Nordic Electricity Market – Q4 2025

As the Nordic electricity market moves through a period of several changes, Q4 2025 offers a revealing snapshot of how participants, prices, and operational practices continue to evolve.

Shifts in trading behavior, emerging patterns in imbalance pricing, and the growing presence of new BRPs all paint a picture of a market adjusting in real time. This overview brings together the key developments and signals that defined the quarter, setting the stage for the trends that may shape the months ahead. The report is built from the data that is available at the time of imbalance settlement is closed.

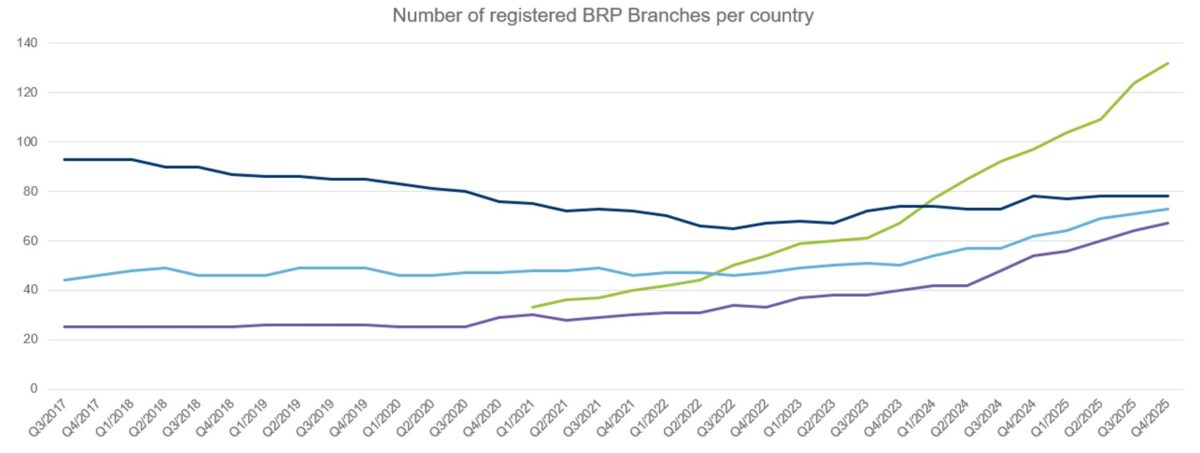

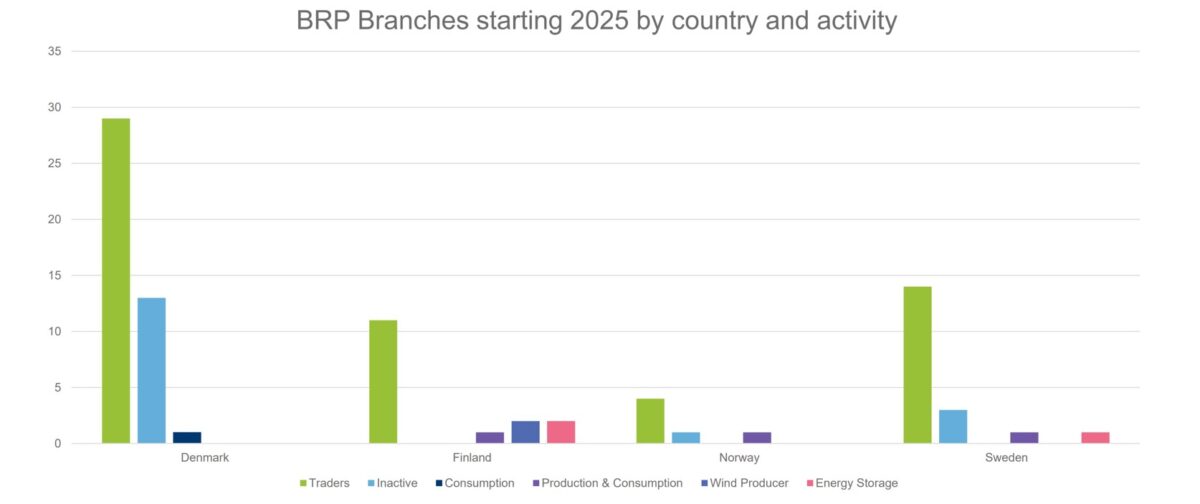

Active Market Participants in Settlement

The amount of active market participants grew in Q4 with some signs of slowing down except for Denmark, where a steady growth was observable for the whole year. Most of the new Balance Responsible Parties (BRPs) in 2025 were trader-BRPs who participate in the power exchanges providing liquidity in the market without having physical production and consumption assets.

Transition to 15-minute day-ahead trading

Starting from Q4, the Nordic day-ahead market transitioned to 15-minute market time unit from 1 hour unifying all energy exchange trading to same resolution. The transition to 15-minute day-ahead trading improves the alignment between market prices and real-time electricity system conditions. Target of shorter trading intervals is to increase market accuracy.

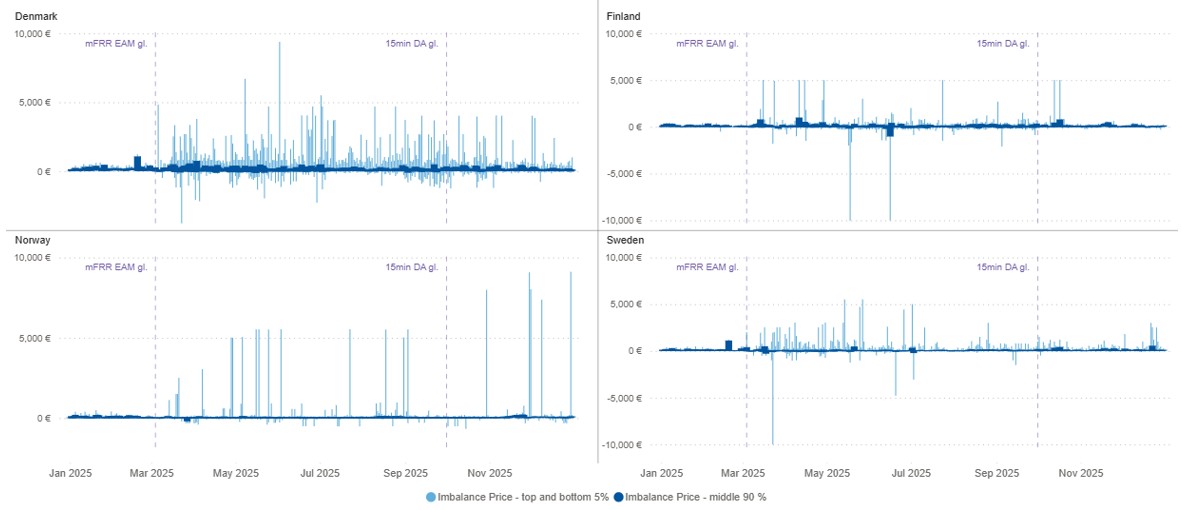

Imbalance Prices

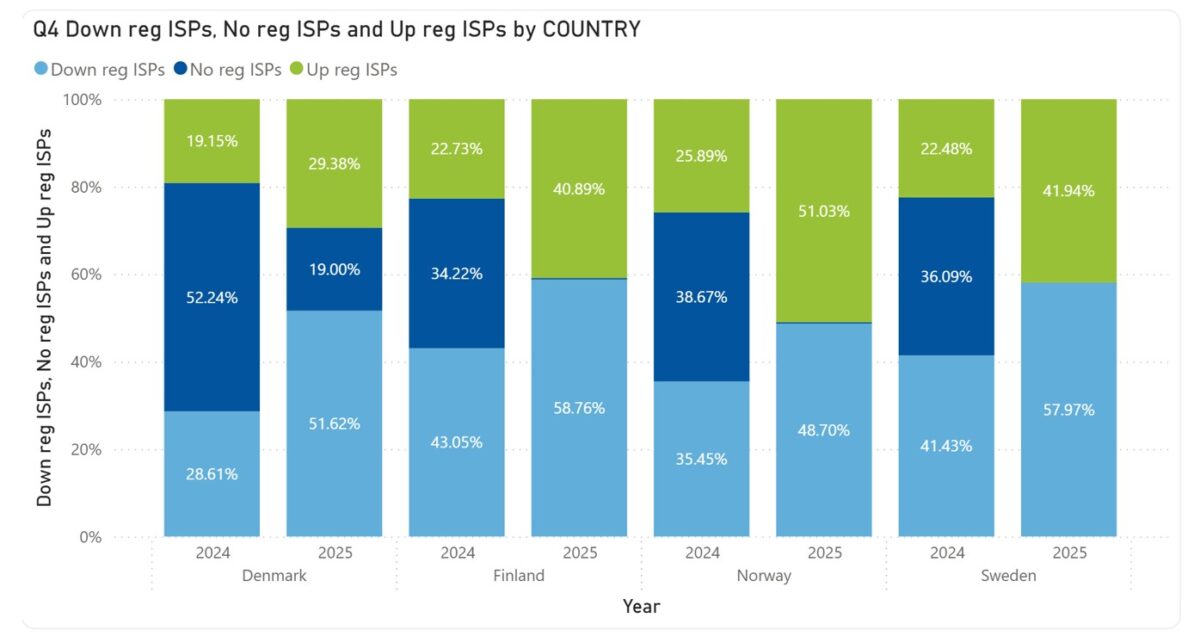

Imbalance prices in Q4 were mostly based on reserve activation pricing given that most of the ISPs have a dominating regulation direction, where reserve activation prices are applied. This trend has continued since EAM Launch on March 4, 2025 apart from Denmark, where a deadband on scheduled mFRR activations was implemented on June 2025.

When comparing Q4 of 2025 and Q4 of 2024 the number of ISPs without regulation direction practically went to zero, Denmark being exception. In Q4-2024 the dominating regulation direction was down in all countries. Q4 of 2025 shows that this applies still today except for Norway, where the main regulation direction was up.

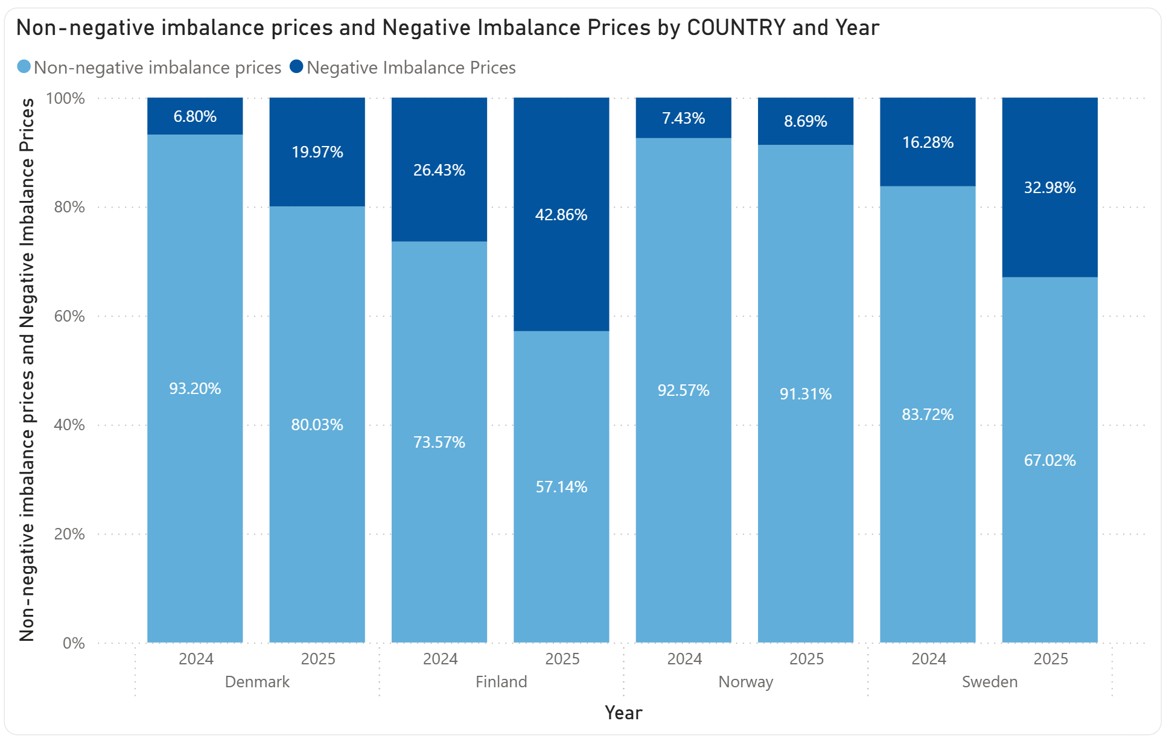

The number of negative imbalance prices rose in 2025 in all countries. Finland saw the highest increase, where over 40% of ISPs had a negative imbalance price. Negative imbalance price means that BRPs sell their imbalance to eSett at negative price and vice-versa, leading to a loss in the case of an imbalance surplus.

Price volatility in Q4 overall has shown slight decrease in Denmark, Finland and Sweden. In Q4 the peak pricing was mostly positive with some negative prices in Denmark. Norway saw most of near peak prices of 10 000 €/MWh.

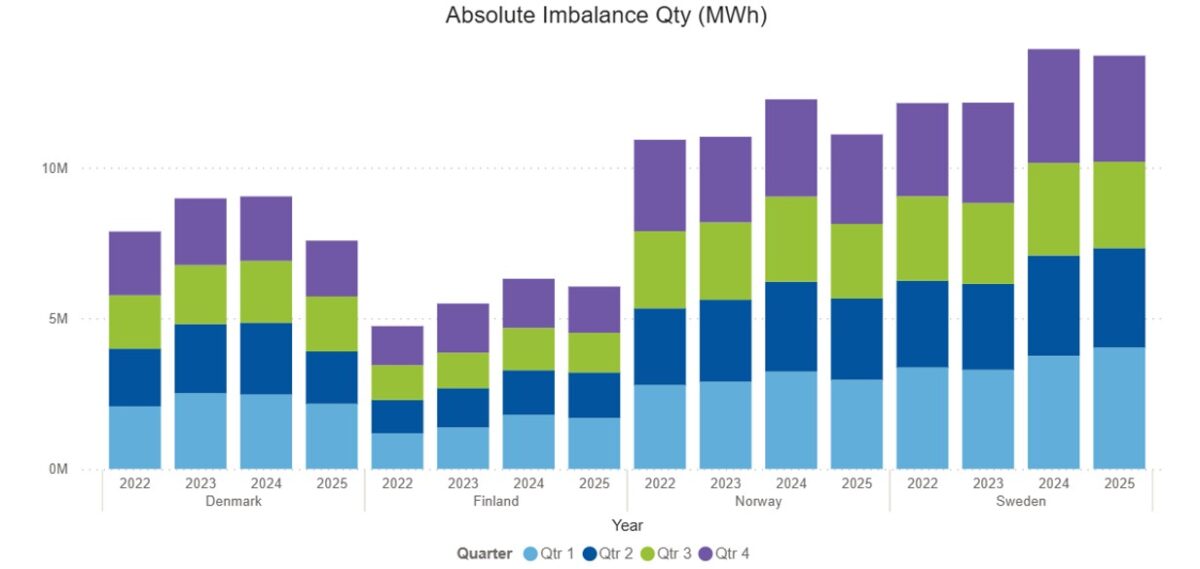

Imbalance volumes

In 2025, the total absolute imbalance quantity decreased in all countries compared to year 2024. Most significant decrease is visible in Denmark and Norway while Finland and Sweden show more moderate decrease.

When comparing Q4 of 2025 against Q4 of 2024 the absolute imbalance quantity decreased in all countries.

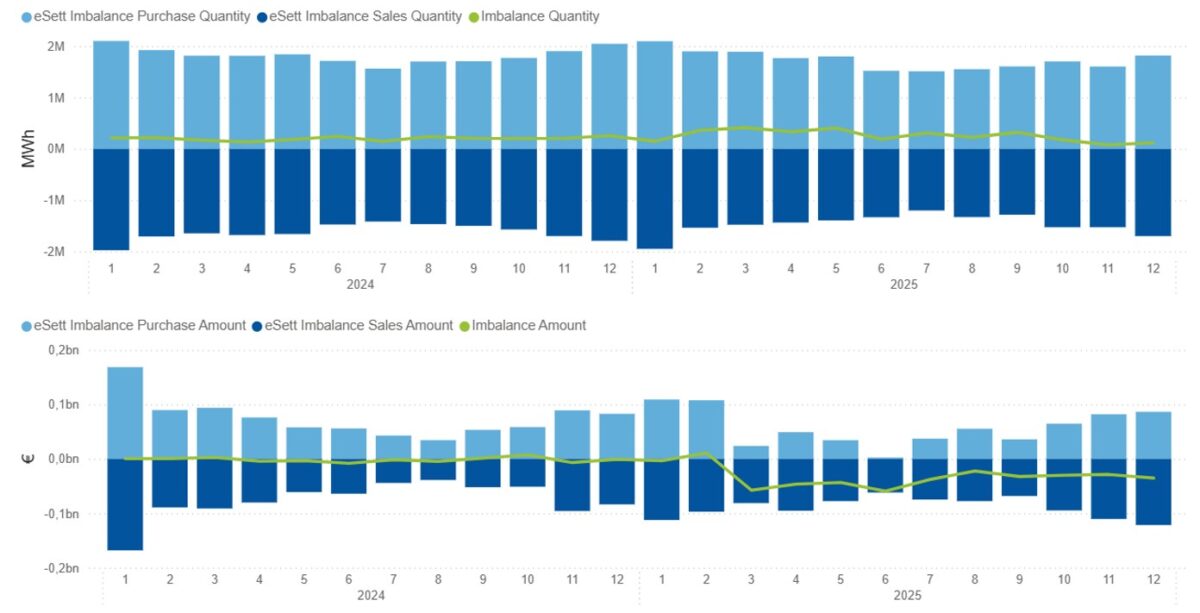

The total net imbalance quantity (MWh) stayed positive in Q4 of 2025 following similar, meaning that there was imbalance surplus on the Nordic level, patterns as previous year. The increase of negative imbalance prices reflects in the total imbalance amount purchased by eSett. The net imbalance amount (€) stayed negative for the end of the year. Whether this will become a permanent trend remains to be seen.

Looking ahead

The move to 15‑minute trading will continue shaping trading behavior and imbalance management as participants refine their forecasting and operations. Trader BRPs are expected to remain active contributors to market liquidity, though the pace of new entries may level off.

With imbalance quantities decreasing across all countries, operational efficiency appears to be improving.