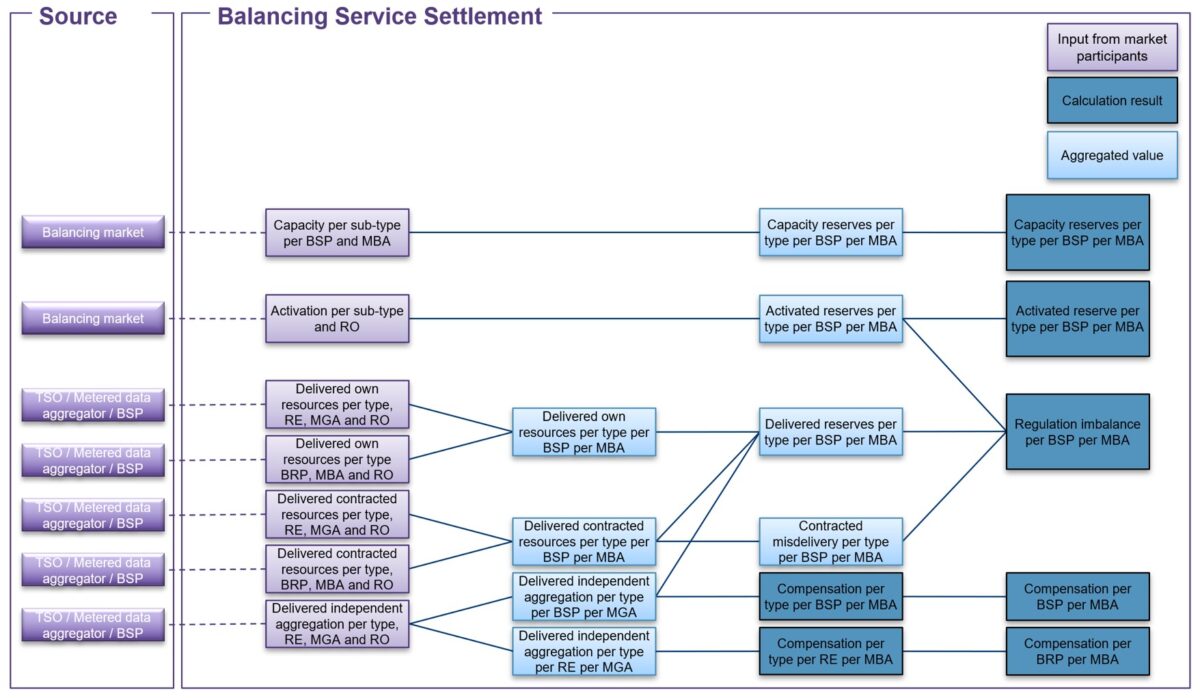

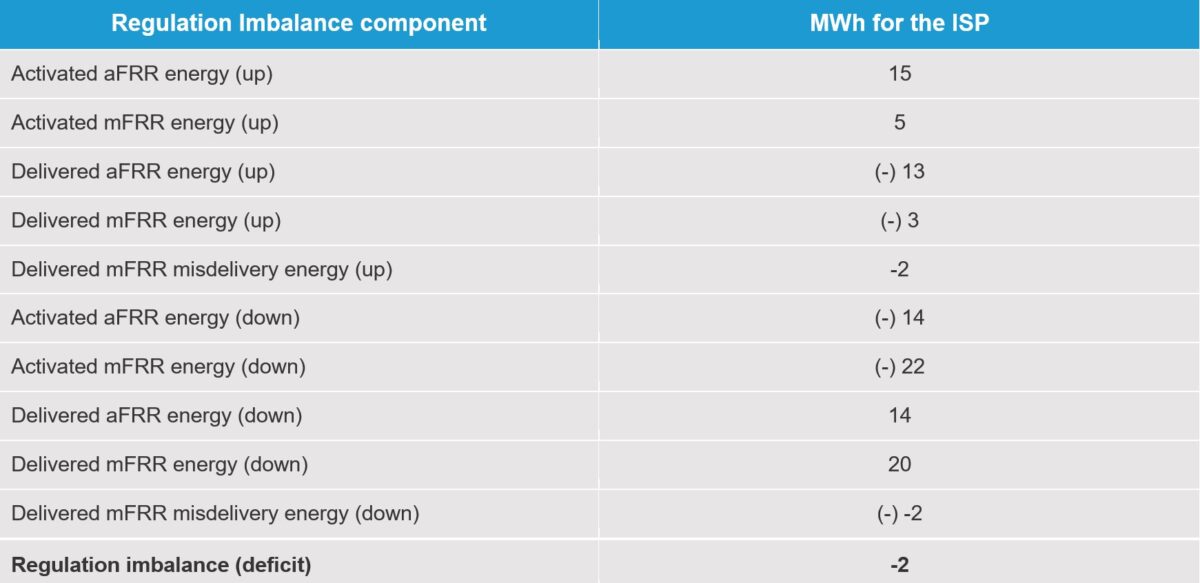

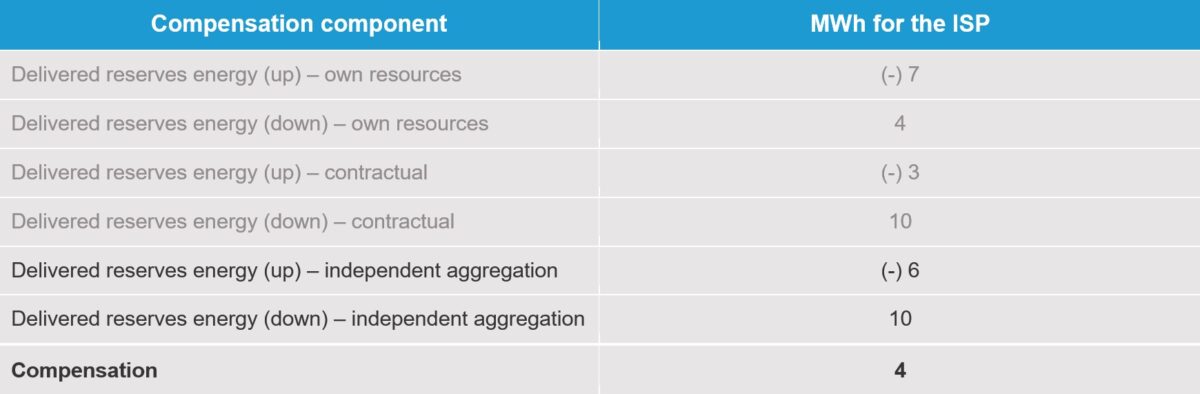

Transmission System Operators (TSOs) procure balancing services from Balancing Service Providers (BSPs) to manage the real-time coordination of supply and demand in the power system. In the Balancing Service settlement the balancing capacity and balancing energy are financially compensated between the TSOs and the BSPs, and possible regulation imbalances are calculated for each BSP based on the differences between activated and delivered reserves.

The Nordic Settlement Model is based on the harmonised model with single imbalance which is calculated and settled. At the core of the Nordic Imbalance Settlement Model is the common operational unit (eSett) which is responsible for the imbalance and balancing service settlement as well as for the reconciliation settlement in Sweden. eSett performs services on behalf of the four TSOs.

The imbalance settlement agreement is a legal contract that defines eSett’s and the BRP’s liabilities, the BRP’s collateral requirements and procedures for exclusion, and the legal items. The balancing service settlement agreement is a legal contract that defines eSett’s and the BSP’s liabilities, the BSP’s collateral requirements and procedures for exclusion, and the legal items. The main stakeholders in the Nordic Settlement Model are the Retailers (REs), the Balance Responsible Parties (BRPs), the Distribution System Operators (DSOs), the Balancing Service Providers (BSPs), the Transmission System Operators (TSOs), Nominated Electricity Market Operators (NEMOs), and eSett. The definitions of these stakeholders are presented in the list of terminology at the beginning of this Handbook.

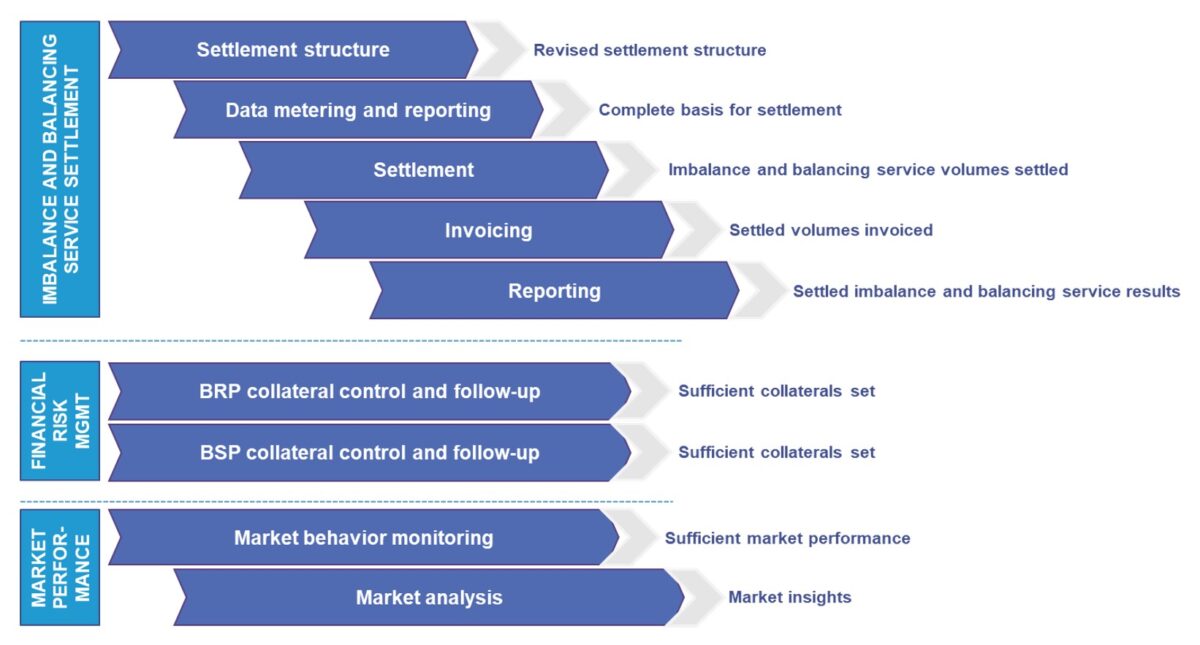

The different procedures and operations of the Nordic Imbalance Settlement Model are divided into five core functions: settlement structure management, metering and reporting data, settlement, invoicing and reporting.

In addition, the Nordic Settlement Model includes separate functions for collateral management and market behaviour monitoring.

The Nordic Settlement Model ensures a transparent and common imbalance settlement and equal treatment of market participants. The main objective of the Nordic Settlement Model is to perform settlement across participating countries with the same principles and based on a single balance. The model provides harmonised and necessary procedures for the settlement:

- Settlement structure defines how the information about the imbalance settlement structure and hierarchy (relations) is collected and managed, e.g. information about a new Metering Grid Area (MGA) or the contact information of a market participant. See Chapter 3, Settlement structure management

- Metering defines the different data types and the basis of the settlement data metering. See chapter 4, Metering

- Reporting data handles the imbalance settlement data reception, validation, storing and reporting by eSett. See chapter 5, Settlement data reporting

- Settlement handles the imbalance settlement calculations, quality assurance and publishing of results. See chapter 6, Settlement

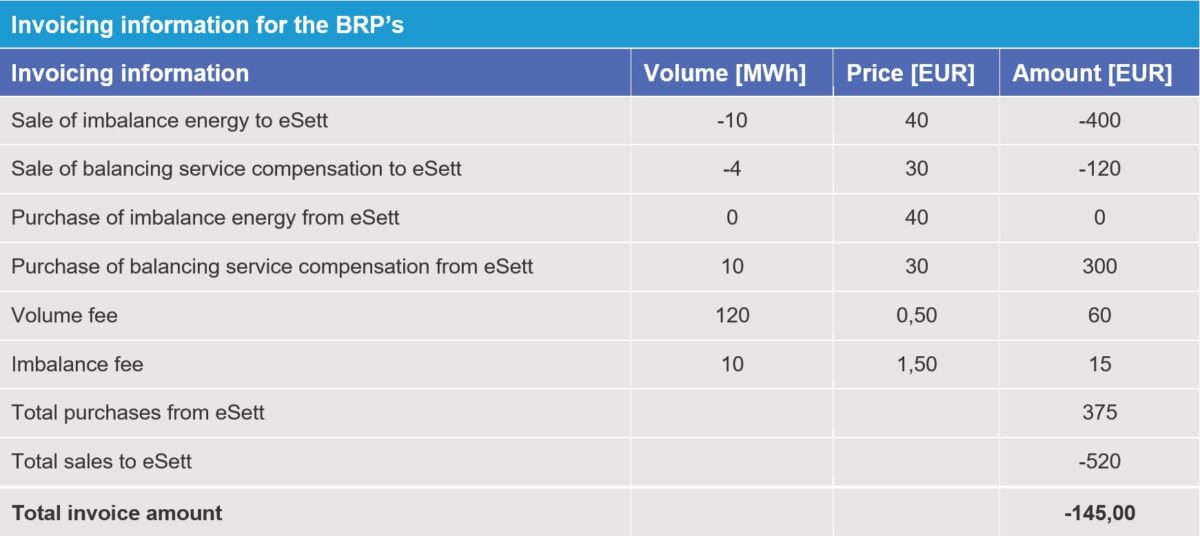

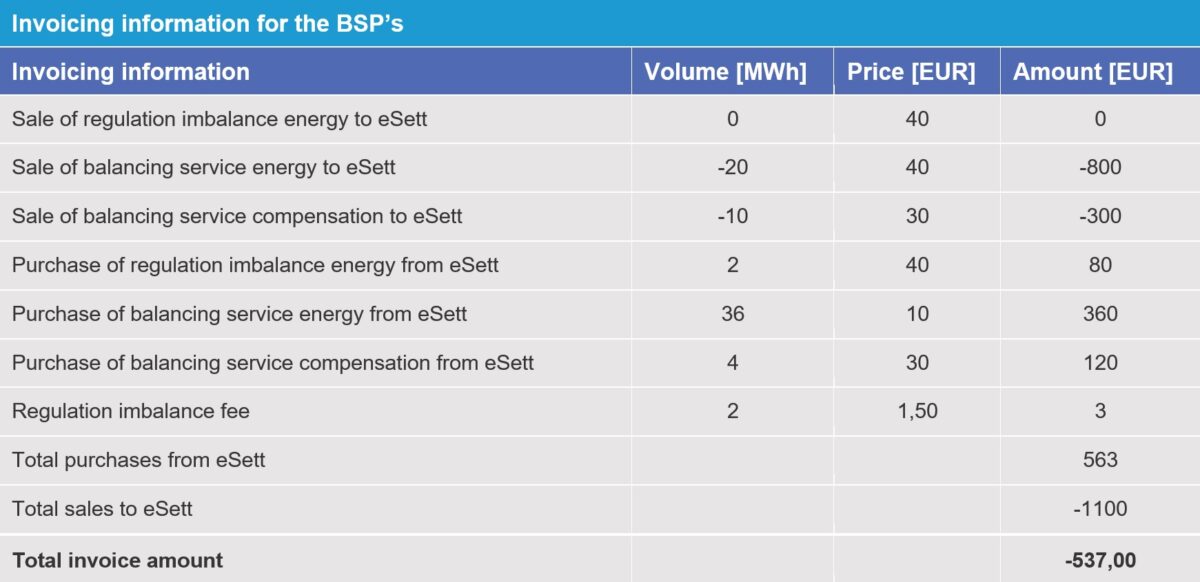

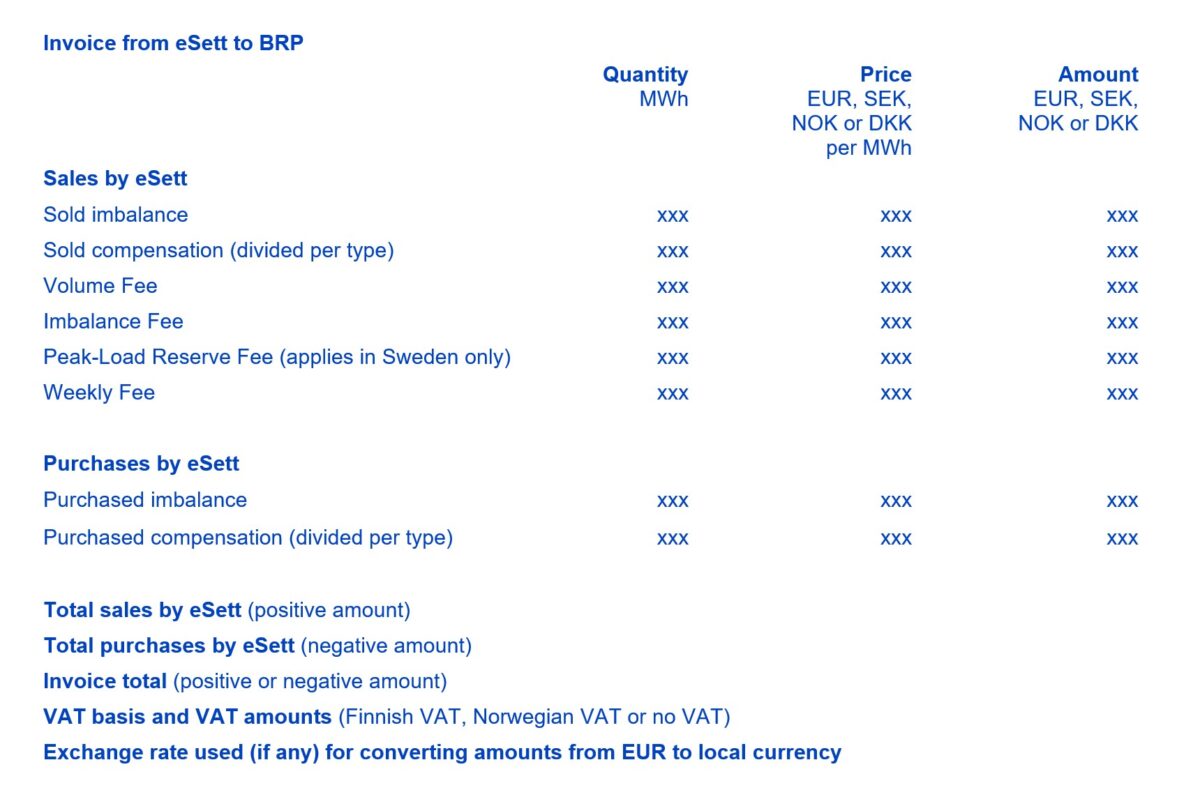

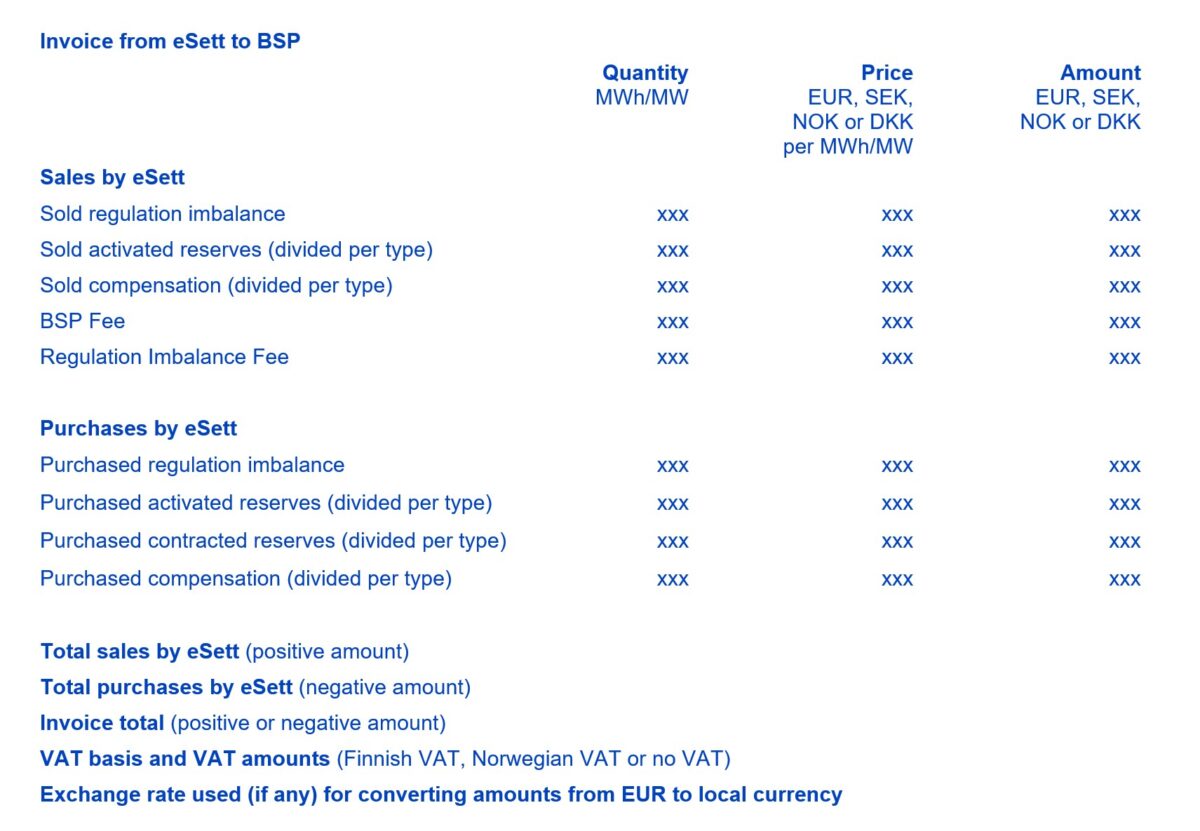

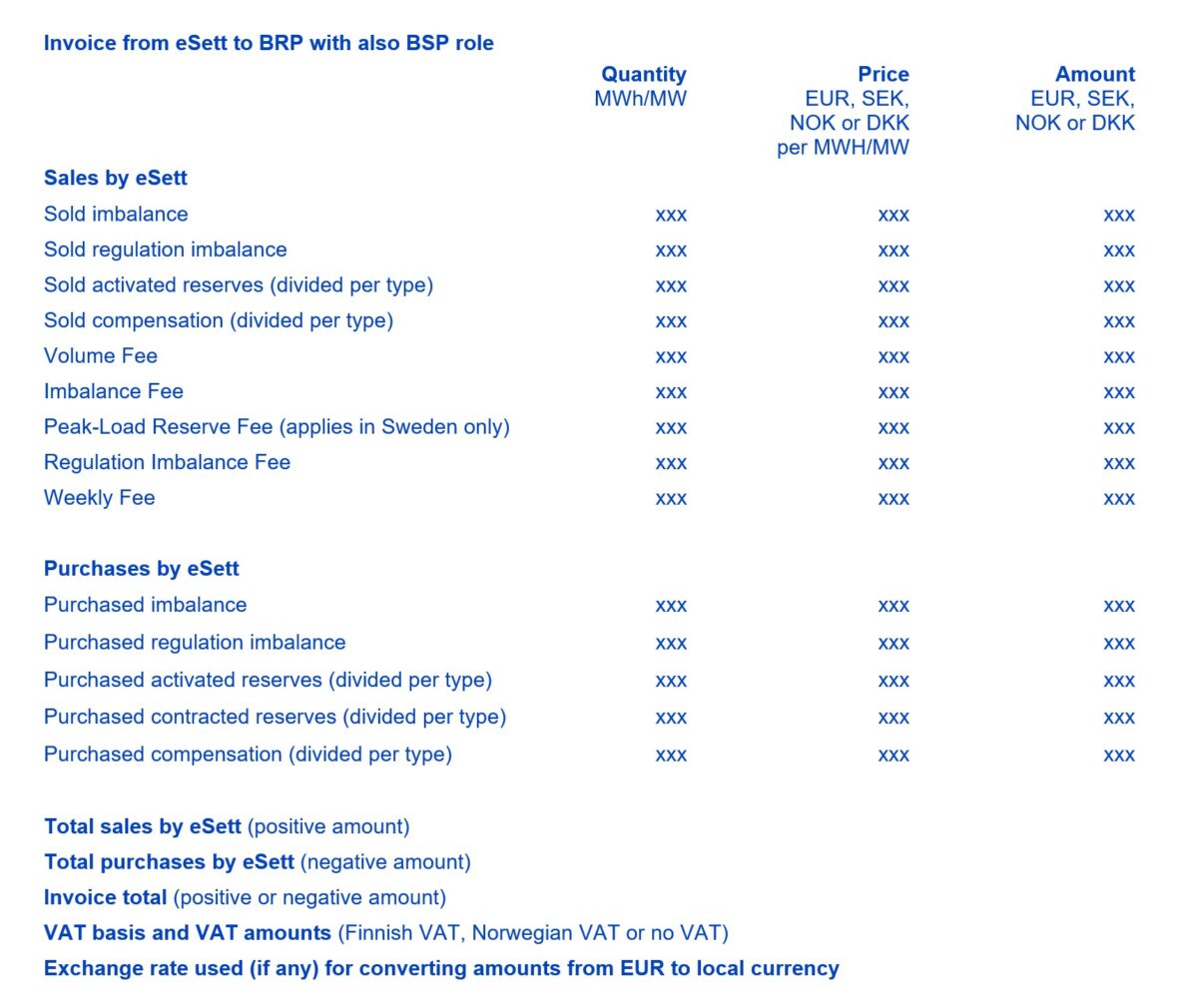

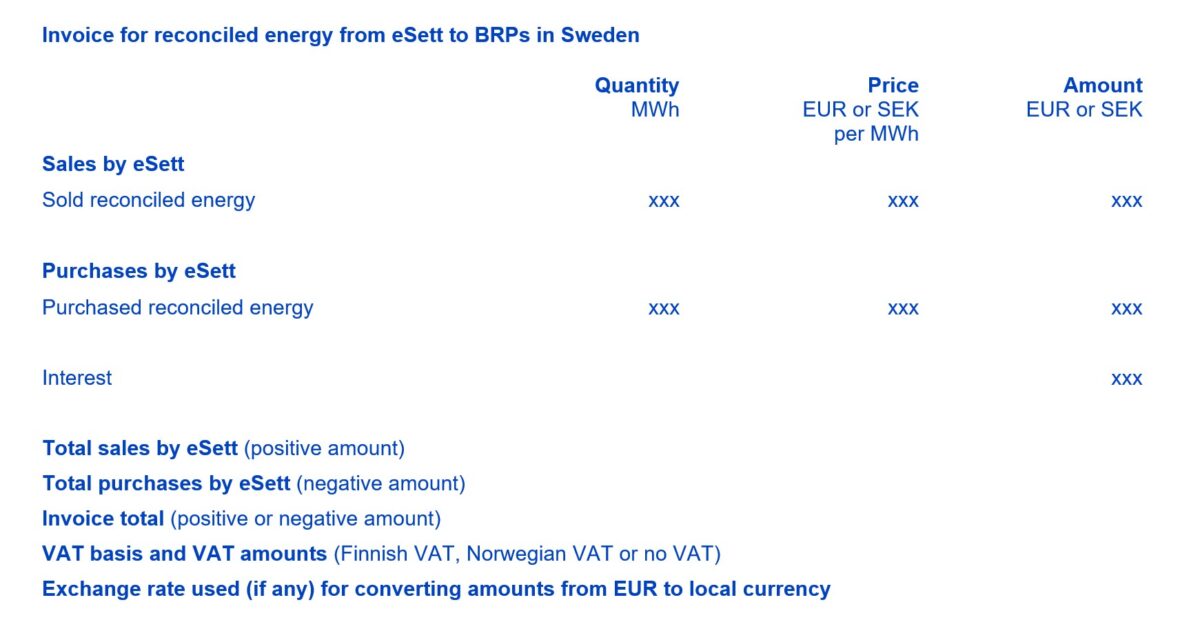

- Invoicing handles eSett’s invoicing of BRPs, based on realised imbalances and BSPs based on balancing services. See Chapter 8 Invoicing

- Reporting includes the creation, distribution and publishing of various reports and files provided by eSett. Reporting is also done through the Online Service, the Messaging Service and the Information Service that are provided to market participants. See Chapter 5, Settlement data reporting

- Collateral management includes control of the BRPs’ and BSPs’ collateral demands, as defined and calculated by eSett, as well as follow-up of the placed collateral deposits in comparison to demands. See Chapter 9, Collateral and risk management

- Communication presents different communication channels and an arrangement of the communication in Nordic Settlement model. It also includes the creation, distribution and publishing of various reports and files provided by eSett. Reporting is also done through the Online Service, the Messaging Service and the Information Service that are provided to market participants. See Chapter 10, Communication

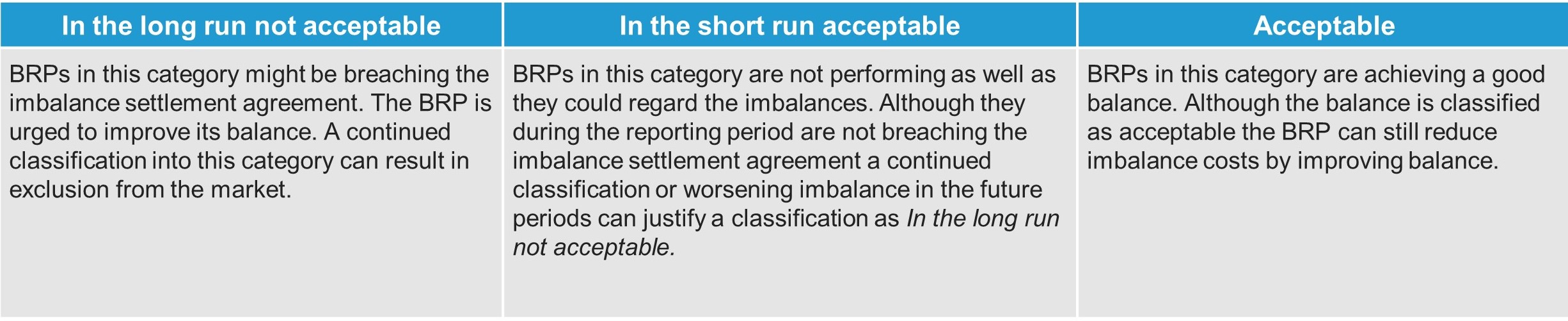

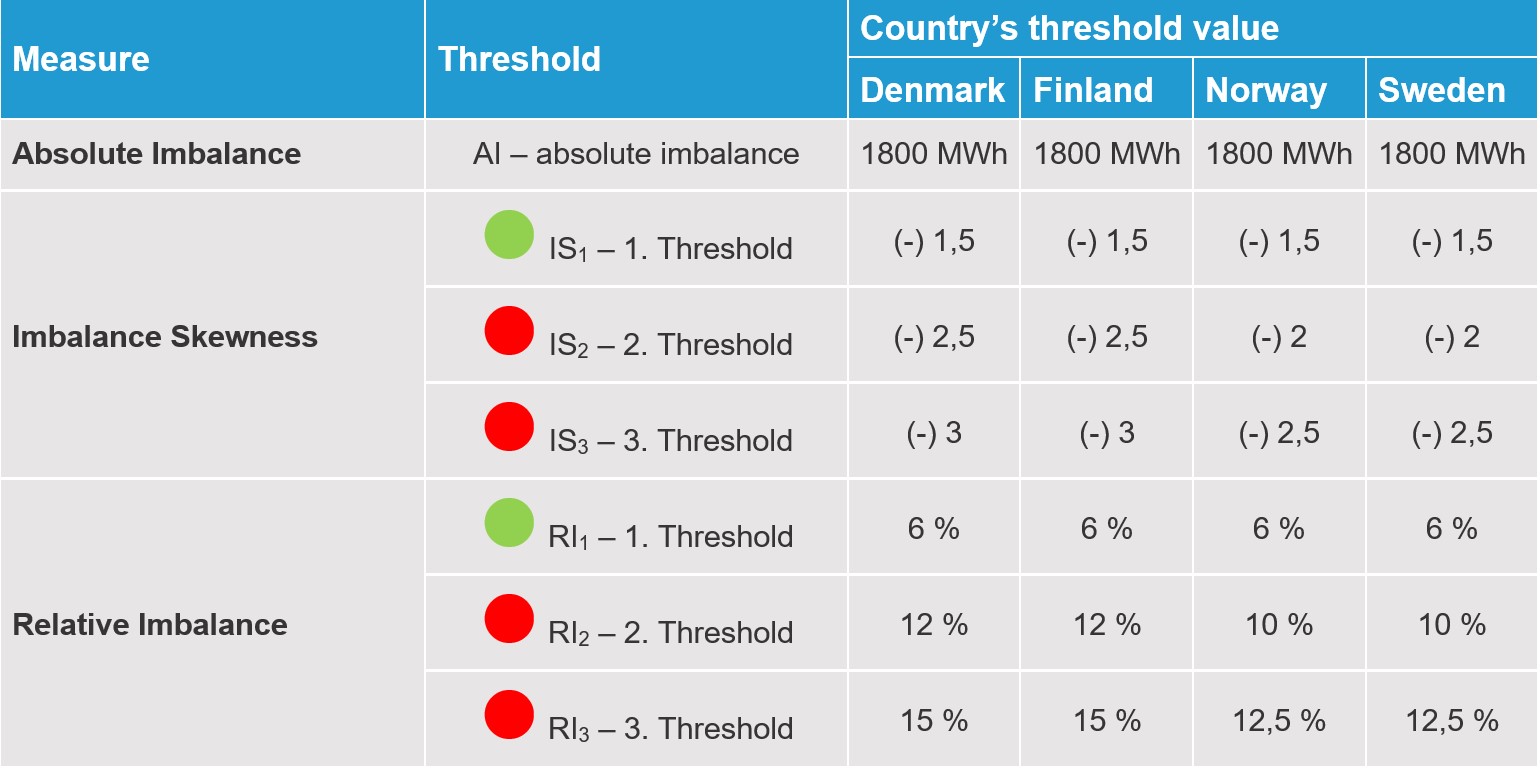

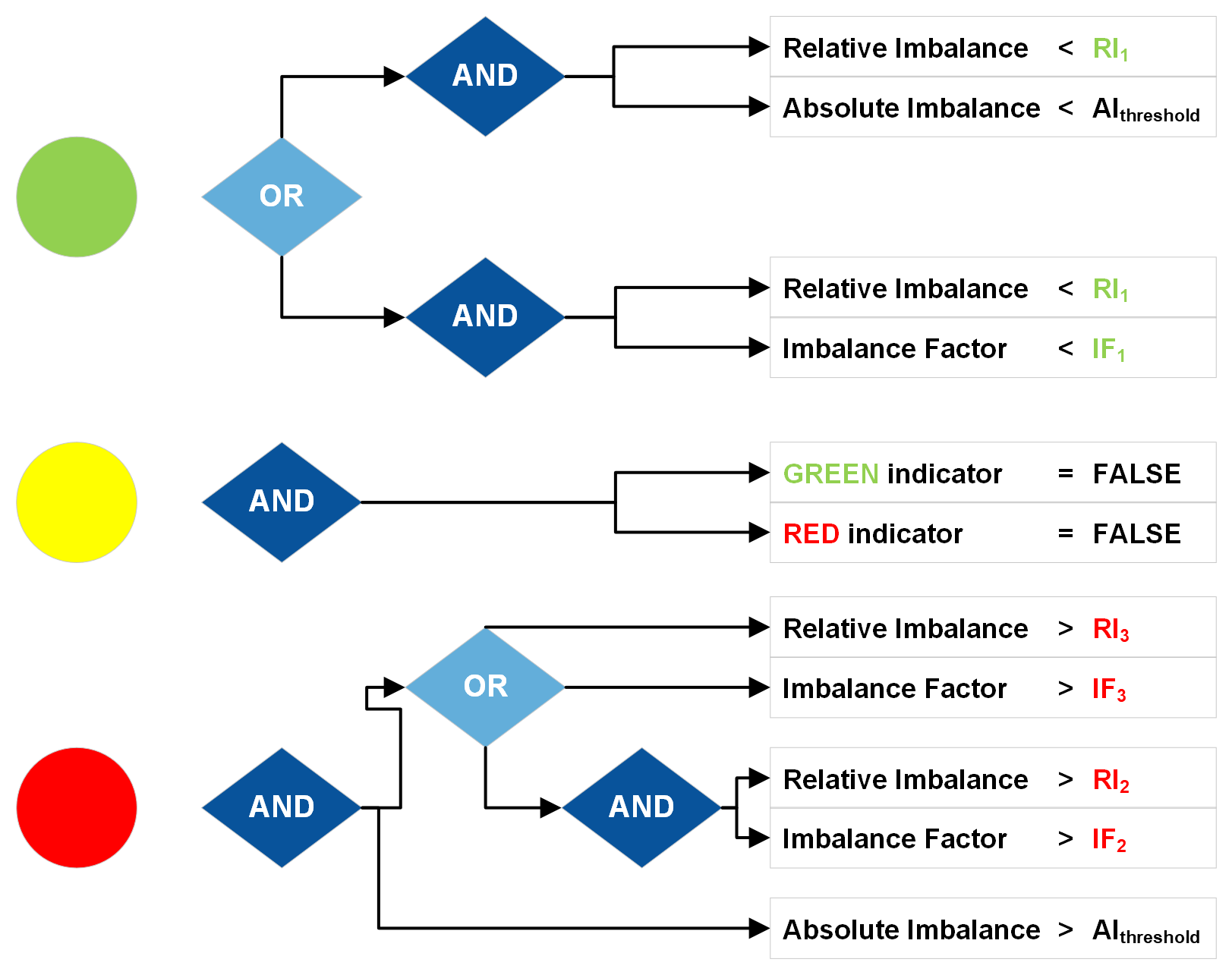

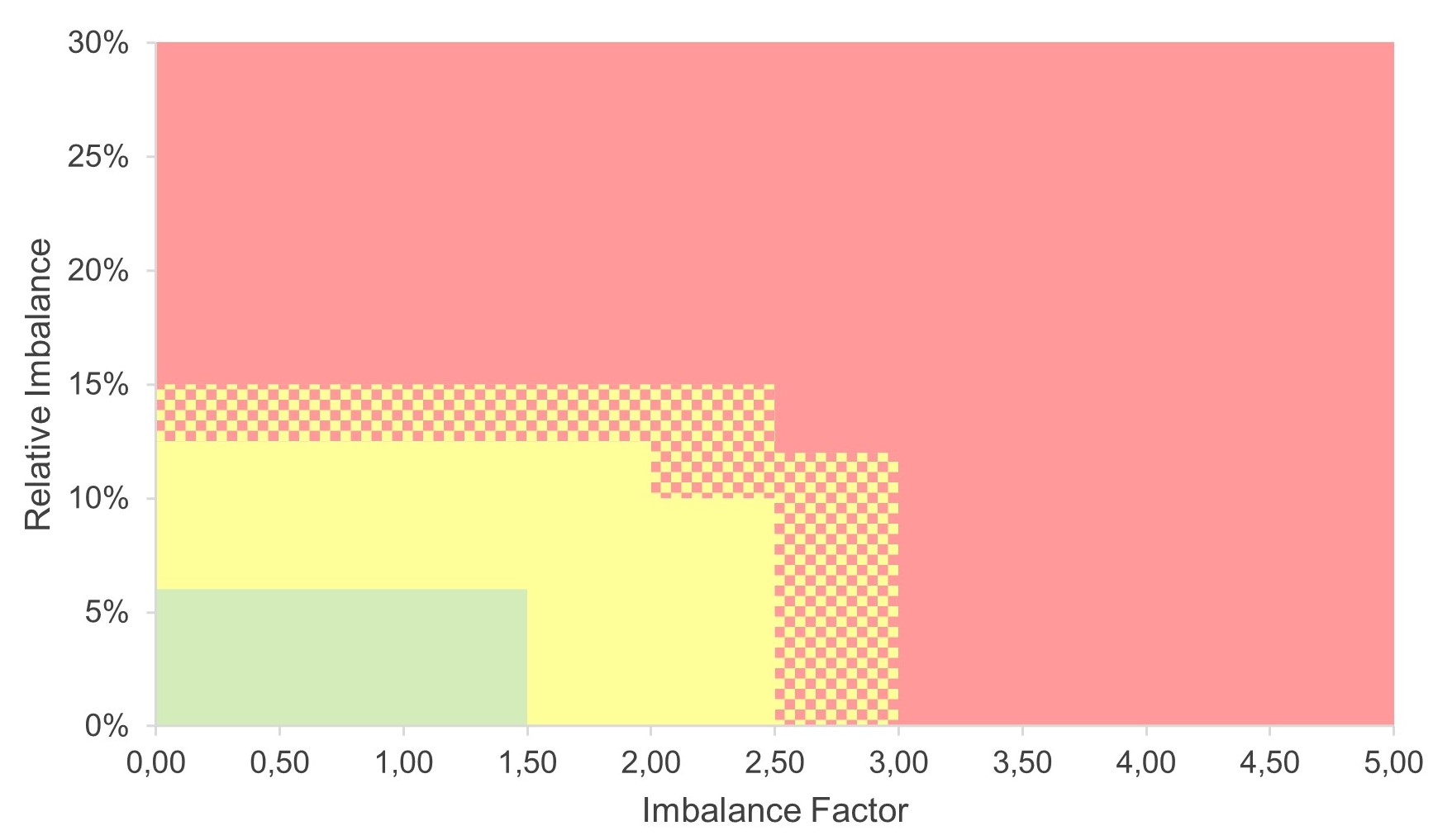

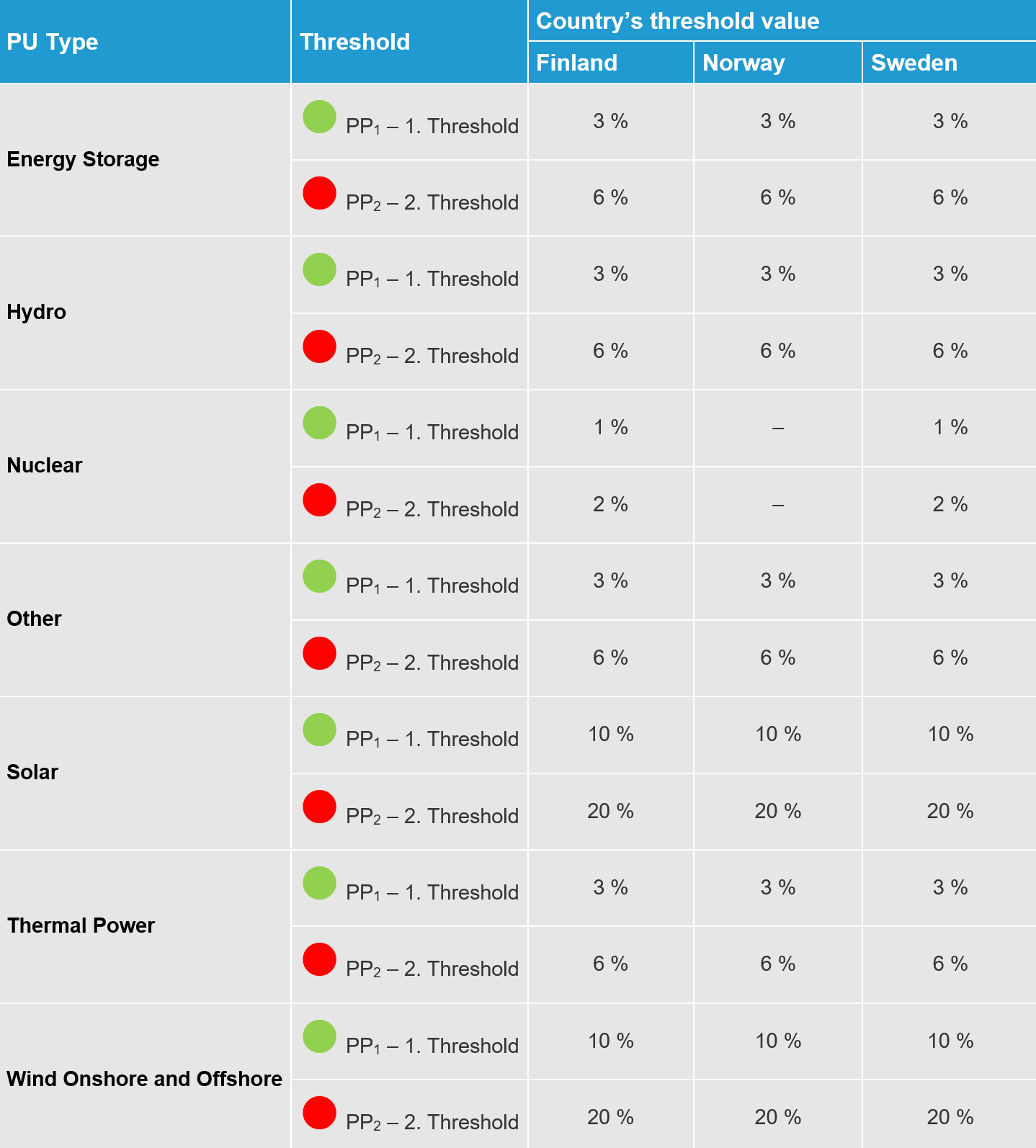

- Market behaviour monitoring is based on the analysis of the BRPs’ imbalances. These are analysed by calculating a set of KPIs, which show the BRPs market performance (e.g. quality of reported data, reporting frequency, relative imbalances, absolute imbalances and imbalance costs per unit). The quality of DSOs reporting will also be monitored. See Chapter 11, Market behavior reporting

- Market analysis refers to an evaluation of the electricity market dynamics from the settlement perspective. The analysis aims to ensure the accuracy and efficiency of settlement, identify trends, and provide insights for owners, stakeholders and for improving market operations.

All functions in the settlement model are described in Figure 2 below.

Figure 2. The Imbalance Settlement and Balancing Service Settlement Model functions.

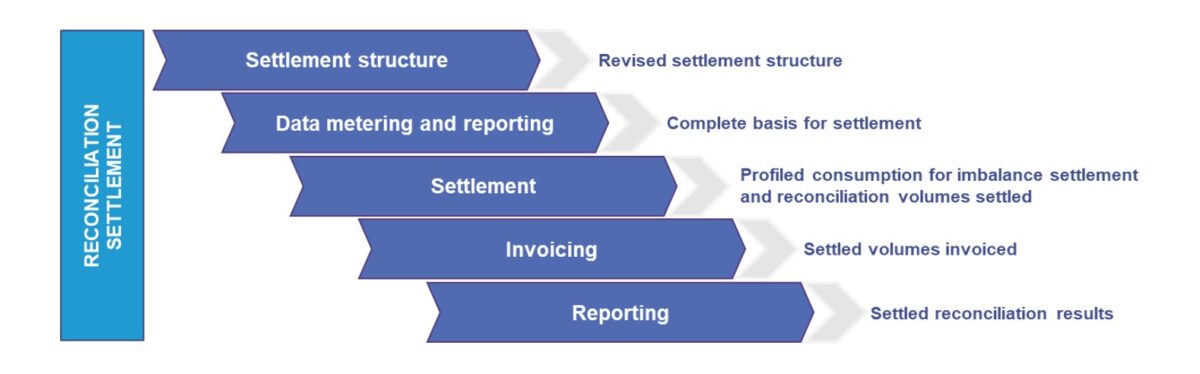

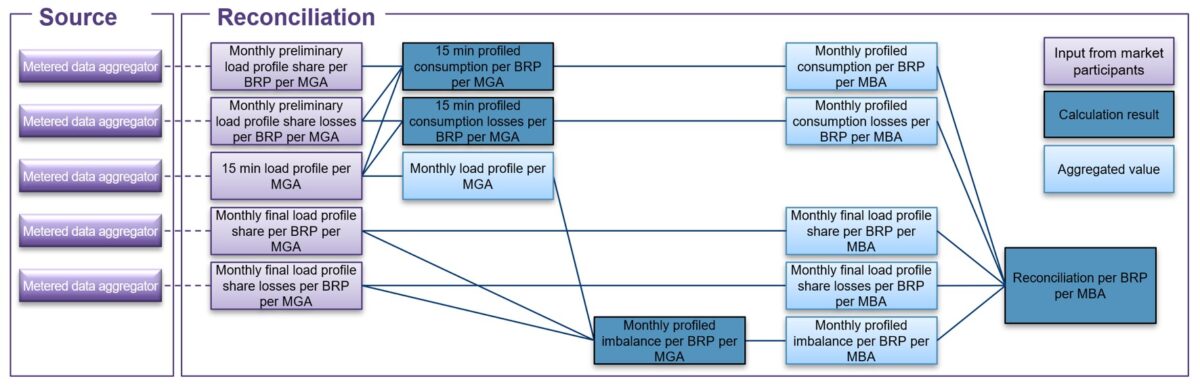

The Reconciliation Settlement Model ensures a transparent and common reconciliation settlement and equal treatment of market participants. eSett handles the reconciliation settlement only for Sweden, and this applies only for BRPs and DSOs in Sweden that have BRP level profiled consumption. The main objective of the Reconciliation Model is to provide profiled consumption data for imbalance settlement, and settle the difference between preliminary and final profiled consumption using day-ahead market prices for the MBA.

- Settlement structure defines how the information about the settlement structure and hierarchy (relations) is collected and managed, e.g. information about a new Profiled Consumption MEC or the contact information of a market participant. See Chapter 3, Settlement structure management

- Input Data defines the different data types and the basis of the reconciliation settlement data metering. See chapter 5.1, Swedish Profiling

- Reporting data handles the imbalance settlement data reception, validation, storing and reporting by eSett. See chapter 5, Settlement data reporting

- Settlement handles the profiled consumption and reconciliation settlement calculations, quality assurance and publishing of results. See chapter 6, Settlement Calculation

- Invoicing handles eSett’s invoicing of BRPs, based on differences between profiled consumption in the imbalance settlement and final monthly metered consumption. See Chapter 8, Invoicing

- Communication presents different communication channels and an arrangement of the communication in Nordic Settlement model. It also includes the creation, distribution and publishing of various reports and files provided by eSett. Reporting is also done through the Online Service and the Messaging Service that are provided to market participants. See Chapter 10, Communication

Figure 3. The Reconciliation Settlement Model functions.

The details regarding the model and data communication are available in the Svensk Elmarknadshandbok and in the Edielportalen.

- Svensk Elmarknadshandbok: https://www.elmarknadshandboken.se/

- Edielportalen: https://www.ediel.se/Info/edielanvisningar

The main stakeholders (i.e. market participants) in the Nordic Settlement Model along with the related roles and responsibilities are presented in the sections below. The validity of a market participant (i.e. the time frame within which the market participant is considered to be active in the market) shall be set after the required documents have been received by eSett. There are gate closures before a new market participant can be active in the Nordic market and they are presented in Table 6 in this document.

eSett is responsible for the financial settlement of imbalances in accordance with the imbalance settlement agreement and the Handbook:

- Collecting and maintaining the imbalance settlement structure

- Performing the imbalance settlement and invoicing/crediting the BRPs for the balancing power

- Invoicing/crediting the BSPs for the balancing services

- Setting the collateral levels so that they cover the imbalance settlement related risk exposure

- Collecting and monitoring the BRP´s and BSPs collaterals and taking necessary action to adjust collaterals when needed

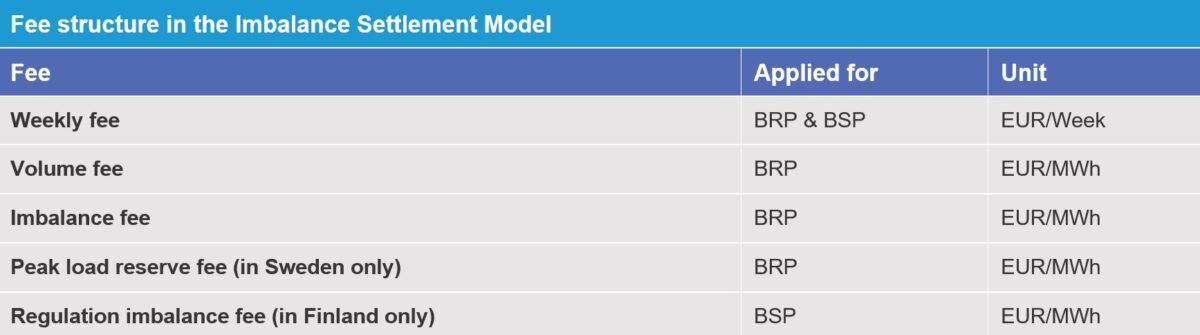

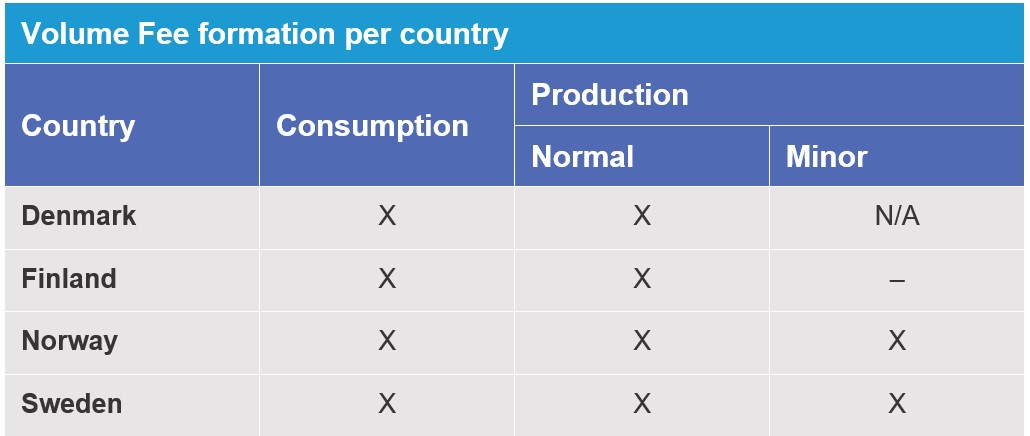

- Collecting fees from BRPs and BSPsto cover:

- Balance management and settlement costs of the TSOs

- A share of the reserve costs and related operational costs for the TSOs

- Monitoring imbalances and assessing whether they are in accordance with published guidelines and regulations

- Operating and providing an imbalance settlement IT solution available for the market participants can use to access and report settlement data

- Report and publish imbalance settlement data including statistics, KPIs and other market information

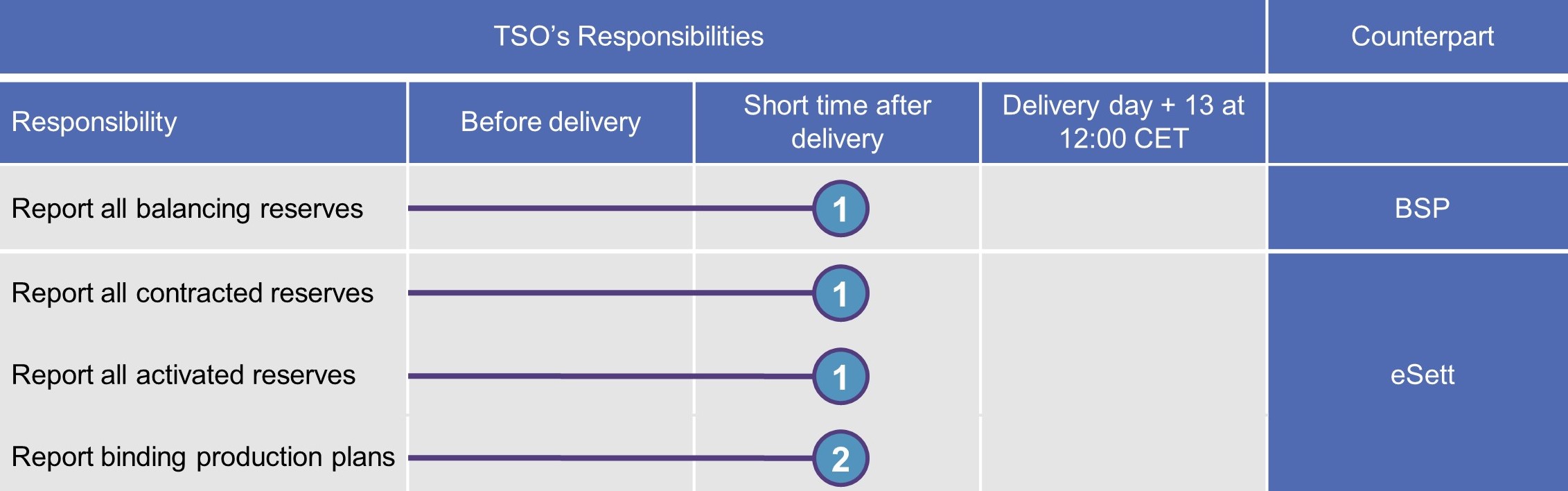

The TSOs have the ultimate responsibility to supervise the physical balance of the electricity system and to take actions in order to rebalance the system.

- Balancing the production/import with the consumption/export during the delivery day to meet the overall demand of a system frequency at 50 Hz

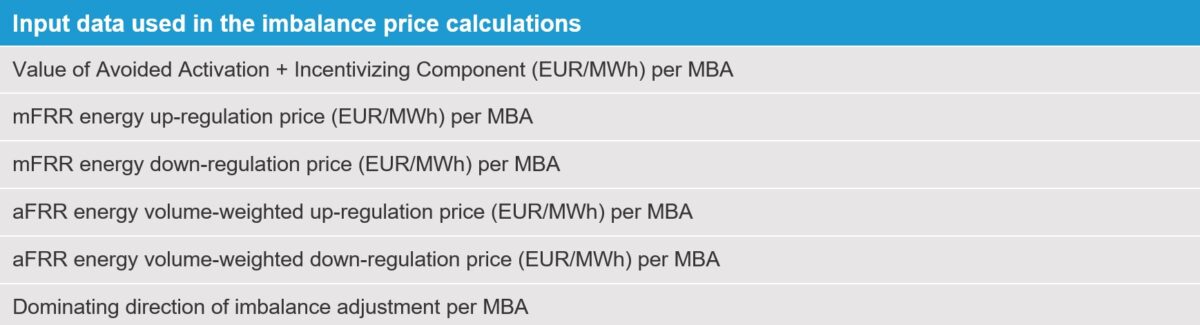

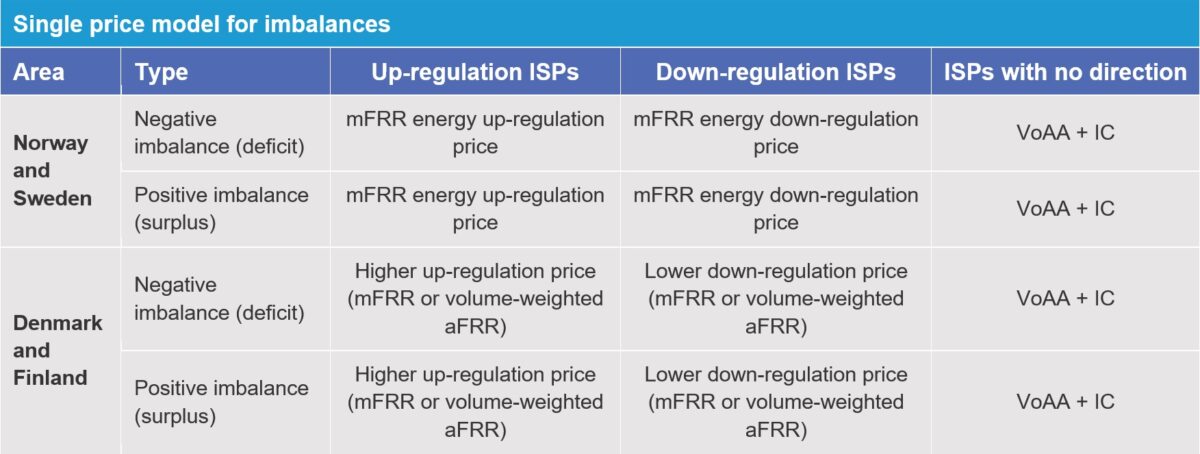

- Calculating imbalance adjustment volumes per imbalance settlement period and determining imbalance prices

- Submitting necessary information per BRP and per BSP to eSett for the imbalance settlement; e.g. production plan and procured balancing services during the imbalance settlement period

- Acting as the financial counterparty towards the BSP for all reserve capacity allocation (eSett is the financial counterparty for the corresponding activated reserves related to the imbalance settlement)

- Reporting to eSett the structural information of MBA, MGA and the relation between them.

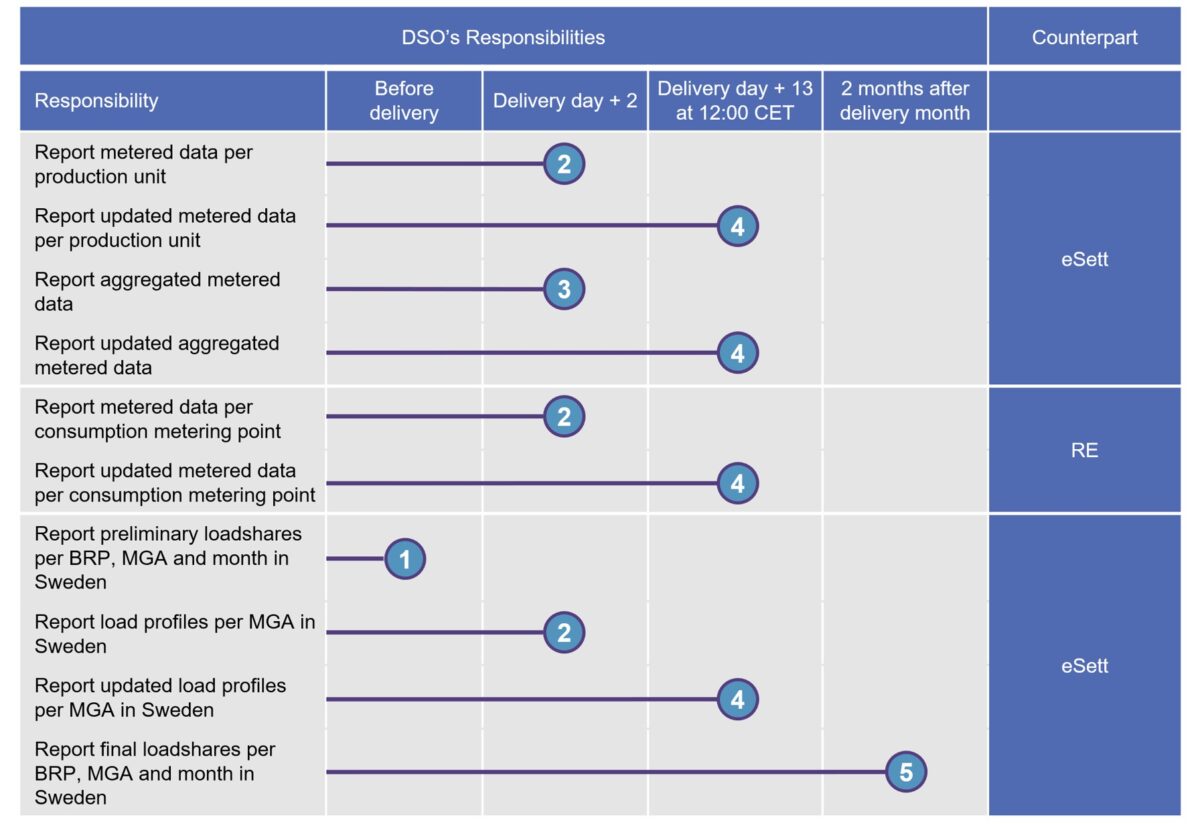

A DSO is a grid operator with the responsibility to connect producers and consumers to its grid. The DSOs have the responsibility to meter production, consumption, and exchange with other grids and to report the metered data to the entitled parties. This includes closed distribution system operators. The DSO has several obligations in relation to imbalance settlement. Some of the DSOs’ responsibilities towards eSett can be transferred to separate Metered Data Aggregator, e.g. to a national hub. Role of Metered Data Aggregator is explained in chapter 2.3.9. The DSO’s responsibilities are as follows:

- Registering the REs’ metering points regarding production and consumption in the respective MGAs

- Operating the metering system and submitting the required metering data to the REs, BRPs, TSO and eSett¹

- Calculating and reporting load profile shares (according to national guidelines)

- Calculating the final profiled consumption and the reconciled energy when all metering for a grid area is completed (according to national guidelines, see sub chapter 6.8. Reconciliation)

- Imbalance corrections, after the imbalance settlement reporting is closed, shall be settled between the DSO and RE. The exact procedure for settlement of imbalance corrections will be developed by the energy industry in each country.

This kind of metering responsible party can be a party having DSO network licence or closed network licence or is registered as a metering responsible. If there is not a clear responsible participant for metering and reporting settlement data of the special metering grid areas (e.g. production or industrial metering grid areas) then a balance responsible party or an open supplier for this metering grid area is responsible for metering and reporting imbalance settlement data. These metering responsibles shall have a role as a DSO in the Nordic Imbalance Settlement.

All Finnish DSOs in the Nordic Imbalance Settlement need to register their own metering grid areas to Fingrid as a TSO.

In Sweden, market participants that have a concession for a line or area have to be approved by the National Energy Authority in order to have a role as a DSO.

In Norway, a trading licensee who owns a transmission grid or is responsible for network services can have a role as DSO. Network services are defined as one or more of the following:

1. transmission of power, including operation and maintenance of and investment in grid installations

2. tariffing

3. metering, settlement and customer service

4. supervision and safety

5. co-ordination of operations

6. required contingency measures

7. required power system planning.

¹DSO’s have responsibility to report BRPs’ metering data to eSett. The responsibility is defined through the legislation and directives by the authorities in each country. eSett will have no duty nor practical possibility to ensure the correctness and completeness of the settlement information

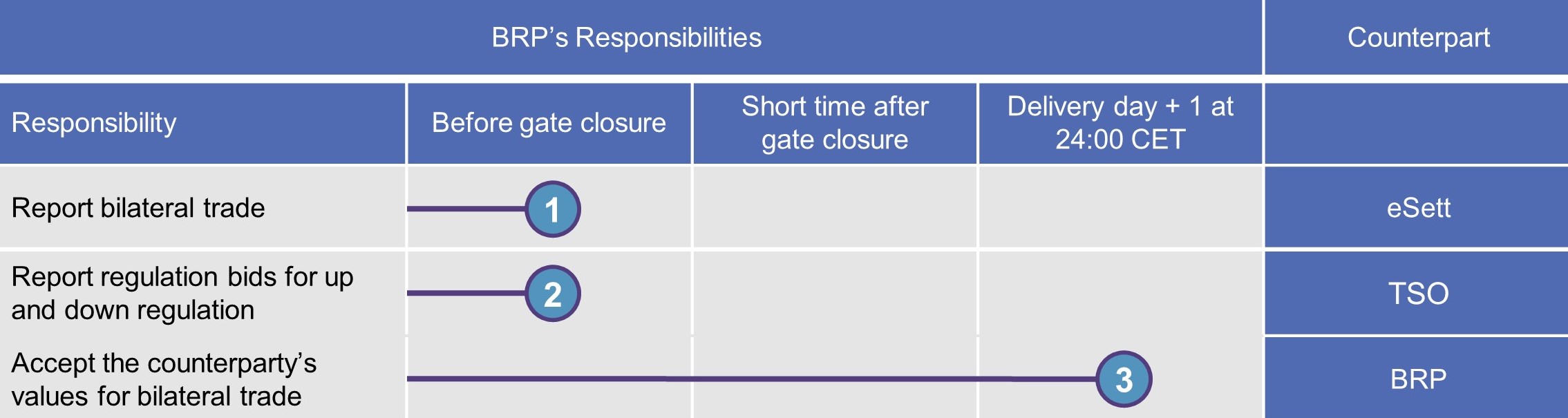

A BRP is a market participant having a valid agreement with eSett and the TSO of the area of operation. The BRP’s responsibilities are defined in the balancing agreement, imbalance settlement agreement and in the Handbook:

- Having a valid imbalance settlement agreement with eSett and providing the required collaterals

- Planning balanced schedules on an hourly basis

- Submitting plans per RO to the TSO

- Submitting bilateral trade information to eSett and verifying the correctness of the bilateral trades submitted by its counterparts, also on RE level.

- Acting as the financial counterpart for the settlement of imbalances and reconciliation according to national guidelines

- Acting as the financial counterpart for the balancing services in case the BRP has also a BSP role

- Keeping the imbalance settlement structure information up to date

- Verifying all relevant data reported by eSett, and notify deviations

- Informing eSett of which REs that the BRP is responsible for, for consumption and production per MGA

A BRP that has a valid agreement with a TSO regarding balancing services, does automatically also hold the market role and obligations of a BSP (see chapter 2.3.5 Balance Service Provider (BSP)).

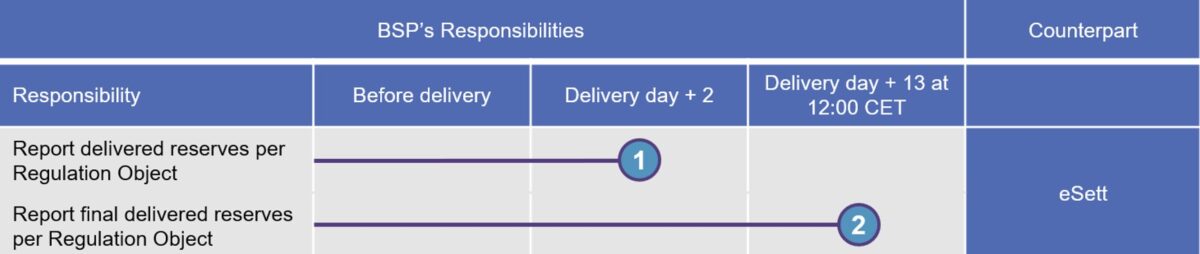

A BSP is a market participant having a valid agreement with eSett and the TSO of the area of operation. The BSP’s responsibilities are defined in the agreement(s) with TSO, agreement with eSett and in the Handbook:

- Having a valid agreement with eSett and providing the required collaterals

- If there is already a valid BRP agreement with eSett for the same business entity, there is no need for a separate BSP agreement.

- Acting as the financial counterpart for the balancing services if the BSP does not have also a BRP role

- Acting as the financial counterpart for the settlement of regulation imbalances according to national guidelines

- Submitting delivered reserves information to eSett or to the TSO as described in the national terms and conditions of the balancing services

- Keeping the imbalance settlement structure information up to date

- Verifying the correctness of the balancing services submitted to eSett

- Verifying all relevant data reported by eSett, and notify deviations

An RE is a market participant that for example sells electricity to final consumers, purchases production or performs trade activity. The RE’s responsibilities regarding imbalance settlement are as follows:

- All REs operating within the countries involved in Nordic Imbalance Settlement have to register to eSett according to the gate closure specified in Table 6.

- Having an agreement with a BRP for production and consumption in all MGAs where the RE is operating

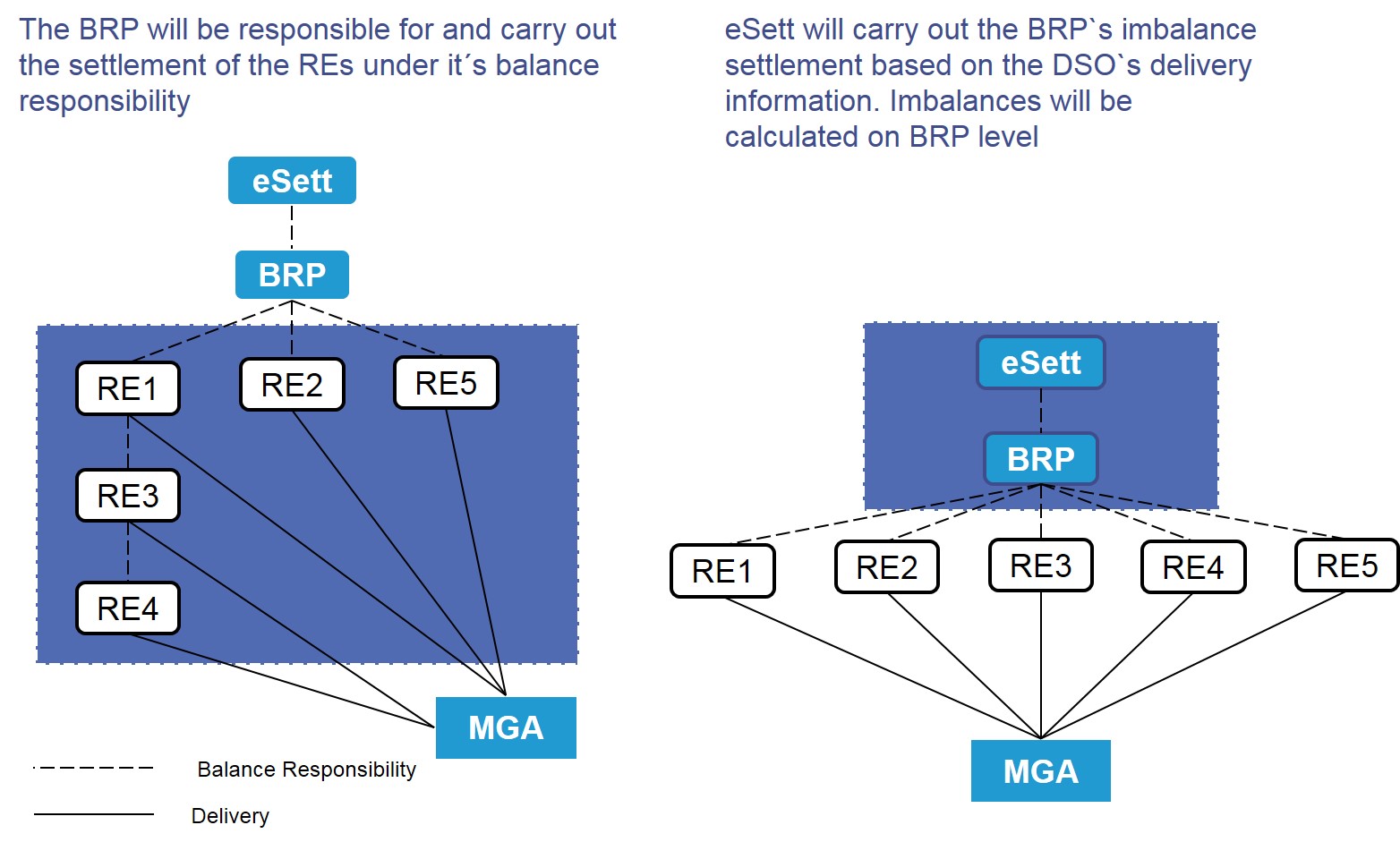

- For Finland this requirement will be adapted in order to facilitate the chain of open suppliers. This model allows that an RE may have an agreement with a BRP, or with another RE who then has an agreement with a BRP. This is illustrated in Figure 4.

Figure 4. Handling the “chain of open delivery” in the Finnish market area.

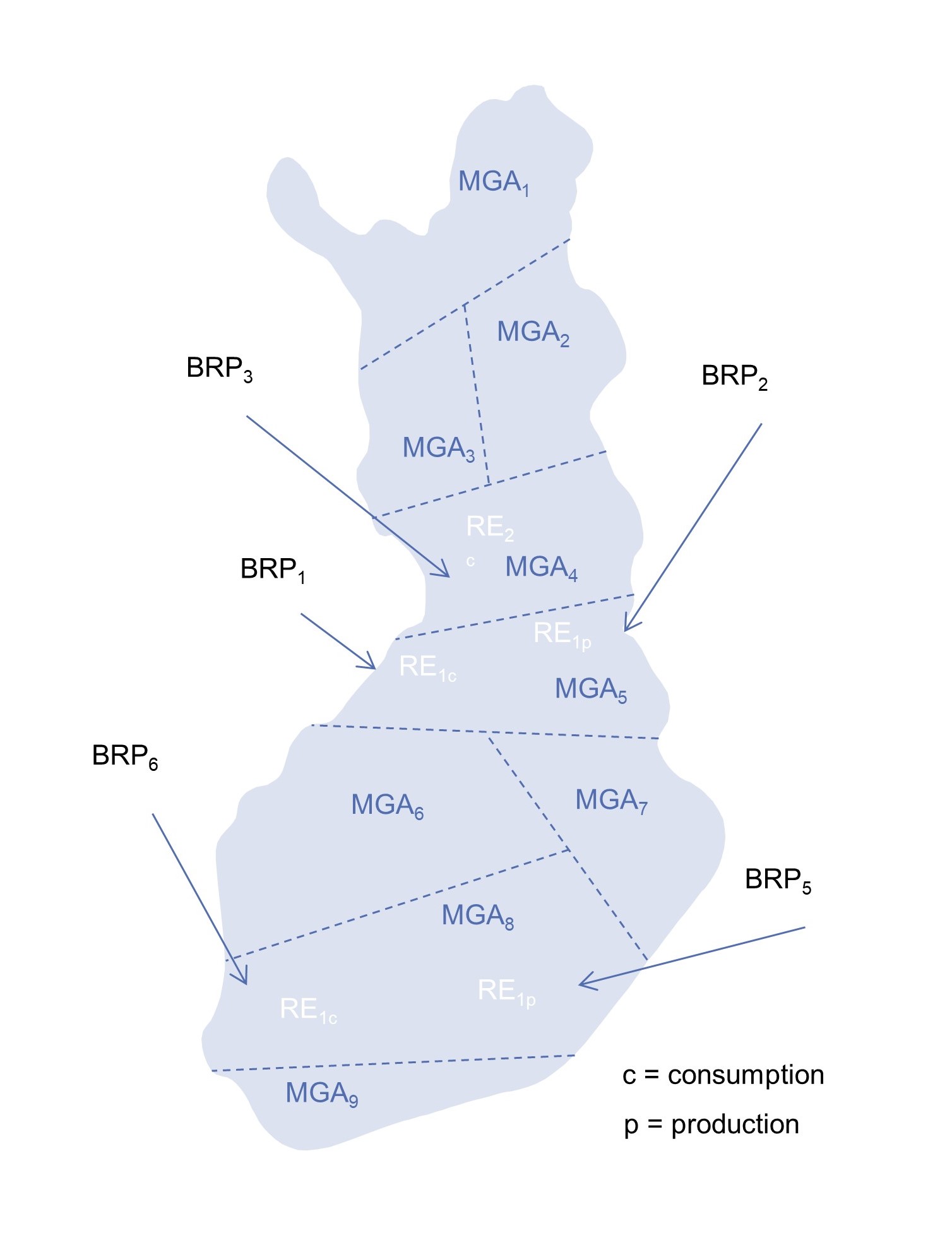

- A RE can use one BRP for consumption and one BRP for production in the same MGA and use different BRPs in different MGAs, this division is highlighted in the following Figure 5 where Finland is used as an example.

Figure 5. An illustrated model of one Retailer using different BRPs per MGA

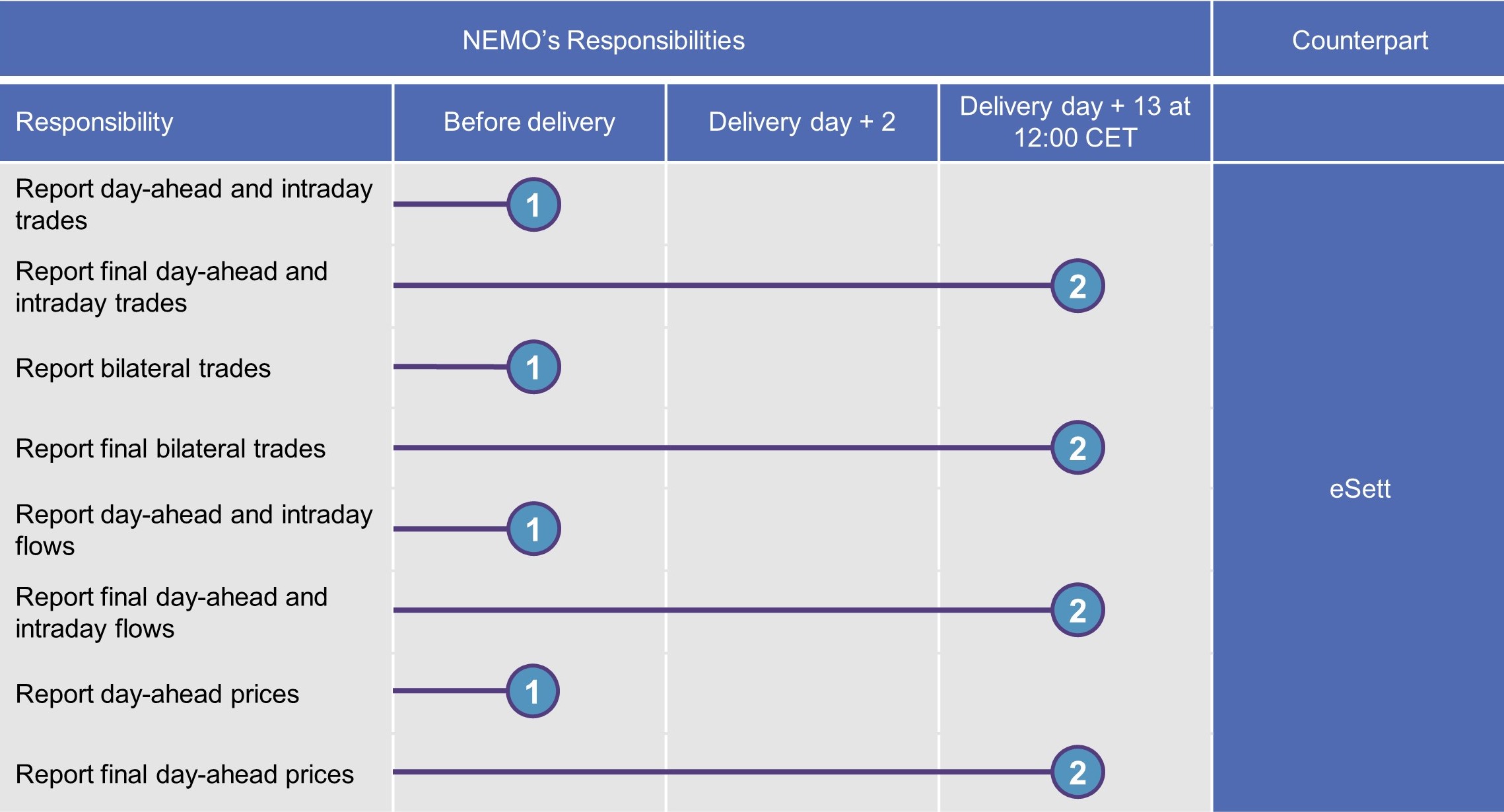

The responsibilities of a Nominated Electricity Market Operator, in its role as a power exchange and in regard to imbalance settlement are as follows:

- Reporting trade data for Day ahead – and Intraday trades (PX market trades) per RE and MBA to eSett (and TSO where needed)

- Reporting cross border trade (PX market flows) with other power exchanges (market coupling) to eSett and TSOs

- Reporting exchanges between NEMOs (Bilateral trades) per MBA to eSett

- In addition, Nominated Electricity Market Operator, in its role as power exchange, conducts market surveillance and reports any suspected breach of applicable regulations by the market participants to the national regulators

- Each NEMO may delegate the performance of tasks related to balance responsibility as laid down in the captioned Imbalance Settlement Agreement and Balance Agreement(s) to the Central Counter Party (CCP) of the NEMO.

- Keeping the trade data structure information up to date

- Verifying all relevant data reported by eSett, and notify deviations

A Service Provider provides operational balance management and settlement services for the market participants e.g. the BRPs, BSPs, REs and DSOs. According to the services provided for the market participants, the service provider has a right to perform the corresponding tasks towards eSett and the imbalance settlement system.

The service provider can for example provide services below:

- reporting and entering settlement data

- verifying calculated imbalances or

- handling collateral management on the online service on behalf of the market party.

One market party can have several Service Providers (a separate Service Provider for each category) and one Service Provider can serve several market parties.

A Metered Data Aggregator receives metered data from Distribution System Operator and reports aggregated values to eSett instead of DSO. National hubs act as Metered Data Aggregators for DSOs in their operating countries. If there is no national hub responsible for the metering grid area, DSO will aggregate its metered data and report it directly to eSett. Responsibilities of Metered Data Aggregator include:

- Registering the REs’ production and consumption MECs in the respective MGAs

- Receiving metered and profiled data and calculating of aggregated consumption and production time series per MGA

- Reports aggregated time series to eSett

The Nordic Settlement Model utilises a combined Nordic calendar, which consolidates the public national holidays from all involved countries. You can find the calendar on eSett’s homepage and in Appendix 2, Nordic Calendar. No invoicing shall be performed during a public holiday, and they will be taken into account in the terms of payment in settlement related invoicing. Also, no collateral shall be released during a public holiday.

As an example, if a certain day is considered as a public holiday in Sweden, it will also be considered a public holiday in all involved countries.

The Nordic Settlement Model will be operated in Central European Time (CET)/Central European Summer Time (CEST) and a 24-hour clock (10 o´clock in the evening will be written as 22:00) in operation (for example in invoicing and imbalance settlement), which is required to be supported by all market participants acting with eSett. The Nordic Imbalance Settlement Model will also use winter and summer time change, last Sunday in March will have 23 hours and last Sunday in October will have 25 hours.

The settlement structure management (e.g. retailer balance responsibility, RBR) will be complied with national legislations. In Finland, the settlement structures will be managed in Eastern European Time (EET)/Eastern European Summer Time (EEST) and in Sweden the settlement structures are managed in Swedish Normal Time (SNT). In Denmark and Norway Central European Time (CET)/Central European Summer Time (CEST) is used.

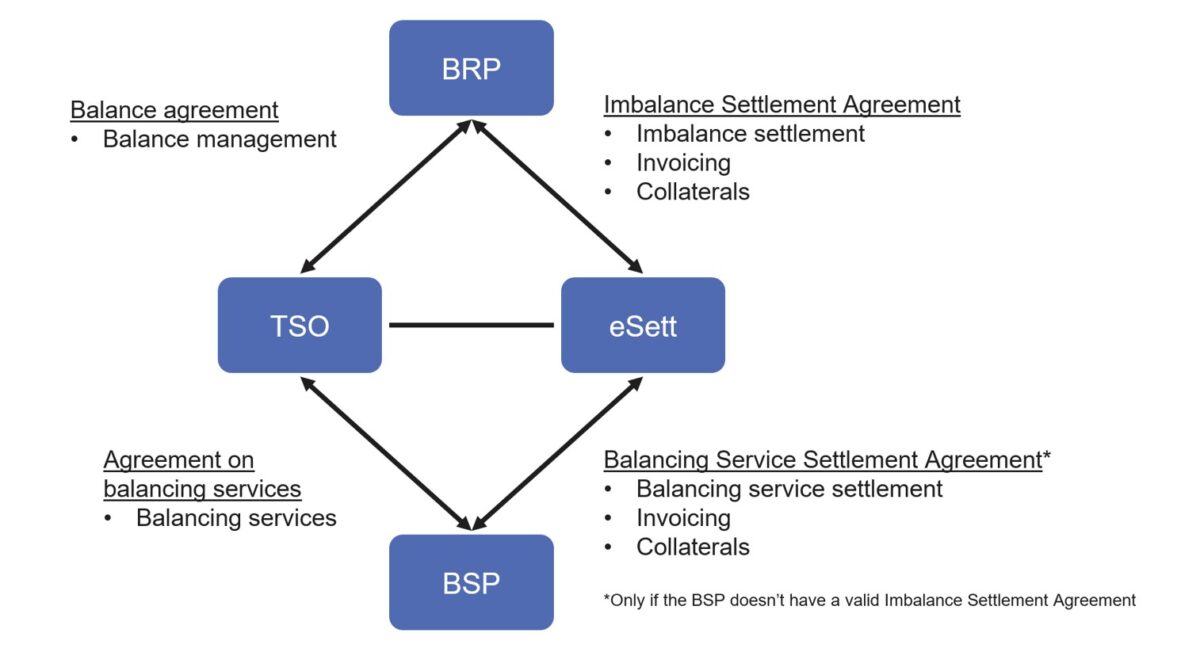

Participating as a BRP in the electricity market settled by eSett requires a valid Balance Agreement between the BRP and the respective TSO, as well as valid Imbalance Settlement Agreement between BRP and eSett. Similarly, participating as a BSP in the electricity market settled by eSett requires a valid agreement on providing balancing services between the BSP and the respective TSO, as well as a valid Balancing Service Settlement Agreement between BSP and eSett unless the BSP already has a valid Imbalance Settlement Agreement for the same business entity.

The scope of the imbalance settlement agreement and balancing service settlement agreement are limited to issues regarding the settlement and invoicing of imbalances and balancing services. The TSO agreements regulate balance management, provision of balancing services and related issues.

Figure 6. BRP and BSP agreements.

As before, a BRP or BSP must comply with the TSOs requirements if they are providing reserves in the balancing markets.

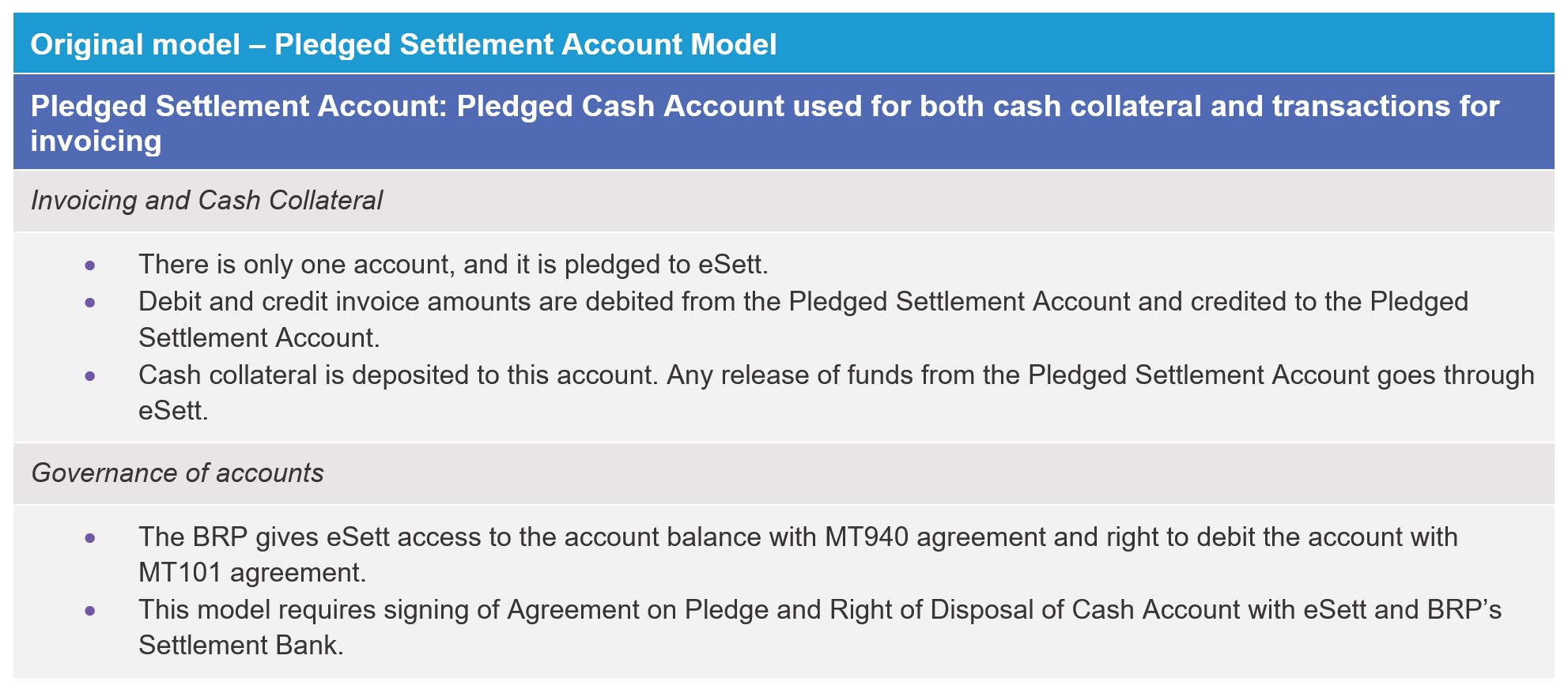

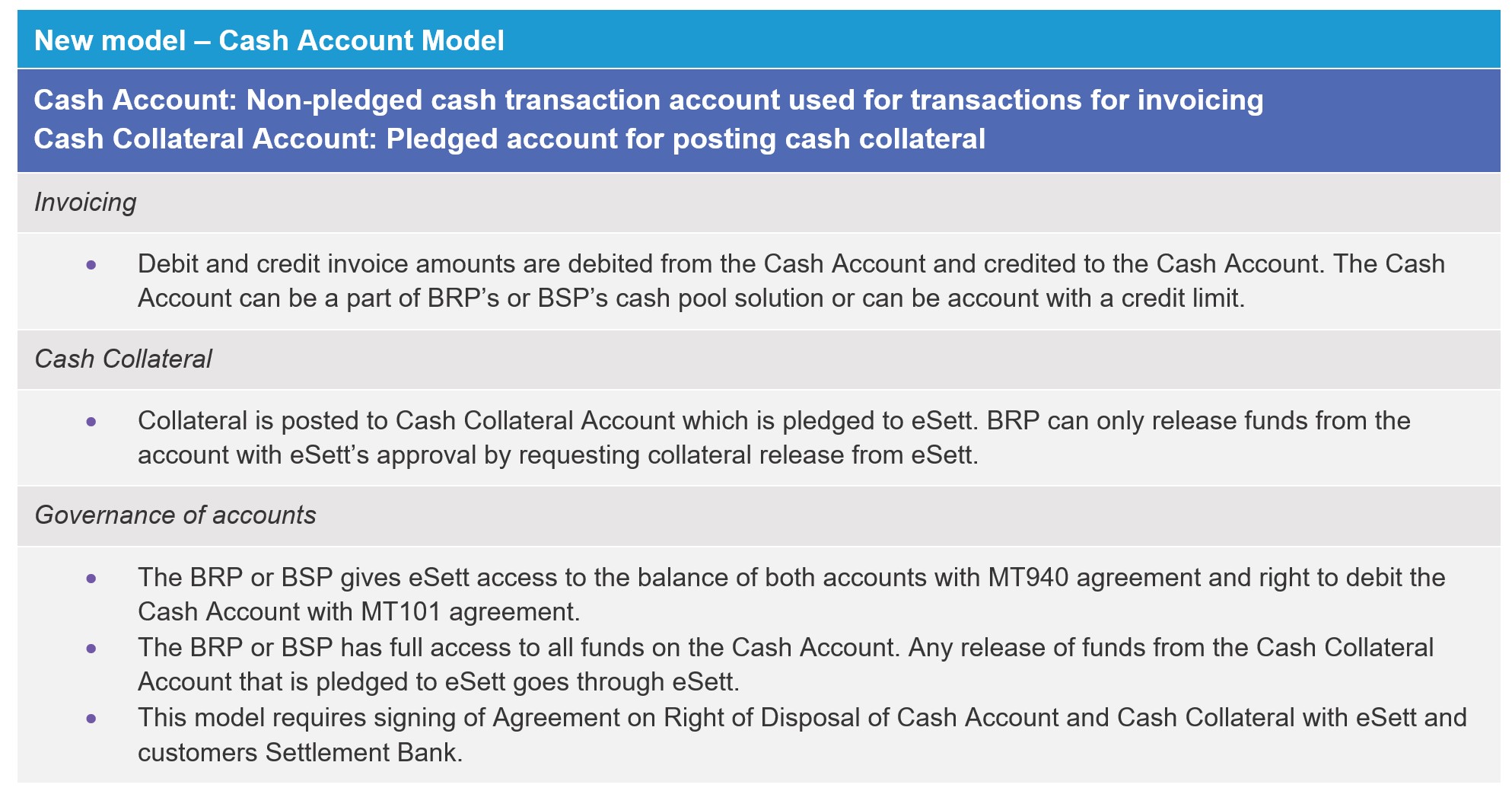

In addition, BRPs and BSPs need to hold a bank account(s) in an approved settlement bank, i.e. a bank which has been approved by eSett to be used in the settlement. See chapter 8.4 for the required banking setup and related agreements.

The Imbalance Settlement Agreement between eSett and BRP regulates the relations between the parties and the settlement requirements that the BRP must comply with. The following topics are included in the imbalance settlement agreement:

- BRP’s rights and obligations

- eSett´s rights and obligations

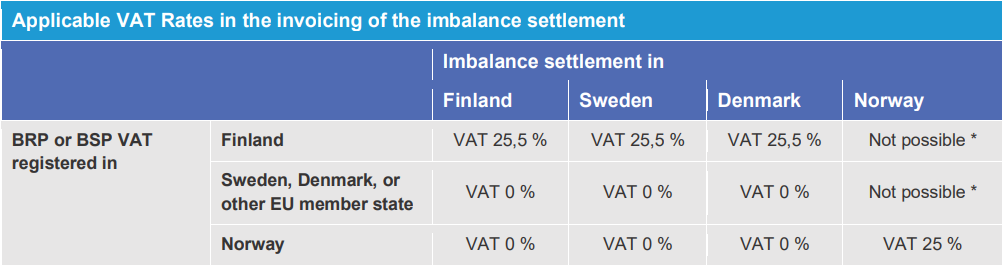

- Fees and taxes

- Invoicing and payment process and requirements

- Collaterals procedures and obligations

- Imbalance settlement rules as defined in the Handbook

- Parties’ contractual liability

- Procedures when the agreement is breached by the BRP

- Term and termination of the agreement

- Procedures when the agreement and its appendices are amended

- Dispute resolution and governing law

The Balancing Service Settlement Agreement between eSett and BSP regulates the relations between the parties and the settlement requirements that the BSP must comply with. The following topics are included in the balancing service settlement agreement:

- BSP’s rights and obligations

- eSett’s rights and obligations

- Fees and taxes

- Invoicing and payment process and requirements

- Collaterals procedures and obligations

- Settlement rules as defined in the Handbook

- Parties’ contractual liability

- Procedures when the agreement is breached by the BSP

- Term and termination of the agreement

- Procedures when the agreement and its appendices are amended

- Dispute resolution and governing law

In order to enter into agreement with eSett and the TSO(s), the BRP or BSP shall contact eSett for more information. Valid imbalance settlement agreement or balancing service settlement agreement, the appendices and contact information can be found on eSett’s web site.

Each party has the right to terminate the agreements with eSett and the TSO(s) according to what has been specified in each agreement.

The terms, under which eSett and TSOs shall have the right to terminate the agreements with eSett and the TSO(s), have been specified in each of the agreements. If a BRP or BSP acts against the rules of the agreements, following steps will be taken by eSett and TSO(s).

- eSett and TSO shall inform each other and assess the situation together.

- eSett or TSO shall inform the party of breach of agreement(s) and possibly

- request for explanation for the breach of contract

- give a deadline within which the situation must be corrected.

- TSO may inform the national regulator, eSett and NEMOs that exclusion is possible. (Only in Norway.)

- After an analysis, TSO has the right to decide whether an immediate termination of agreement is needed or not.

In case of termination of agreements with immediate effect, and thus causing a BRP to become a subject to exclusion from the market, the processes hereinafter are followed.

- eSett or TSO shall inform the party of the decision and market exclusion.

- eSett or TSO shall inform the national regulator, NEMOs, DSOs and affected REs about the exclusion.

- Information shall be published via eSett and possibly also via TSO and/or national regulator.

In case of a market exclusion of a BRP, there are some national differences for the handling of the affected retailers, which have been described in the sub-chapters below

The affected retailers must sign a contract with a new BRP to effectuation within 3 days after the information from Energinet. During the period from the BRP market exclusion until the contract with a new BRP becomes valid, Energinet will operate as a BRP for the retailer. eSett will help to establish the necessary setup in the imbalance settlement system. If a retailer fails to get a contract with a new BRP within the time frame, Energinet will distribute the retailer’s metering points to other retailers.

DSOs will stop the deliveries and distributions of a retailer that does not have an open supplier or a BRP. However, a DSO cannot stop the deliveries to the end users due to reasons of the retailer before the DSO has informed the end users about the termination. DSOs will guarantee the deliveries to the end users at least 3 weeks after the announcement of termination. If the DSO has not pointed out other open supplier, deliveries will be part of the MGA losses.

The affected retailers in Norway will, if they are unable to obtain a new BRP, be excluded immediately at the time when the existing BRP responsibility ends. DSOs will act as a supplier of last resort for the end users of the retailers that are excluded.

The affected retailers have 10 working days and at most 15 calendar days to obtain a new BRP. During the period from the BRP market exclusion until the contract with a new BRP becomes valid, each affected retailer will operate as a BRP for themselves. If a retailer fails to get a contract with a new BRP within the time frame, DSO should replace the retailer with the retailer of last resort.

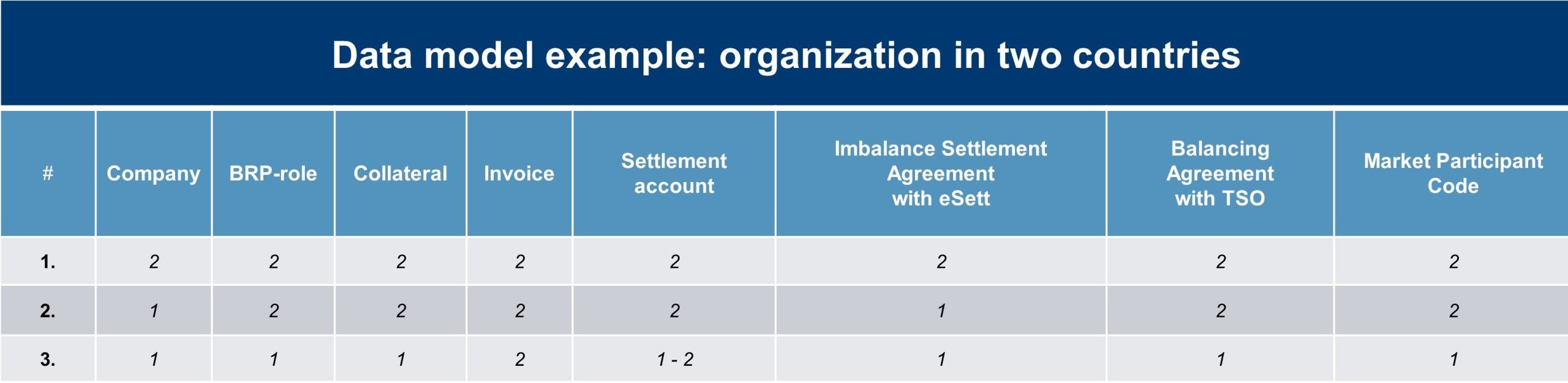

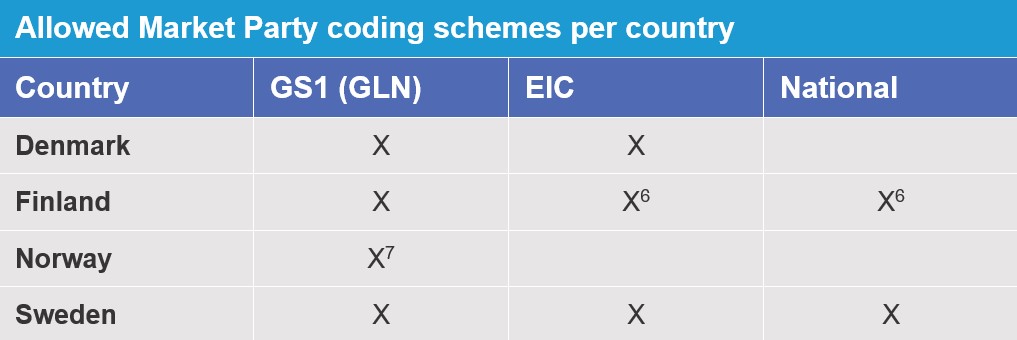

This chapter shall clarify the different options the market participants have when organising themselves for the imbalance settlement model. As previously mentioned, the purpose of the imbalance settlement model is among other things meant to lower the barriers for operating in more than one country. However, national laws and the imbalance settlement system set certain requirements and limitations under which the market participants are expected to act. Company data model ties important concepts together by connecting the country, company, market participant role, collaterals, invoices, balance account, agreements, coding scheme and the related market participant code. In principle, there are three different ways to act in several countries and these possibilities are demonstrated in the following with the help of an illustrative table, which presents the case of a BRP. This chapter refrains from favouring any of the presented options and it is thus left for each company to consider and choose an option they deem to be most suitable for themselves.

Table 1. Company data model in NBS.

The first option in the above table describes a situation where two separate companies with their own business IDs are established, or already exist, in order to operate the BRP roles in two different countries. In practice, this set-up means that both of the market participant roles will have their own collaterals, separate invoices, and their own settlement accounts with eSett, one agreement with both TSOs and eSett depending on the countries the BRPs operate in, and finally, their own separate market participant codes, which are used, e.g. for messaging. In this case, these codes may follow the local coding schemes when operating only in one country. The agreements here are the Imbalance Settlement Agreement with eSett and the Balancing Agreements with TSOs. In this option, the companies are registered in different countries.

The second option is based on only one company having two separate BRP roles. This results in two separate collaterals, invoices, settlement accounts, agreements and market participant codes.

In order to prevent a situation where it is necessary to place several collaterals, the third option could be considered. This option gives the possibility to organise the company structure based on only one company and one BRP role, which operates in more than one country. However, differences in legislation between countries set limitations to this scenario in case the company is active in Norway. Due to Norwegian legislation, it is mandatory that in this option the company is registered in Norway since it is required that BRPs acting in Norway are locally registered companies.

One market participant role results in one set of collaterals as they are role-specific. In this scenario, the company will receive as many invoices as there are countries where the BRP operates since the invoice is always country-specific. The number of required settlement accounts depends on the number of currencies used, which means that if the BRP uses one common currency it is sufficient to have only one settlement account. For agreements, the same applies as to collaterals: they are role-specific. Logically, one BRP role requires only one market participant code as long as it is not any of the national codes, but either the EIC or GS1 code. However, it is mandatory to use Norwegian GS1 codes for market participant roles related to Norwegian companies.

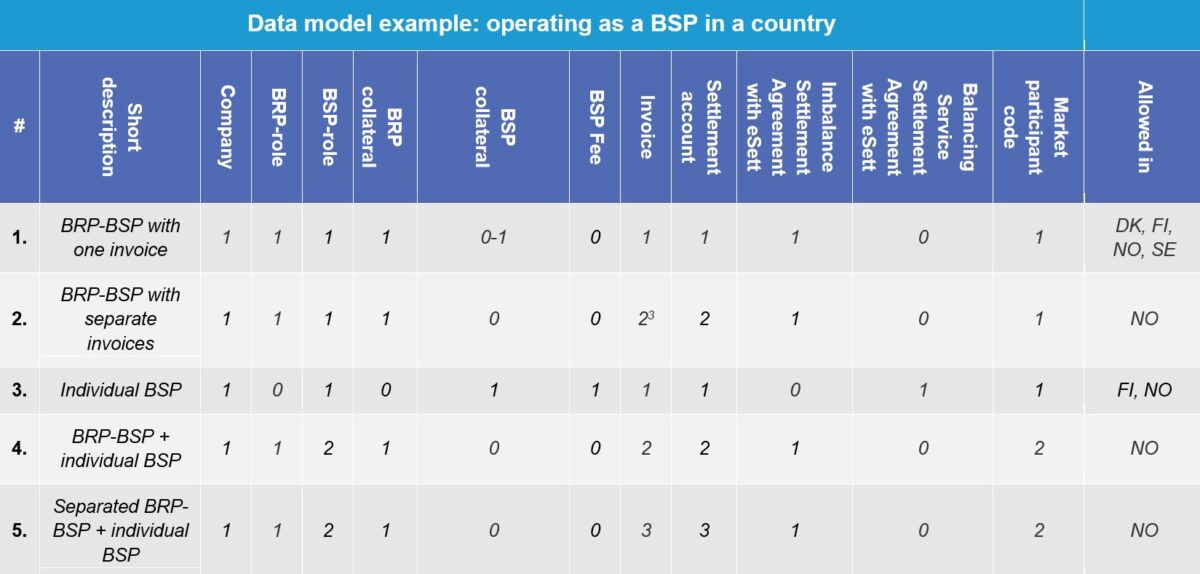

This chapter shall clarify the different options the market participants have when organising themselves as Balancing Service Provider in the NBS model. As many BSPs are also BRPs, which impacts on the possible setup of agreements and invoices compared to a market participant that only operates as a BSP. However, national regulation set certain requirements and limitations under which the market participants are expected to act. The data model ties important concepts together by connecting the company, market participant role, collaterals, invoices, settlement account, agreements, coding scheme and the related market participant code. In principle, there are three different ways to operate, and these possibilities are demonstrated in the following with the help of an illustrative table.

Table 2. Data model for operating as a BSP in a country in NBS.

The first option is that a Balance Responsible Party (BRP) is also providing balancing services in the same country through same company. There will be both BRP and BSP roles, but only one BRP collateral and invoice, which contain also the products from the BSP-role. An exception is a BSP in Finland that provides independent aggregation, as they need to provide also BSP collateral on top of the BRP role. The market participant doesn’t need to sign Balancing Service Settlement Agreement with eSett as the Imbalance Settlement Agreement already stipulates necessary rights and obligations to operate as a BSP. Also, only one settlement account and by extension related account agreement is required in this option. The BRP and BSP roles may use the same market participant code for data exchange.

The second option is the same as the first one, but with t This will be useful in cases where the BRP and BSP market roles wish to be invoiced with different currencies. This setup requires two separate settlement accounts and related account agreements for both accounts.

The third option represents a case where a market participant is operating as a Balancing Service Provider (BSP) without having a BRP-role. In this case, there is a BSP collateral as defined in chapter 9.11 and nationally defined BSP fee. The BSP needs only one settlement account and receives one invoice. Instead of Imbalance Settlement Agreement, the BSP signs a Balancing Service Settlement Agreement with eSett. The BSP has its own unique market participant code for data exchange.

The fourth option is a scenario where a company has a Balance Responsible Party (BRP) providing balancing services in the same country through one company (option 1). Additionally, the same company has an individual Balancing Service Provider (BSP) role with its own unique code (option 3). This setup may be used when the company wants to separate some balancing services under a different BSP role and invoice, or use different currencies for different balancing services.

In the fifth option, a company separates the BRP and BSP role-related products into their own invoices (option 2). Additionally, the same company has an individual Balancing Service Provider role with its own unique code (option 3). This setup could be used, for example, when the company wants to separate imbalance settlement into a BRP invoice and some balancing services under a different BSP role and invoice, or wishes to use different currencies for different balancing services.

All balancing services (i.e. capacity and activated reserves) are on the BSP invoice while imbalance settlement (i.e. imbalances and fees) are on the BRP invoice.

The settlement structure is one of the key elements in the Nordic Settlement Model. Each market participant is responsible for informing and updating structural information. Structural information is information about the market participants and their relations to each other (e.g. the relationship between a BRP and an RE) and to the Market Entities and Market Entity Connections (e.g. the relationship between an RE and an MGA). Every market participant has to register for acceptance to operate in the market. The participants themselves are responsible for registering and keeping their own information up-to-date.

Every company taking part in imbalance settlement needs to register in the imbalance settlement system. Company information will be registered together with information about the different roles that the company operates. A company can have several different roles (BRP, BSP, DSO, RE). Every role the company operates will be registered as a market participant. It is also possible for a company to have multiple market participants of the same role.

eSett will maintain the structure information, based on the information provided by the DSOs, BRPs, BSPs and TSOs. The DSOs are responsible for updating the structure related to metering points in the MGAs they are accountable for (e.g. a retailer’s consumption and production within a MGA) and the BRPs are responsible for updating the structure of their obligations (e.g. which RE in the different MGA they are responsible for). BSPs are responsible for updating the balance responsibility information of their reserve resources.

The market participants shall enter changes in the settlement structure in the Online Service, provided by eSett. The changes are validated and approved after they have been entered in eSett´s imbalance settlement system. Once the changes are approved, they will be used in imbalance settlement. The structure information is published in the Online Service where market participants can view the up-to-date settlement structure information. Restrictions to view are managed with access rights in accordance with the legislation.

Furthermore, market participants will also be able to view and download the area-specific structure for all countries, i.e., information for MGA master data, MBA master data, MGA-MGA relations and MGA-MBA relations. The content of the MGA and MBA master data will be area-specific information, such as type, name, area identification, etc.

Up-to-date structural information is essential for managing the reporting and other imbalance settlement functions. The settlement structure contains the information related to different market participants: TSOs, DSOs, BRPs, BSPs and REs, and information on the relationship between the market participants.

Information regarding the BRPs’ responsibility for an RE in all MGAs, and the specific period of time, is essential to enable correct reporting of data and calculation of imbalances. One common and public overview with this information is therefore developed and maintained in eSett’s imbalance settlement system.

Every entity of structural information has a validity period. The given start and end date define the period of time during which the specific entity is considered to be active. The end date is not required when creating a new structure, but it shall be entered when the end date has been confirmed.

A description of the structure elements and their relations are available in Figure 7.

A detailed description of the interface and the process of managing the structural information will be provided as a User Guide in the Online Service.

Figure 7. An illustrative example of the structure elements and their relations.

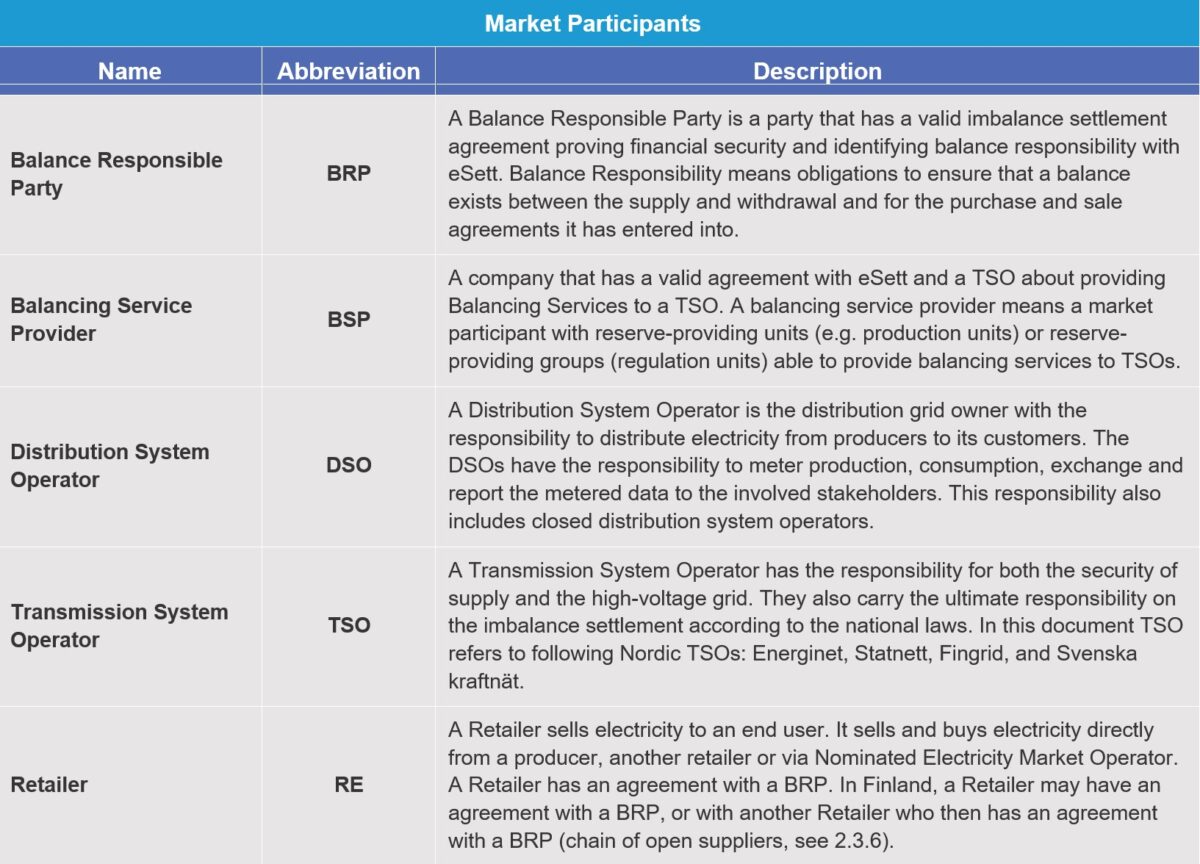

Information about the settlement structure is related to different types of roles (RE, BRP, DSO and TSO). One company may have multiple roles, and each of these roles shall be presented by a separate Market Participant operating in the electricity market. It is also possible for a company to have multiple market participants with the same role. In the Nordic Settlement Model, there is always a connection between the structure information and specific market participants, being valid for a specified period of time. The roles are defined and described in the Table 3 below.

Table 3. The Market Participants in the Nordic Settlement Model

Unbundling rules define the roles that can be performed by a single company. Currently, there are some national differences in this legislation that will impact imbalance settlement.

Unbundling rules in Sweden, Denmark and Finland define that REs and DSOs must belong to separate companies. The exceptions are Finland and Norway where DSOs with non-concessional grid (e.g. production and industrial metering grid areas) can belong to the same company as the RE.

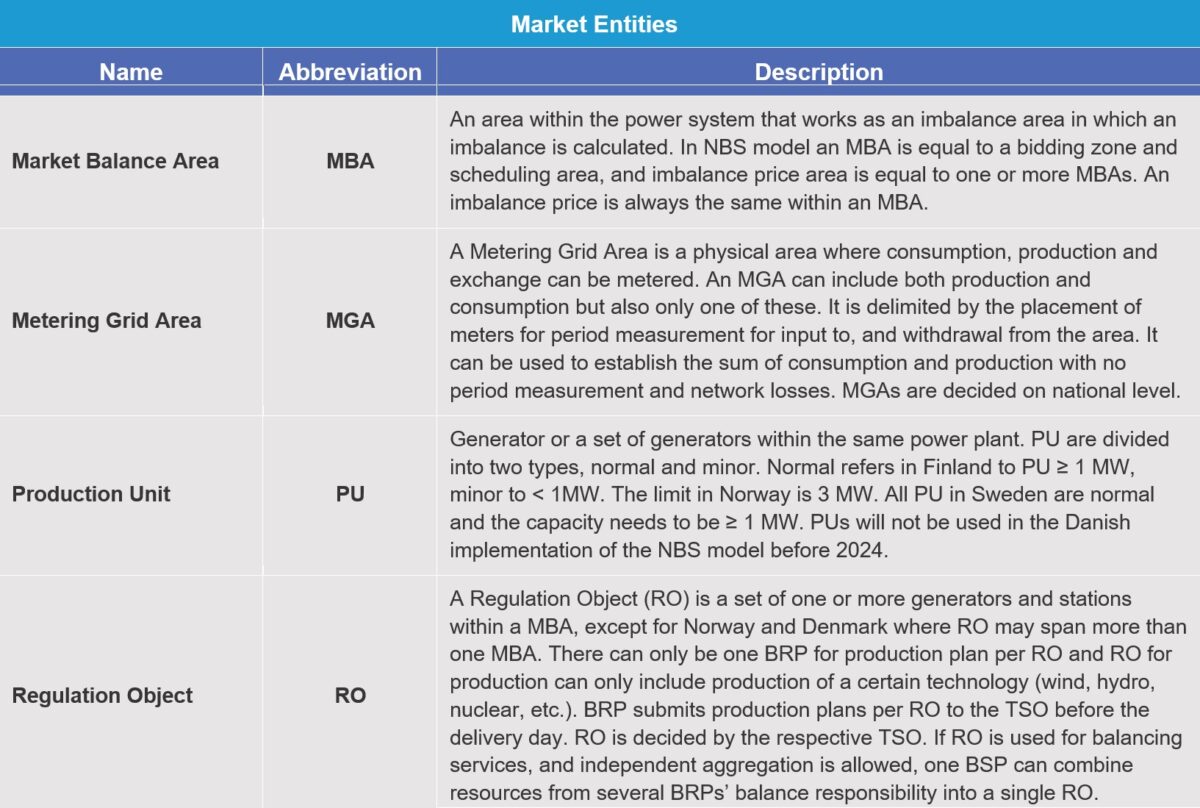

In order to organize the settlement information in a structured way, the structure information is also related to a market entity (ME). These are used to further specify the areas where consumption, trade and exchange occur, including also the power generator and regulation object. The defined MEs and the corresponding descriptions are shown below in Table 4.

Table 4. Market Entities in the Nordic Settlement Model

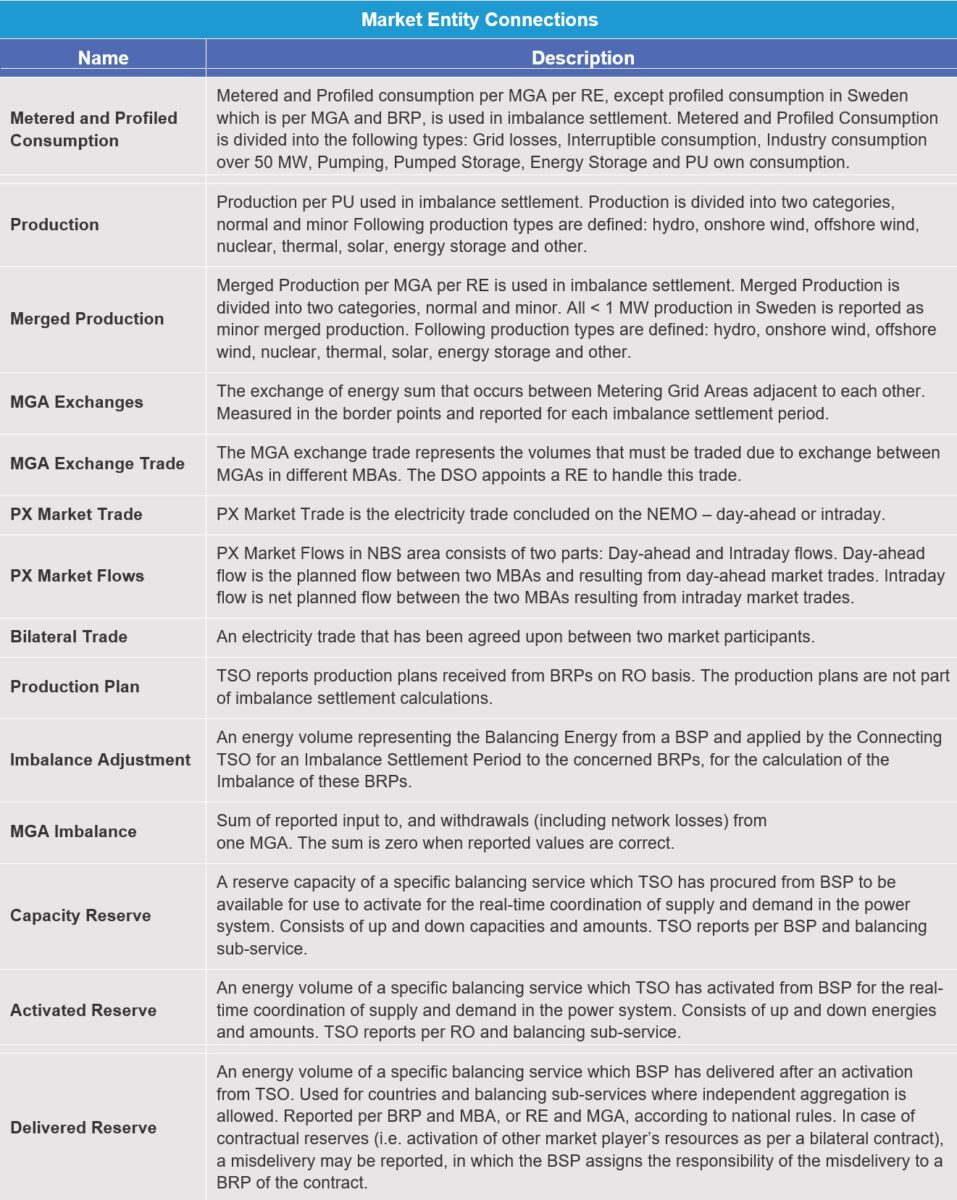

A large amount of settlement information is exchanged between market participants within the Nordic settlement. The information is organised into so called Market Entity Connections (MEC). The MECs are central in the imbalance settlement structure as they facilitate reporting of all the time series with settlement data.

MECs are different kinds of connections either between market participants (e.g. bilateral trades between parties) or between market participants and market entities (e.g. market participant’s metered consumption in MGA or market participant’s production per Production Unit). MEC’s time series data is the core of the settlement. Table 5 explains the MECs utilised in the Nordic Settlement Model.

Table 5. Market Entity Connections in the Nordic Settlement Model

eSett receives structure information from market participants containing imbalance settlement structure information that should be added, updated, or closed in the imbalance settlement system. The structure information is entered via the Online Service and validated by eSett. When the settlement structure has been updated, eSett publishes the settlement structure to market participants in the Online Service.

Every participant in the electricity wholesale market will have to apply to eSett for acceptance into the settlement structure. The participants themselves are responsible for registering and verifying that their information is up-to-date. Responsibilities regarding the settlement structure information management are explained in the following sub-chapters.

eSett hosts the common settlement structure information. The related responsibilities are the following:

- Setting BRPs as active when the imbalance settlement agreement is set into force and related requirements are fulfilled (Appendix 1)

- Setting BRPs as inactive when the imbalance settlement agreement has been terminated

- Setting BSPs as active when the required agreements are set into force and related requirements are fulfilled (e.g. possible collateral)

- Setting BSPs as inactive when the required agreements have been terminated

- Setting DSOs as active when they fulfil all requirements as DSO (license from the local authority, ID, certificate, testing)

- Setting DSOs as inactive when DSOs activity has ended

- The DSO has for example been merged with another DSO

- Setting REs as active when they fulfil the requirements set upon them by the regulators

- Since an RE may have a different BRP in every MGA it’s most efficient that eSett perform this control instead of many DSOs or BRPs controlling the same RE

- An active RE will be able to handle consumption, trade and production

- Setting REs as inactive when their activity has ended

RE is responsible for reporting the following structure information to eSett:

- Registering company as an RE

- Retailer initiates the switch of supplier process. This process can only be initiated when the RE has a valid BRP in the MGA where the delivery will take place

- Update own contact information

BRP is responsible for reporting the following structure information to eSett:

- Registering company as a BRP

- If a BRP has a valid agreement with a TSO regarding balancing services, registering company also as a BSP

- Registering for which REs they take on the responsibility for production, and in which MGAs. It is the new BRP that is responsible for applying the correct structure

- Registering for which REs they take on the responsibility for consumption/trade, and in which MGAs. It is the new BRP that is responsible for applying the correct structure

- Manage MECs for bilateral trade for REs that they are responsible for. Registration of a bilateral trade needs to be done by one of the BRPs and the counterpart will then need to approve the registration of the bilateral trade with this BRP

- Assigning PU to the correct RO

- Provide the TSO with sufficient information to register ROs

- Update own contact information

BSP is responsible for reporting the following structure information to eSett:

- Registering company as a BSP

- Provide the TSO with sufficient information to register ROs, including the balance responsibility information of the ROs’ reserve resources

- Update own contact information

DSOs have the main responsibility in maintaining the correct and up to date settlement structure. DSO is responsible for reporting the following structure information to eSett, unless some of these responsibilities are taken over by a Metered Data Aggregator:

- Registering company as a DSO

- Updating the structure for consumption MECs within the MGA

- Provide following information: Retailer, MGA, Consumption Type and Validity

- For the Swedish profiling also: BRP, MGA, Consumption Type and Validity on a monthly basis

- Updating the structure for merged production MECs within the MGA

- Provide following information: Retailer, MGA, Production Type, PU Type and Validity

- Updating the structure for PU within the MGA

- Provide following information: MGA, Production Type, PU Type, Validity, Production Unit ID and Capacity (nominal capacity of the PU)

- Updating the structure for production MEC

- Assign a RE to the PU

- The DSO must select a RE for every MGA to handle the MGA imbalance

- Updating own contact information

Metered Data Aggregator maintains the settlement structures related to DSOs. It can be for example a national hub which handles all reporting towards eSett and acts between DSO and eSett. Thus, Metered Data Aggregator handles several responsibilities instead of DSO. Their reporting to eSett includes:

- Updating the structure for consumption MECs within the MGA

- Provide following information: Retailer, MGA, Consumption Type and Validity

- Assign Retailer for every MGA to handle the MGA Imbalance

- Updating the structure for merged production MECs within the MGA

- Provide following information: Retailer, MGA, Production Type, PU Type and Validity

- Updating the structure for PU within the MGA

- Provide following information: MGA, Production Type, PU Type, Validity, Production Unit ID and Capacity (nominal capacity of the PU)

- Updating the structure for production MEC

- Assign a RE to the PU

- Updating own contact information

NEMO is required to register as a BRP and RE in the settlement structure. In addition, NEMO is responsible for reporting occurred PX Market Trades. NEMO is responsible for reporting the following structure information to eSett:

- Registering company as a BRP

- Managing MECs for Day-ahead trades

- Managing MECs for Intraday trades

- Managing MECs for Day-ahead flows

- Managing MECs for Intraday flows

- Managing MECs for Bilateral trades

- Updating own contact information

- NEMO may delegate the performance of tasks related to balance responsibility to the Central Counter Party (CCP) of the NEMO. In that case, all the above-mentioned responsibilities are responsibilities of the CCP

TSOs have, in addition to below mentioned responsibilities, the similar responsibilities as the BRPs (if applicable):

- Determining the MGAs

- Determining which MGAs that will be included in a MBA

- Managing MECs for MGA exchange

- Managing MECs for imbalance adjustment

- Managing ROs

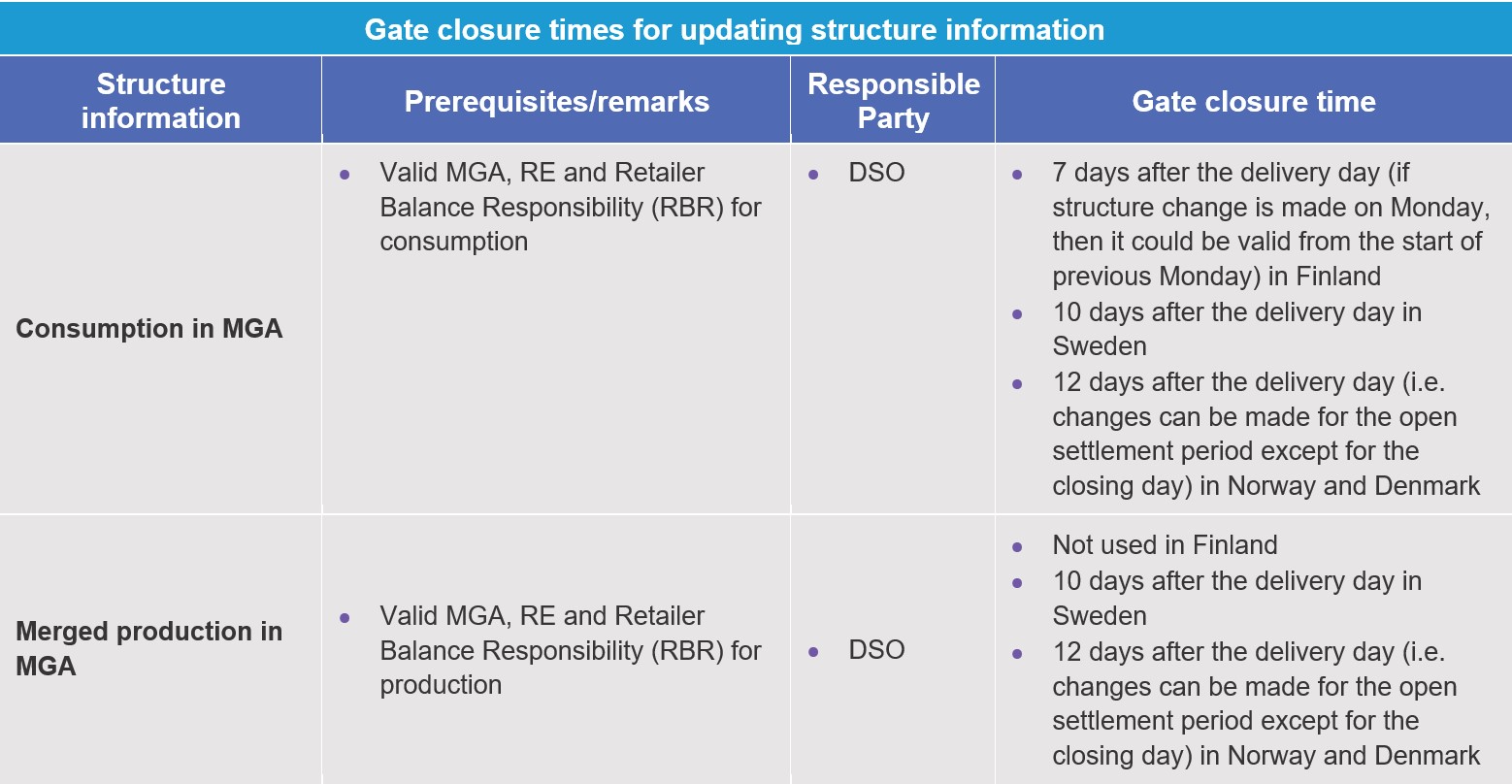

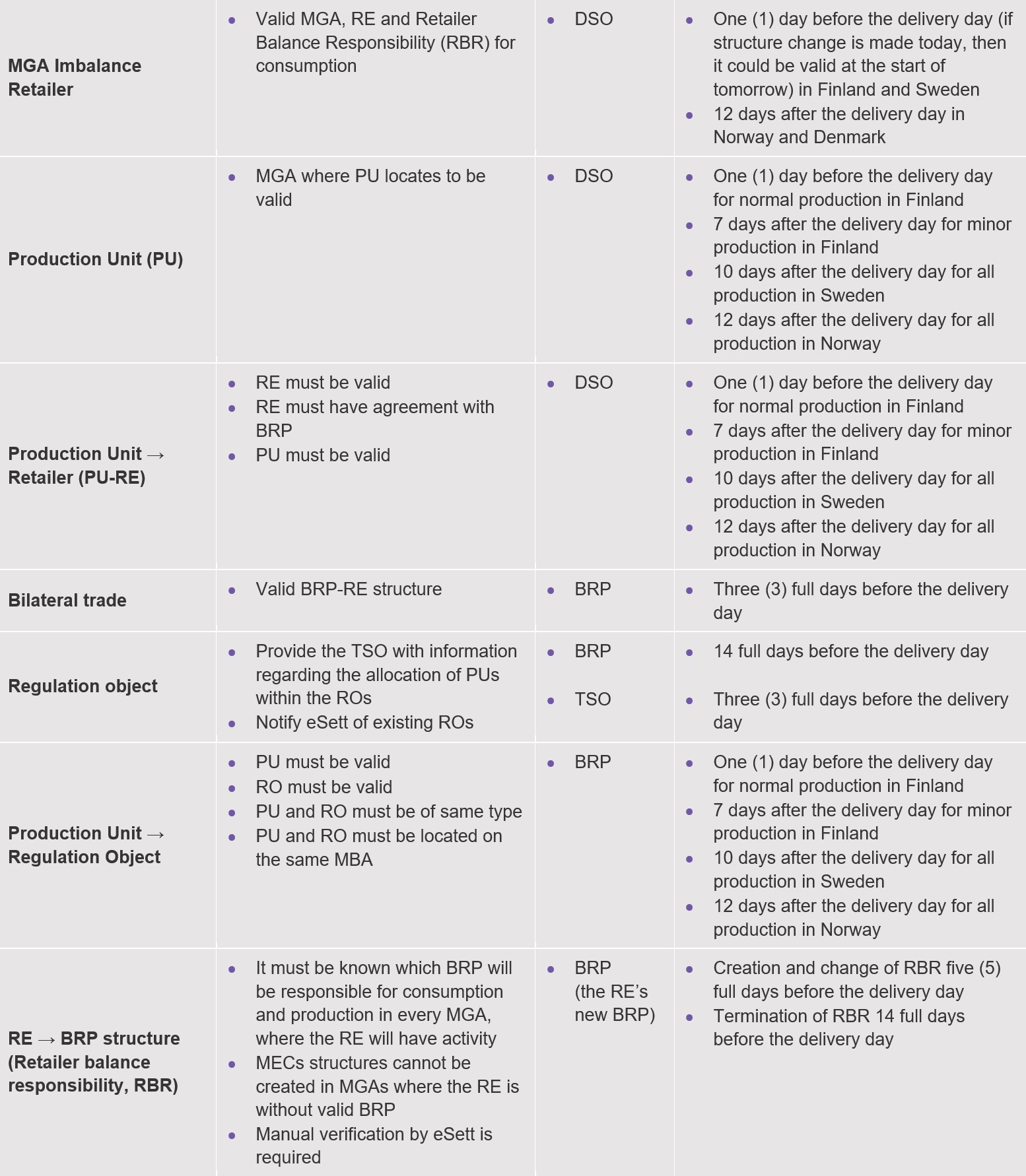

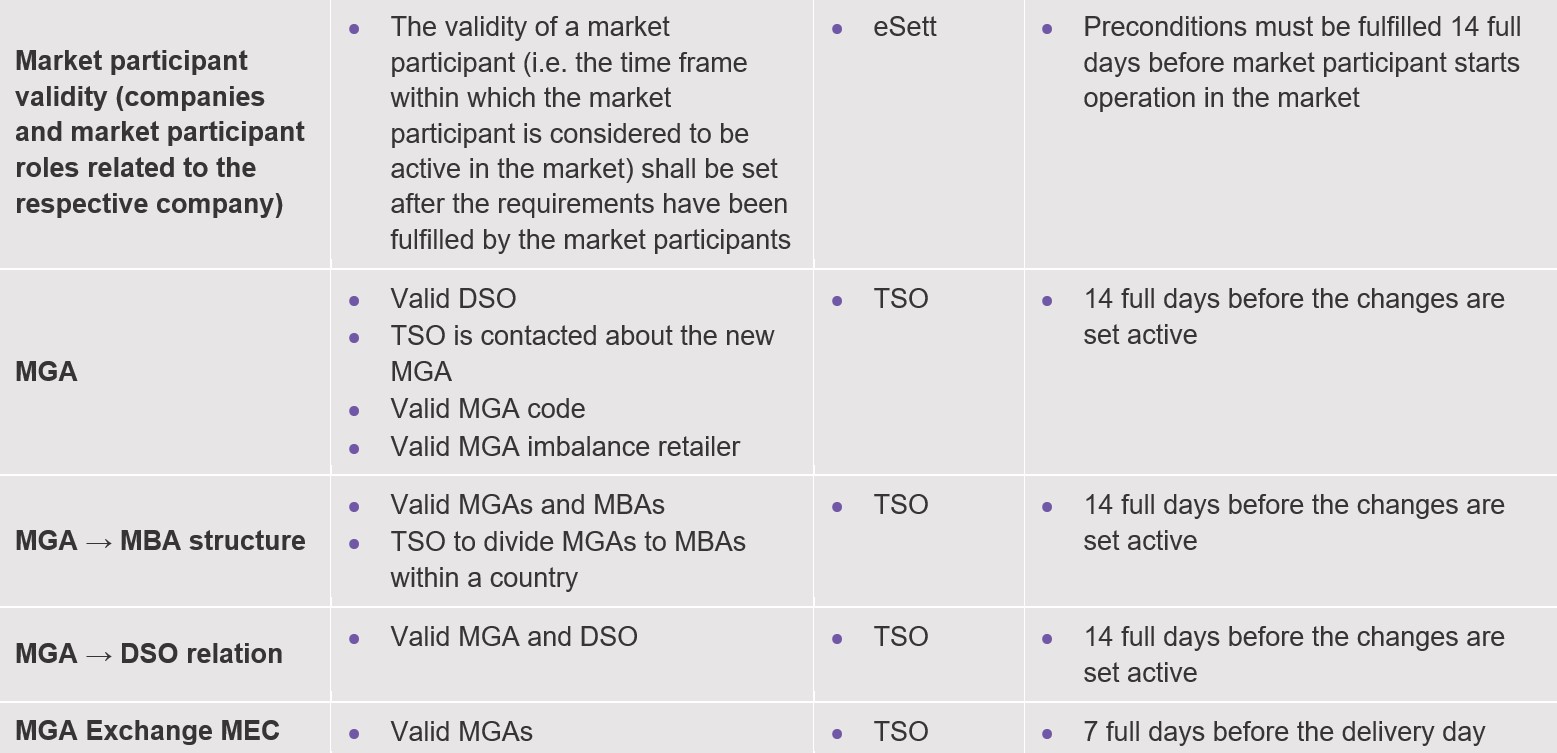

The settlement structure information is to be registered according to the defined gate closure times. The gate closure times per responsible party are described in Table 6.

Table 6. Gate closure times for reporting structure information

Example of the gate closure times for reporting structure information:

New RE that should be registered in the Nordic market:

- The new RE shall provide eSett with required information to register the company. eSett register the new RE and set the RE as valid at the earliest starting from 14 days after all mandatory information has been provided.

- From the day that eSett registers the new RE it will be available for the BRP to register the BRP-RE relation for the specific MGA. Valid start date can earliest be the same as new RE start date but not earlier than 5 days from when the BRP registers the responsibility.

- When the BRP-RE relation is approved by eSett, the DSO will be able to submit the MGA structure (Consumption, Production). Valid from date can earliest be the same as the BRP-RE relation valid start date, given that the DSO submits the structural information.

Already registered and valid RE in the Nordic market:

- A registered and valid RE is already available for the BRP in order to register the BRP-RE relation in the specific MGA. The BRP is required to enter the information at least 5 days prior to when it shall be in operation.

- When the BRP-RE relation is verified by eSett, the DSO will be able to submit the MGA structure. Valid from date can earliest be the same as the BRP-RE relation valid start date, given that the DSO submits the structural information.

In the first example, the process will take at least 14 days. In the second example, the process will take at least 5 days.

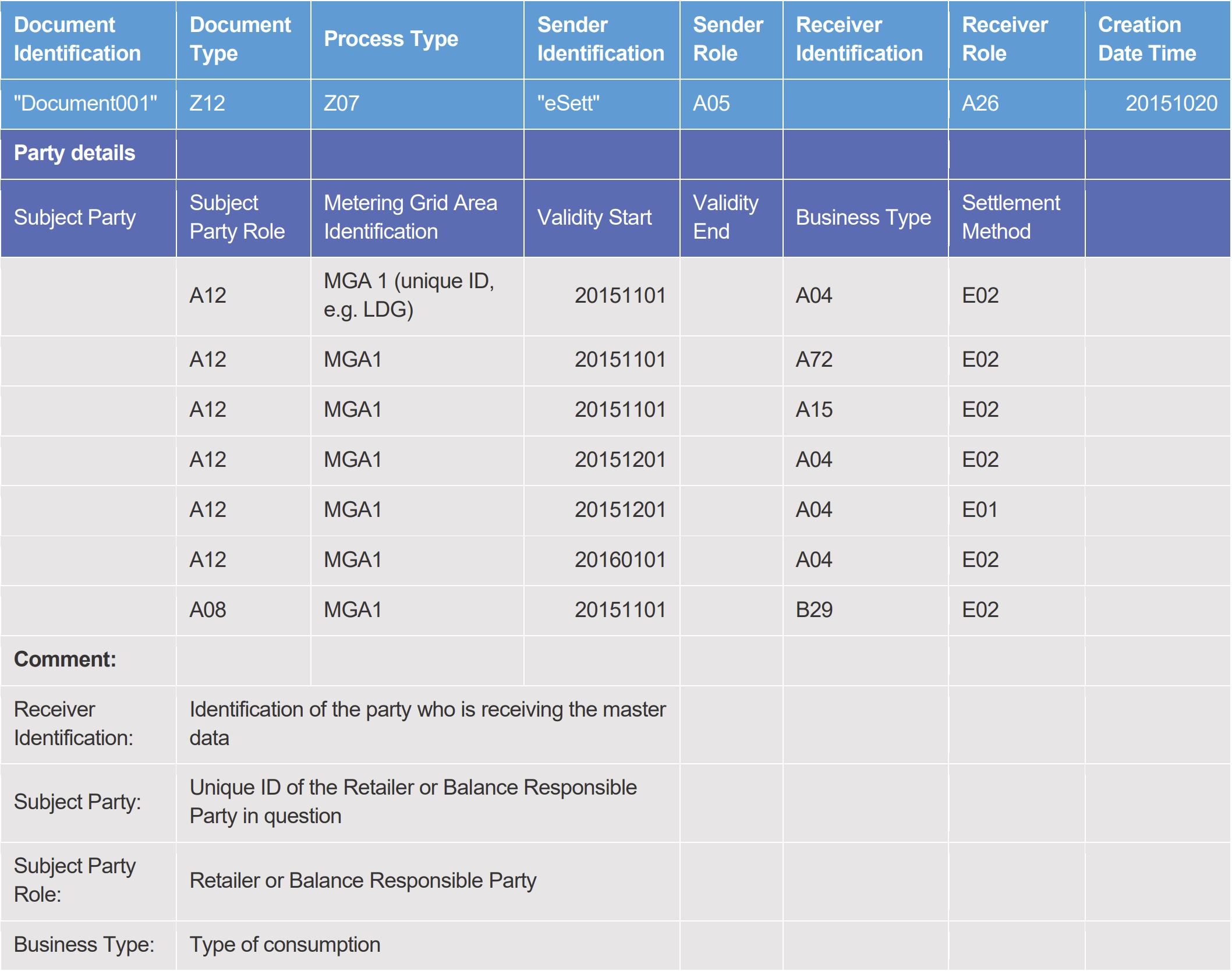

The published structure information in the Online Service will also be provided with an XML-file. Table 7 shows an example of structure information regarding a DSO that will be provided via file. The example is based on the format of the settlement information that will be published on https://ediel.org.

Table 7. Structure report MGA example

The Nordic Settlement Model organises all metered data, exchange, consumption and production, into MGAs. Each MGA is connected to a single MBA and DSO, thus connecting the metered consumption and production as MECs to the imbalance settlement structure.

Reporting of metering data (as further described in chapter 5) is considered as a responsibility of a DSO in the Nordic Settlement Model, including the aggregation of data to RE level. eSett is responsible for aggregation of received metering data on a BRP level for imbalance settlement purposes.

Considering the critical role of the metering data from the imbalance settlement perspective, it is thus important to secure sufficient quality on reported data to ensure accurate imbalance settlement, by minimising variations caused by data quality (e.g. missing or incorrect values) and its timely submission within specified gate closures. Therefore, the quality of reported data will be closely monitored by eSett and reported to related market participants by specific reports and KPIs (see chapter 11 for further information).

This chapter defines and describes the different types of metering data utilised in the Nordic Settlement Model for exchange, production and consumption and how these are expected to be handled by the DSOs in order to report these to eSett.

MGAs are defined nationally by respective TSOs in accordance with national rules and legislation. Therefore, practices can differ between the countries participating in the Nordic Settlement.

In Finland MGAs for imbalance settlement and for consumption and production have been defined in cooperation with Fingrid as a TSO, BRPs and DSOs. Every MGA has to have one responsible DSO for metering and reporting (licence for DSOs networks, licence for closed networks or agreed with Fingrid). There has to be one RE responsible for MGA imbalance within a one MGA.

In Norway the MGAs are defined by the imbalance settlement responsible with support from TSO and DSO. The DSO of the MGA must be responsible for metering and reporting of all metering points within the MGA. All metering points within the MGA must belong to the same MBA. In Norway Elhub reports data to eSett instead of Norwegian DSO.

In Sweden MGAs for imbalance settlement and for consumption and production have been defined in cooperation with Svenska kraftnät as a TSO. The principle is that the MGA is electrically connected, and the distribution is limited to one market balance area. Every MGA has to have one responsible DSO for metering and reporting. One RE is responsible for the losses within a MGA.

In Denmark MGAs for imbalance settlement have been defined in cooperation with Energinet as a TSO. Each MGA has a responsible DSO for metering and reporting of data within the MGA. There has to be one RE responsible for MGA imbalance within a one MGA. In Denmark, DSOs report data to Energinet DataHub, and they will report it to eSett instead of Danish DSOs.

There are three different main types of metered data (or types of metering points) utilised in the Nordic Settlement Model. The identified metering data types are the following:

- Exchange metering point to other MGAs:

- Metered exchange with adjacent MGAs

- Production metering points:

- Metered production per PU

- Metered merged production within the MGA

- Consumption metering points:

- Metered consumption from the MGA, divided into following subtypes:

- Metered consumption

- Metered energy storage consumption

- Pumped (only in Norway)

- Pumped storage (only in Norway)

- Interruptible (only in Sweden)

- Industry over 50 MW (only in Sweden)

- PU Own consumption (only in Finland). Production units own consumption can be separated from the metered consumption by using this type

- Profiled consumption, divided into following subtypes:

- Profiled consumption

- Pumped (only in Norway)

- PU Own consumption (only in Finland).

- Losses, may be divided into following subtypes:

- Metered grid losses

- Profiled grid losses

- Flex-settled losses (Only in Denmark)

- Metered flex-settled consumption (Only in Denmark)

- Metered consumption from the MGA, divided into following subtypes:

Losses shall be calculated in Finland as stated in chapter 5.4.3.4 and it’s not required to separate losses for both metered and profiled losses (metered shall be used and reported to eSett).

The different consumption types are explained in more details in chapter 5.4.3.4.

It is to be noted that a number of country specific types of consumption metering points shall be utilised in the Nordic Settlement Model as highlighted above.

eSett do not regulate how the estimation of missing measurement values shall be done. Practices differ between the countries today. Below information about the national principles has been provided.

The Finnish Energy industry’s directions of how the missing values shall be estimated or replaced are presented in the document “Principles of electricity metering 2024”. The document can be found at https://energia.fi/energiasta/energiamarkkinat/sanomaliikenne/ohjeet_ja_suositukset.

The Swedish directions on how the missing values shall be estimated or replaced are presented in “Elmarknadshandboken”. The document can be found at http://elmarknadshandboken.se/Dokumentation/Texter/NEMHB.pdf.

The Norwegian Elhub project has described the requirements for quality assurance that shall be performed by the DSO before reporting to Elhub. These requirements are presented as standards for validation, estimation and change of metered values. The Norwegian name of the document is “Standard for Validering, Estimering og Endring (VEE) av AMS måleverdier” and can be found at https://elhub.no/.

The Danish market regulation D1 “AFREGNINGSMÅLING OG AFREGNINGSGRUNDLAG” describes handling of and demands for estimation of missing values. The document can be found at Energinet’s homepage with Market regulations: https://energinet.dk/regler/el/elmarked/.

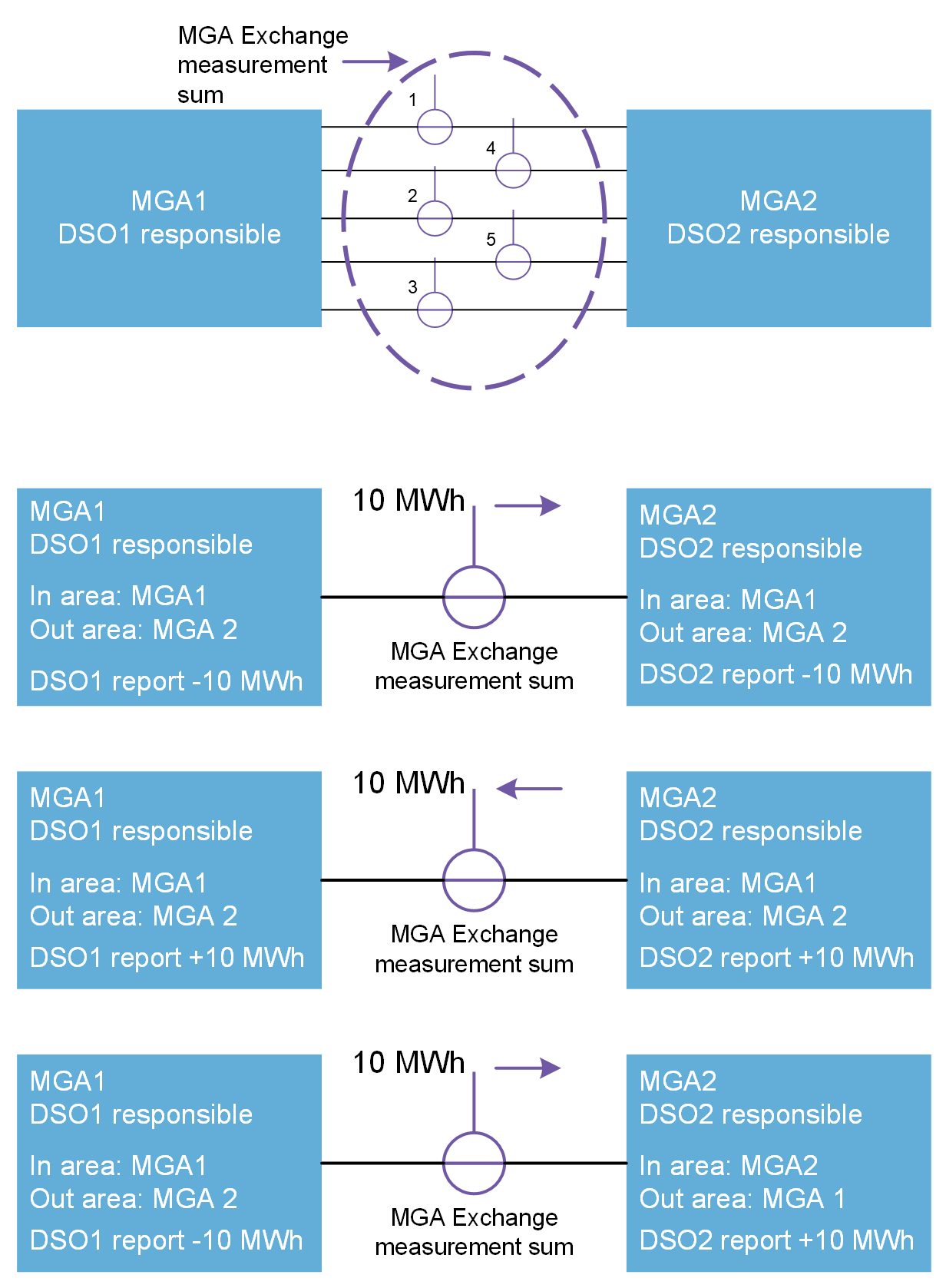

The MGA exchange meters measure the energy flows between the adjacent Metering Grid Areas. The meters measure the exchange in the border points. The DSOs are responsible for the MGA exchange meters (e.g. reporting the values to the imbalance settlement).

The MGA exchange means exchange of energy sum that occurs between adjacent Metering Grid Areas. These sums shall be used in eSett’s imbalance settlement. Both DSOs of the adjacent MGAs shall report the sums to the imbalance settlement, or the DSOs can agree that one of them shall report the sums.

All production metering in the Nordic Imbalance Settlement Model is based on netted metering. Netted metering is defined as metered production after own consumption used for power generation has been subtracted. Until legislation in Denmark, Finland, Norway and Sweden have been harmonised, the Nordic Imbalance Settlement Model will handle both gross and net metered production, which can be metered, aggregated and reported in accordance to principles defined below.

An industry site that also has its own production units are not allowed to net the production with their consumption. Production and consumption should be metered and reported separately to eSett’s imbalance settlement.

The definition of own consumption has not been harmonized. Information about the national principles has been provided below:

- In Finland the legislation for own consumption of the production plant can be found in the document “Kauppa – ja teollisuusministeriön asetus voimalaitosten omakäyttölaitteista”. The document can be found at: https://www.finlex.fi/fi/lainsaadanto/saadoskokoelma/2003/309.

- In Sweden there is no legislation describing own consumption of the production plant.

- In Norway the definition of own consumption of the production plant can be found in the document “Forskrift om elsertifikater” in chapter 3 § 16 “Bestemmelser om måledata og korreksjonsfaktor”.

- In Denmark rules for settlement metering of production in various cases, including handling of own consumption, is described in Market regulation D1 chapter 5 in combination with the document “RETNINGSLINJER FOR UDFØRELSE AF MÅLINGER TIL BRUG FOR NETTOAFREGNING”. Both documents can be found at Energinet’s homepage with Market regulations: https://energinet.dk/regler/el/elmarked/.

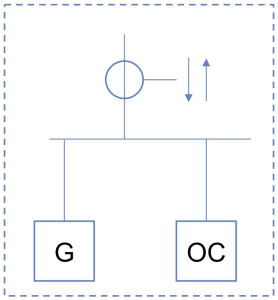

Net metering has been implemented so that both generator and own consumption of the production unit are metered by the same meter. This is illustrated in the Figure 8 below. In this case, the meter is a so-called two-way meter and it is possible to measure energy in both directions. If production energy exceeds the own consumption, it is reported as production. If there is no production during an imbalance settlement period, the own consumption will be reported as consumption (consumption type: PU Own Consumption).

Figure 8. Net metering of production

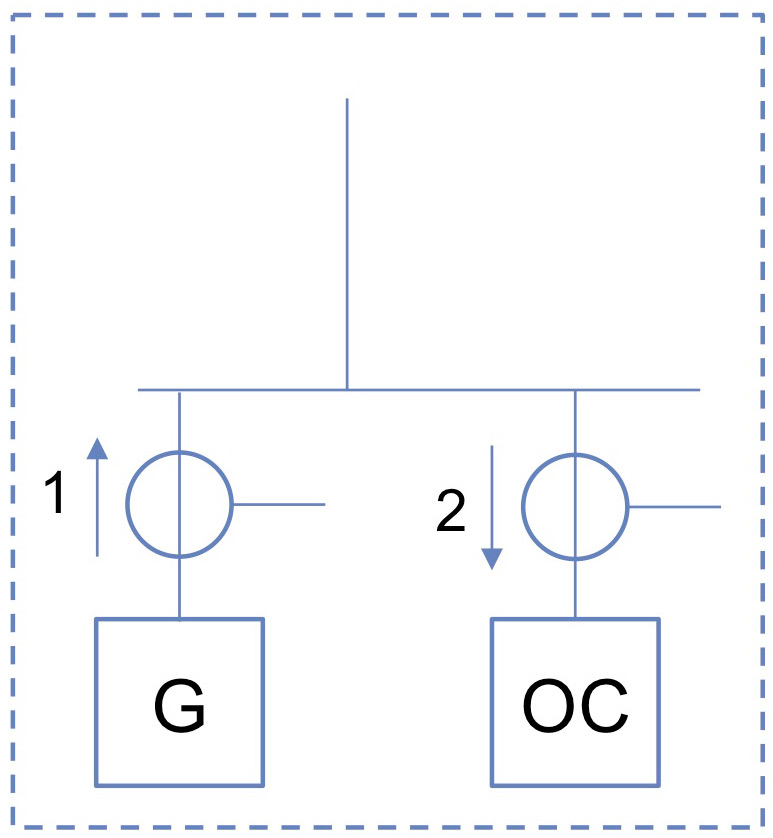

Gross generation is defined as the sum of the electrical energy production by all the generating sets concerned, measured at the output terminals of the main generator. In Figure 9 the principle of gross metering has been described. Meter 1 is for production metering and meter 2 is the metering of own consumption. Meter 1 will be the reported production of the PU. Metered values from Meter 2 will be aggregated together with other meters that the RE has in this MGA before it is reported to eSett.

Figure 9. Gross metering of production

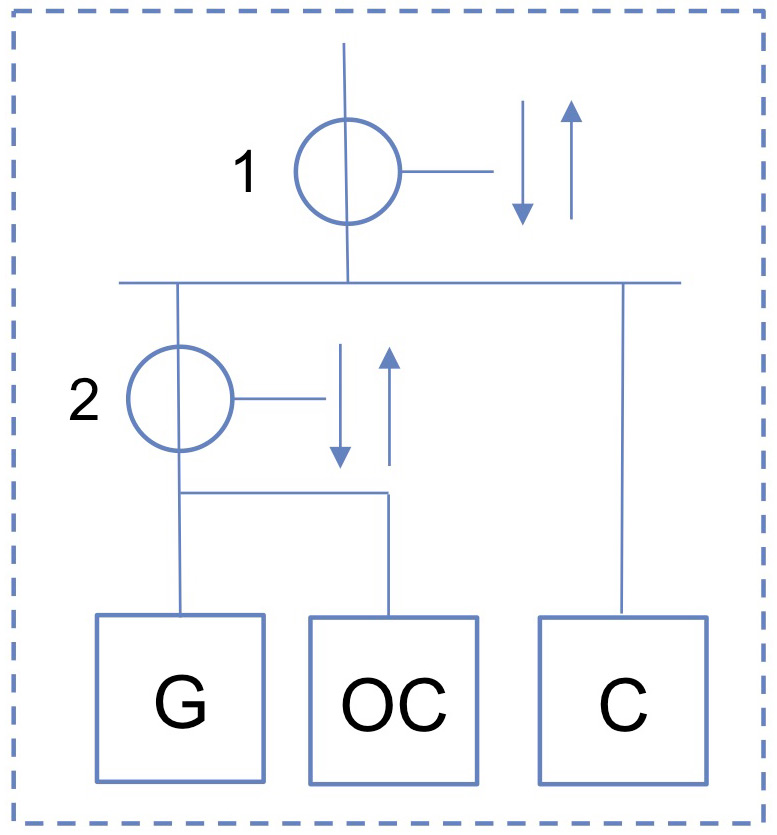

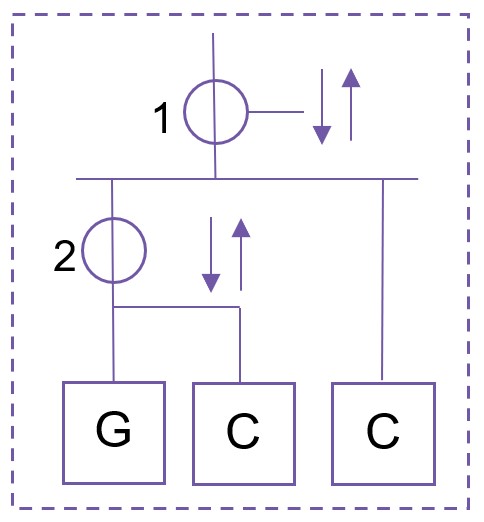

Net metering of PUs with own consumption and an additional consumption (C) may be set up according to Figure 10 (no meter 2 is required for sites with main fuse up to 3x63A in Finland). The additional consumption (C) (e.g. a factory) may not be netted with the production. Only netting of own consumption behind meter 2 is allowed.

Figure 10. Meter for production, own consumption and consumption

Consumption (C) is calculated as: C = (1 – 2)

If the production (2) is ≥ 1 MW the production (2) shall be reported separate from consumption (C). If the DSO doesn´t have this task the plant owner is obliged to organize the site as an own MGA and report production and consumption.

As defined above minor production (e.g. < 1 MW in Finland) can be netted with consumption e.g. in the case when there will be wind turbines and solar panels in a household level. This production will deduct consumption and can be netted with RE’s aggregated consumption in the specific metering grid area. But when this kind of minor production exceeds RE’s consumption in the MGA, it has to be reported separately. Practically (based on e.g. the data formats) the PUs for this kind of minor production need to be established and it’s possible to create a virtual PU to all RE’s minor production in a one specific MGA. It’s always possible to report minor production and consumption separately.

In Finland, reserve power generators, energy storages or other low-power machines over 1 MW that are only intended for temporary use and disturbance management purposes are handled as above defined minor production.

The DSO should, in a settled meter point, meter values at each shift of imbalance settlement period. The DSO is recommended to perform data acquisition as soon as possible after the delivery day.

The handling of consumption metering will be done in accordance with existing national rules.

In Sweden, if the DSO has profiled consumption (monthly meters), they are also obliged to meter or estimate:

- Preliminary profile shares per MGA and BRP

- One load profile share for losses included

- Load profile per MGA

- Final Load Profile Shares per MGA and BRP

- One load profile share for losses included.

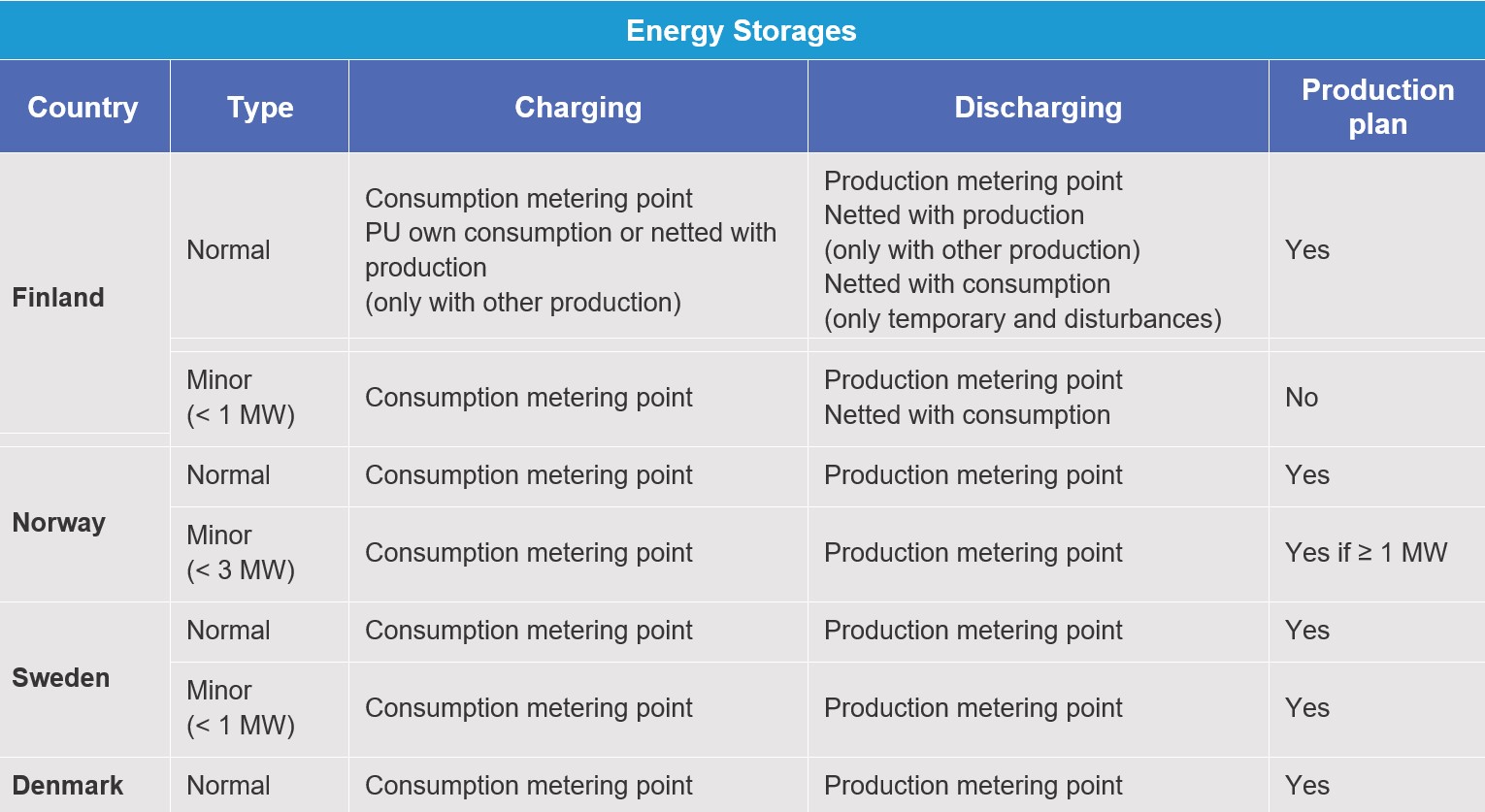

There are not yet harmonized rules, but the main principles for the handling of energy storages are the same

for all countries in the Nordic Imbalance Settlement. There are some national differences that are specified

below.

The main principle is that an energy storage will be registered with two metering points; one for consumption

for when the energy storage is charging, and another for production for when the energy storage is

discharging. Netting between charging and discharging is not allowed for energy storages. A production plan

is required for the discharging always in Denmark and Sweden, and also in Finland and Norway if the energy

storage capacity is 1 MW or higher.

In Denmark, Norway and Sweden there are no specific rules for the metering of energy storages. It is

handled according to the rules for Production metering (discharge) and Consumption metering (charge).

Netting with other metering points is not allowed for energy storages.

The specific rules for Finland have been described in detail in chapter 4.6.1.

Table 8 compiles the cases for handling of energy storages in imbalance settlement per country and type.

Table 8. Handling of energy storages in different countries.

In Finland, following rules are applied depending on the case:

- Energy storage with distribution/national grid:

- Energy storage of 1 MW or larger

- Discharging = Production

- Charging = Consumption

- Production plan is required for the discharging.

- Energy storages that are used for disturbance situations or for temporary use, can be also netted with the consumption.

- Under 1 MW energy storage

- Discharging can be netted with the consumption of the retailer.

- Energy storage of 1 MW or larger

- Energy storage with other production:

- When energy storage is connected to a power plant and the power plant is producing, charging of the energy storage can be handled as an own consumption. Charging and discharging of storage can be netted with the production of the plant.

- If the Power plant is not producing, energy storage will be handled as in with distribution/national grid.

- Energy storage with consumption:

- Under 1 MW energy storage can be netted with the consumption

- Energy storages with capacity of 1 MW or larger, that are used for disturbance situations or for temporary use, can be also netted with the consumption. Otherwise as in with distribution/national grid.

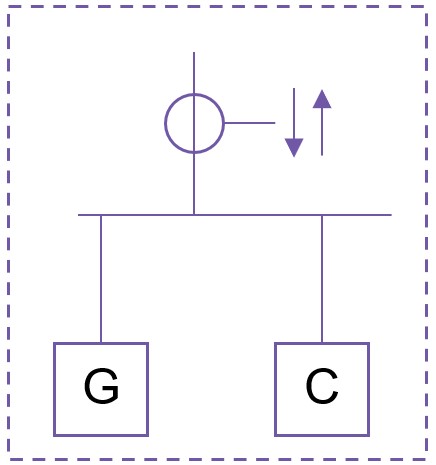

A standalone energy storage has been implemented into a distribution or transmission grid. Both generation (discharge) and consumption (charge) of the energy storage are metered by the same meter. This is illustrated in the Figure 11 below. In this case, the meter is a so-called two-way meter, and it is possible to measure energy in both directions. Both production and consumption during an imbalance settlement period, will be reported individually with type: Energy Storage.

In Finland, if the capacity of the energy storage is < 1 MW, the production can be netted with the other consumption of the same retailer in the area.

Following settlement structures are needed:

- Production metering point with type energy storage.

- Consumption metering point with type energy storage.

Figure 11.Meter for energy storage that can’t be netted with production or consumption.

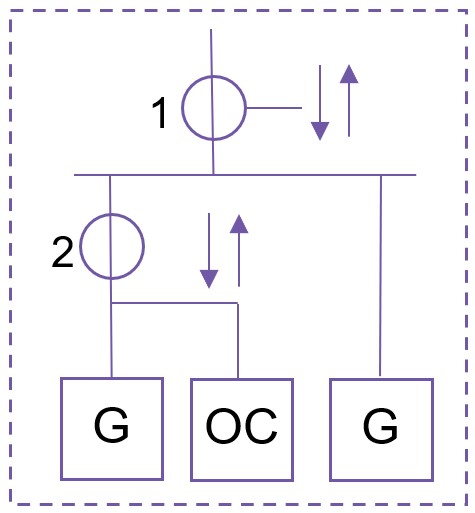

This scenario is only allowed in Finland as described in chapter 4.6.1. An energy storage has been implemented together with production. This is illustrated in the Figure 12 below. Both generation (discharge) and consumption (charge) of the energy storage during an imbalance settlement period, can be netted with the production if the production ≠ 0.

Production (P) is calculated as: P = (1 + 2) if G > 0.

If the other production is zero, then both production and consumption during an imbalance settlement period, will be reported individually with type: Energy Storage.

Following structures are needed:

- Production metering point with the appropriate PU type.

- Consumption metering point with the type of PU Own Consumption if the charging exceeds the production.