Nordic Electricity Market – Q3 2025

During Q3 of 2025, the Nordic electricity market continued to adjust following the launch of the mFRR Energy Activation Market (EAM). Some recovery and market adaptations is seen in price volatility and number of negative prices. Imbalance volumes levels are decreasing in most countries except Sweden. New Market participants with trader activity is still a growing trend in all countries.

Prices

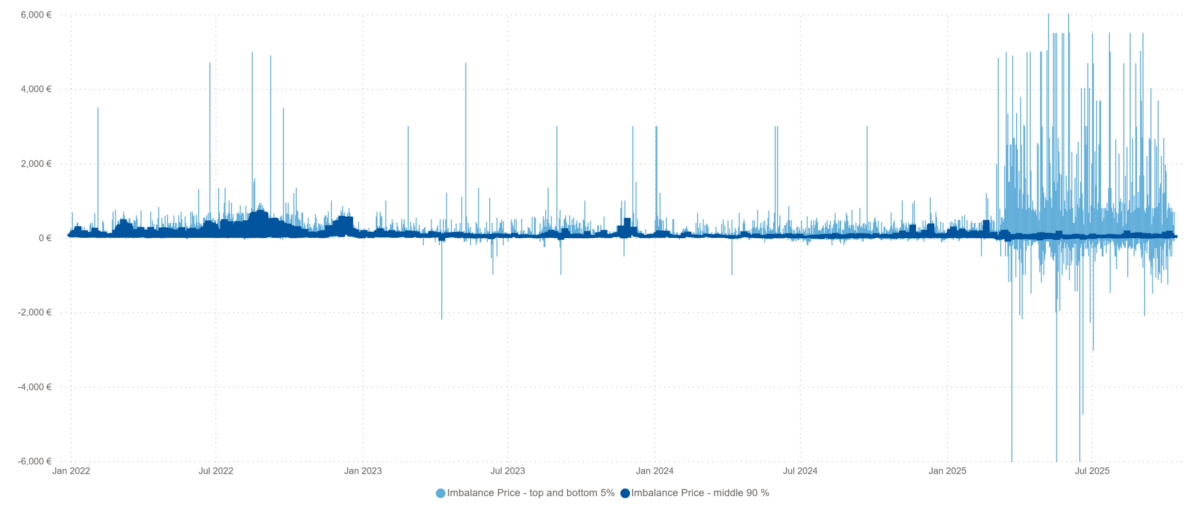

In Q3 2025, the market continued to exhibit significant price volatility, consistent with the instability observed in the aftermath of the mFRR EAM launch on March 4, 2025. While 90% of imbalance prices across Nordic MBAs (dark blue bars) stayed within reasonable limits, the top and bottom 5% of imbalance prices (light blue bars) continued to exhibit significant deviations. Q3 of 2025 showed some decline in price volatility particularly in negative prices, driven by overall market adjustments and manual price interventions by TSOs.

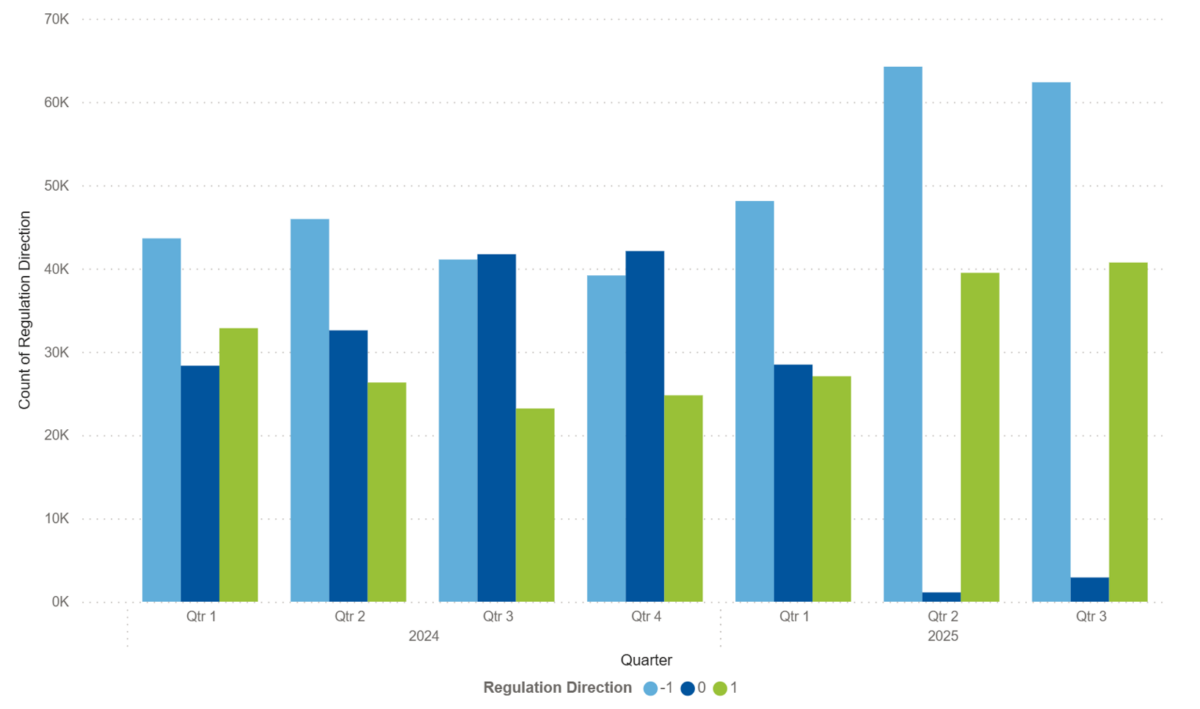

The Q2 data show that one of the most visible changes after the EAM launch is the near disappearance of imbalance settlement periods (ISPs) without a defined regulation direction. The rate of ISPs without a dominating direction increased slightly from 1% in Q2 to 2,7% in Q3.

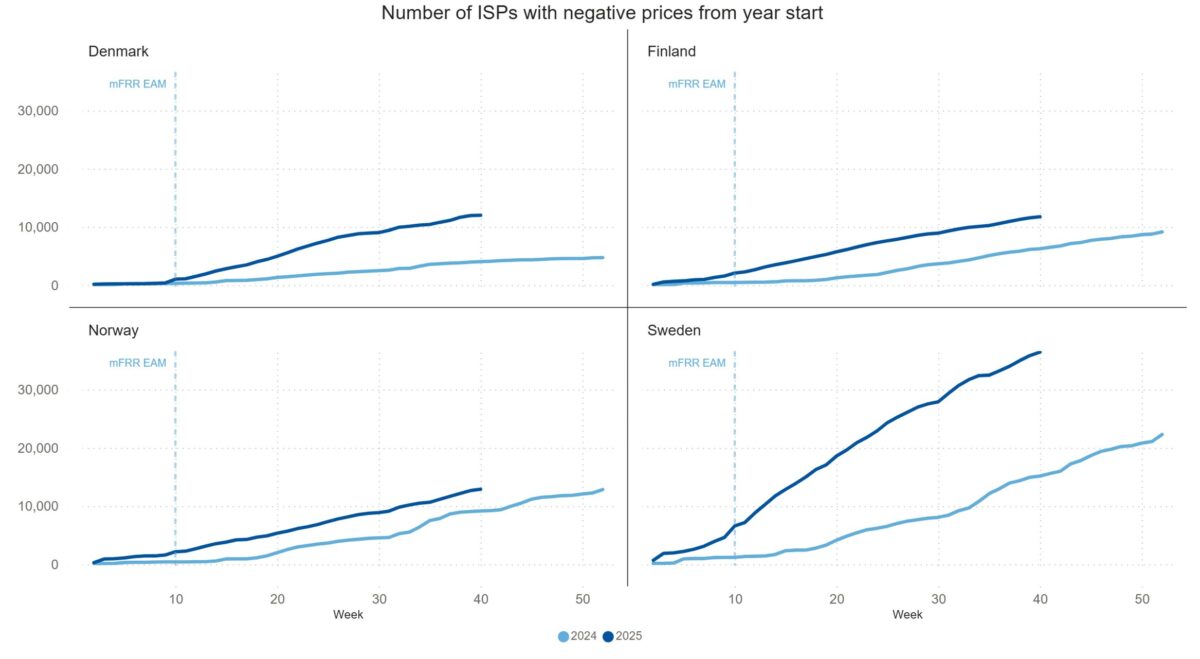

In 2025, the Nordic electricity market has seen increase in ISPs with negative prices. By the end of Q3 of 2025, the number of recorded negative prices in all countries have already surpassed the total of 2024 (graphs below). As the significant growth in negative prices happened after the mFRR EAM go live in Q2, the number of negative prices in Q3 of 2025 have been closer to Q3 of 2024. Denmark and Sweden are projected to experience a substantial increase in negative price occurrences in 2025 relative to 2024.

Imbalance volumes

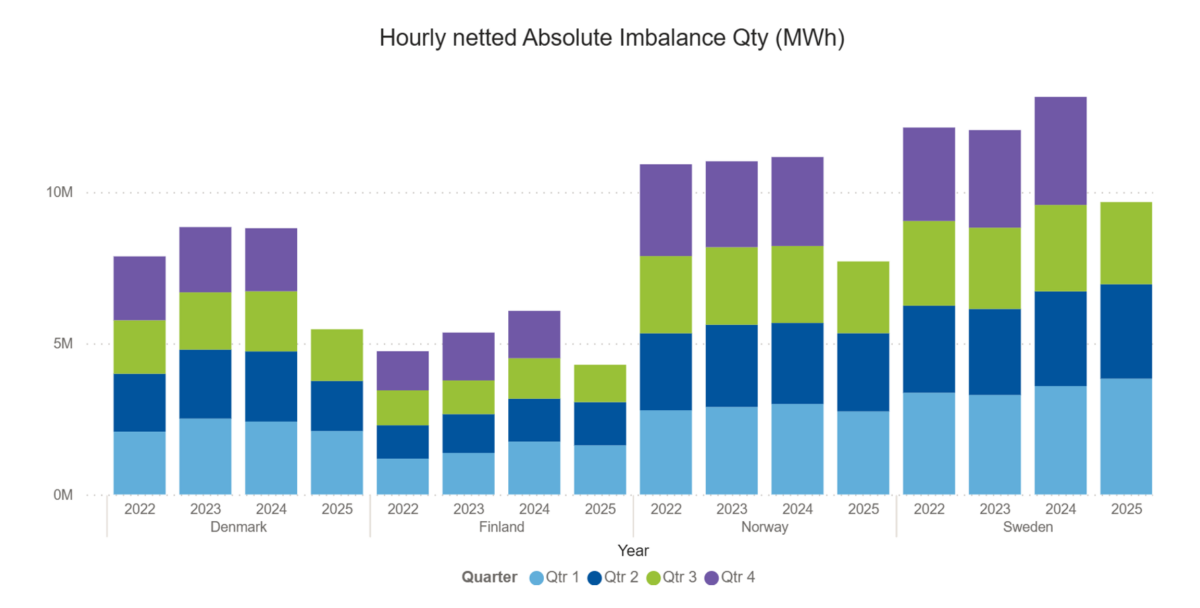

The absolute imbalance volumes recorded in the first three quarters have followed different patterns across the Nordic countries over the past four years. Denmark peaked in 2024 before dropping sharply to its lowest level in 2025 while Sweden has steadily increased since 2023, reaching a new high in 2025. Finland’s volumes remain elevated compared to earlier years despite a slight decline from 2024. Norway’s levels have been largely stable but 2025 record a clear drop.

Focusing on Q3 of 2025 compared to Q3 of 2024, imbalance volumes decreased slightly in all countries. The total absolute imbalance volumes for 2025 compared to 2024 is expected to be decreased in all counties except Sweden.

A closer analysis of imbalances reveals a correlation with price trends. Following the launch of the EAM on March 4, 2025, Nordic Balance Responsible Parties (BRPs) experienced a slight increase in surplus imbalance volumes (column chart above). Due to the high number of negative prices, eSett imbalance purchases (€) shift to sales in Q3 and Q4 (column chart below). When price is negative, BRPs pay for selling surplus imbalance power.

Market participants

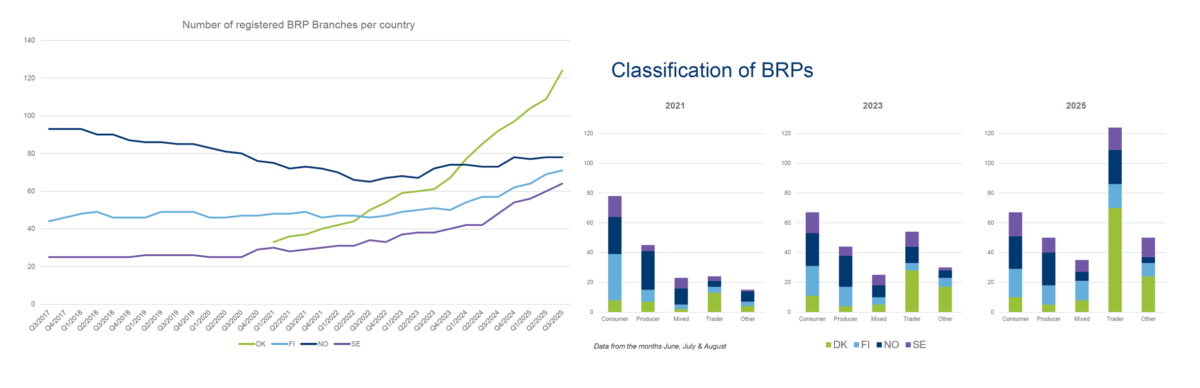

The number of Balance Responsible Parties (BRPs) continued to increase during the third quarter, with Denmark contributing most new entrants to the market. (left line chart). When BRPs are roughly categorized based on their portfolio (right bar charts), new BRPs are mostly traders without physical generation or consumption assets. Their activity is concentrated in the power exchange (PX) market, contributing to liquidity but not directly impacting physical balancing. This trader-heavy growth pattern is consistent across all four Nordic countries. The number of traders has increased 2023 to 2025 mostly in Denmark and Finland (130 %) and slightly less in Norway (100%) and Sweden (50%).

Looking ahead

The landscape of the Nordic power market in 2025 reflects the impact of recent regulatory changes and the adaptation to new operational realities introduced by the mFFR EAM. The high price volatility, rise in negative price events, and the growing role of traders show some market adjustment but are all themes to follow over the next quarter. Entering Q4 of 2025, from 1 October 2025, day-ahead trading transitioned from hourly to 15-minute resolution. This long-awaited change is expected to improve market efficiency and sharpen price signals, supporting more accurate balancing of volatile generation and demand. A review of the October data reveals no significant changes at this stage. Further conclusions will be drawn once the data for the fourth quarter becomes available.