Nordic Electricity Market Q1 2025

The first quarter of 2025 has been a period of significant development in the Nordic energy market, particularly concerning the implementation of the 15-minute imbalance settlement period (ISP) and its impact on market operations.

Transition to 15-Minute Imbalance Settlement Period

The transition to a 15-minute ISP has continued to influence market dynamics into 2025. This change was designed to enhance the accuracy of balancing production and consumption, reflecting the evolving nature of energy generation and consumption patterns. By early 2025, all Nordic countries had integrated the 15-minute ISP into their operations. March 2025 cross-border Intraday trading switched from hourly resolution to 15-minute resolution and additionally, imbalance prices and dominating directions are calculated separately for each 15-minute ISP. The adoption of the 15-minute ISP has led to more granular data collection, allowing for a detailed analysis of imbalance prices and volumes.

Imbalance Prices and Volumes

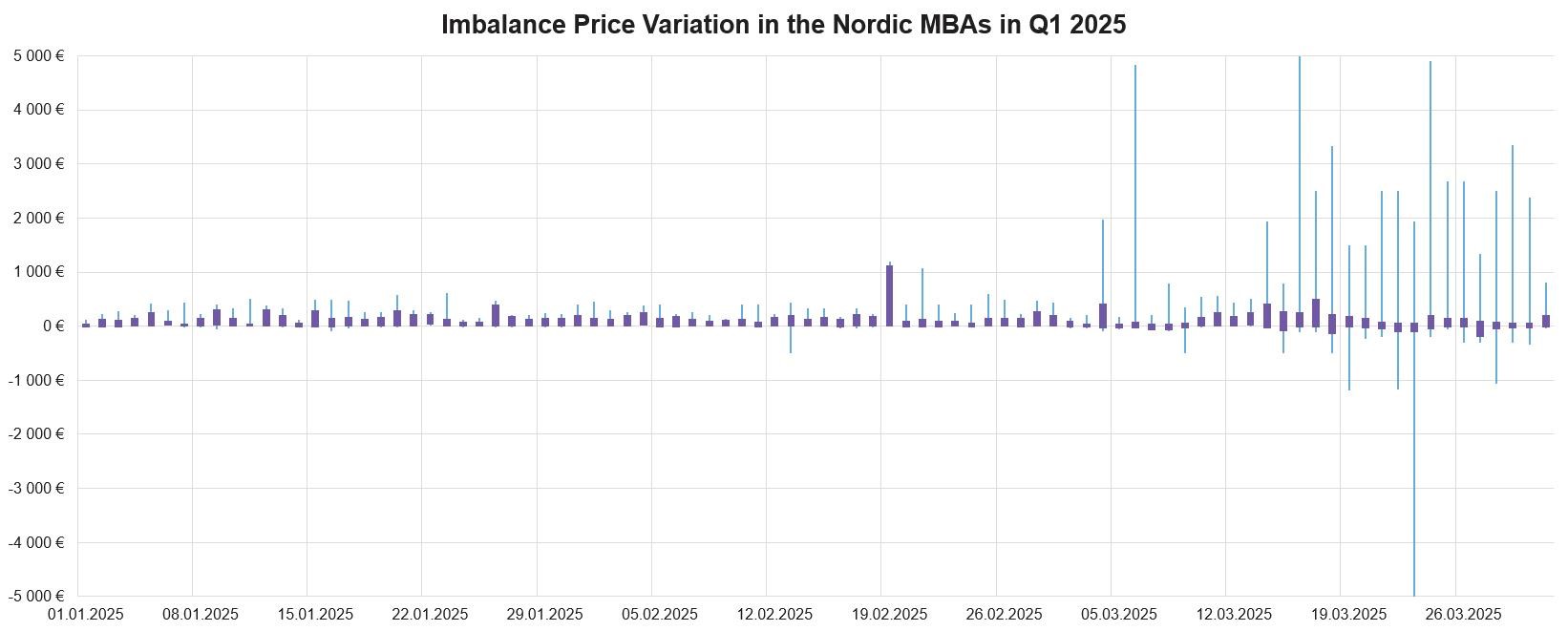

In Q1 2025, data suggests that the imbalance prices have more fluctuation and makes it more crucial for Balance Responsible Parties (BRPs) to balance themselves within the 15-minute imbalance settlement periods. 90 % of the 15-minute prices in all Nordic MBAs (purple bar) were still within reasonable boundaries. However, the top and bottom 5 % (blue lines) of the imbalance prices have consistently shown significantly higher and lower prices starting from the 4 March 2025.

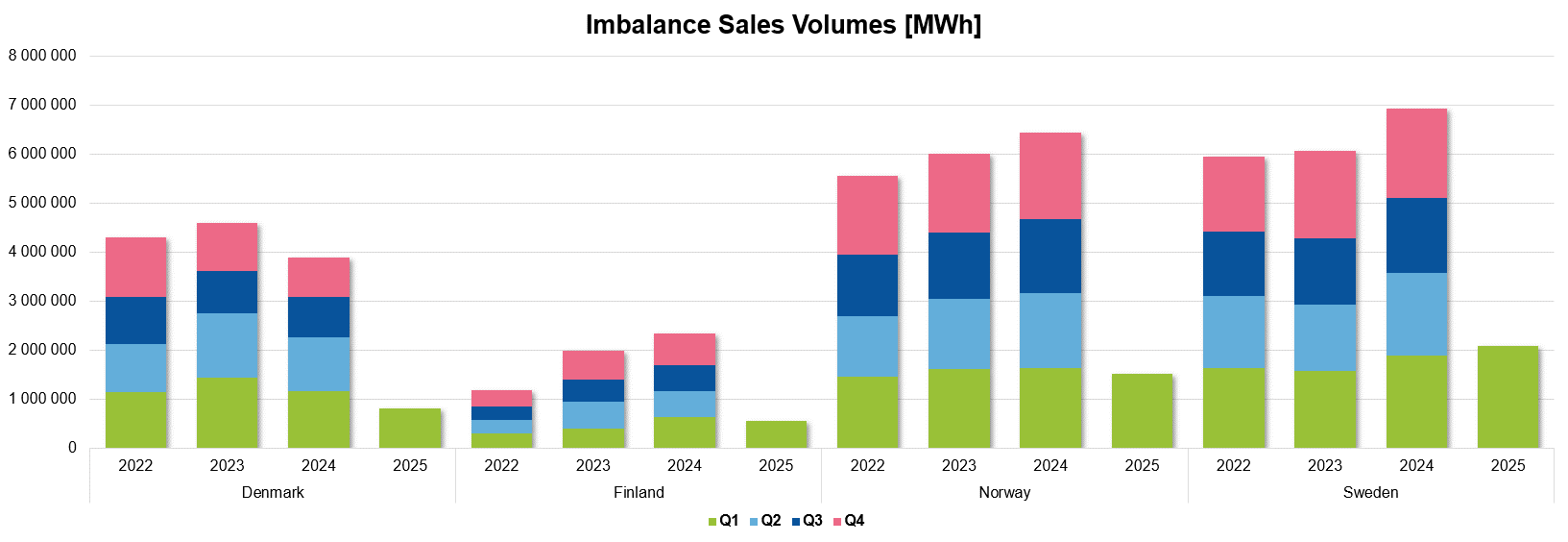

Imbalance volumes have also shown notable trends. The total imbalance sales volumes settled by eSett reached 4,96 TWh in Q1 2025, marking a 6,9 % decrease from 2024. Denmark experienced a significant decrease of 31,4 %, while Sweden displayed a significant growth rate of 10,7 %. Finland and Norway saw decreased rates of 14 % and 6,8 %, respectively.

Market Participant Adaptation

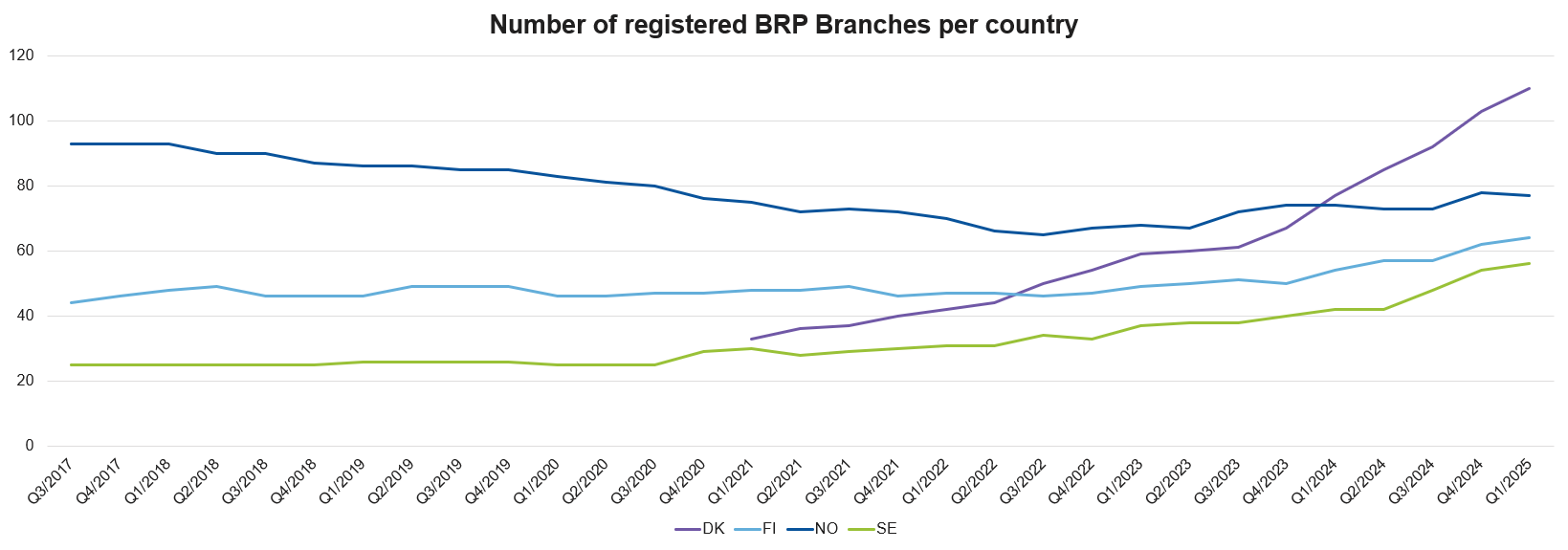

The number of Balance Responsible Parties has continued to grow, increasing from 245 at the end of 2024 to 253 by the end of Q1 2025. Denmark experienced the most significant growth, with BRPs rising from 103 to 110 during Q1 2025. As of early 2025, 32 % of BRPs in the Nordic region are operating across multiple countries, indicating a trend towards greater regional integration.

The number of Balance Service Providers (BSPs) has reached 50 at the end of Q1 2025.

Trading volumes

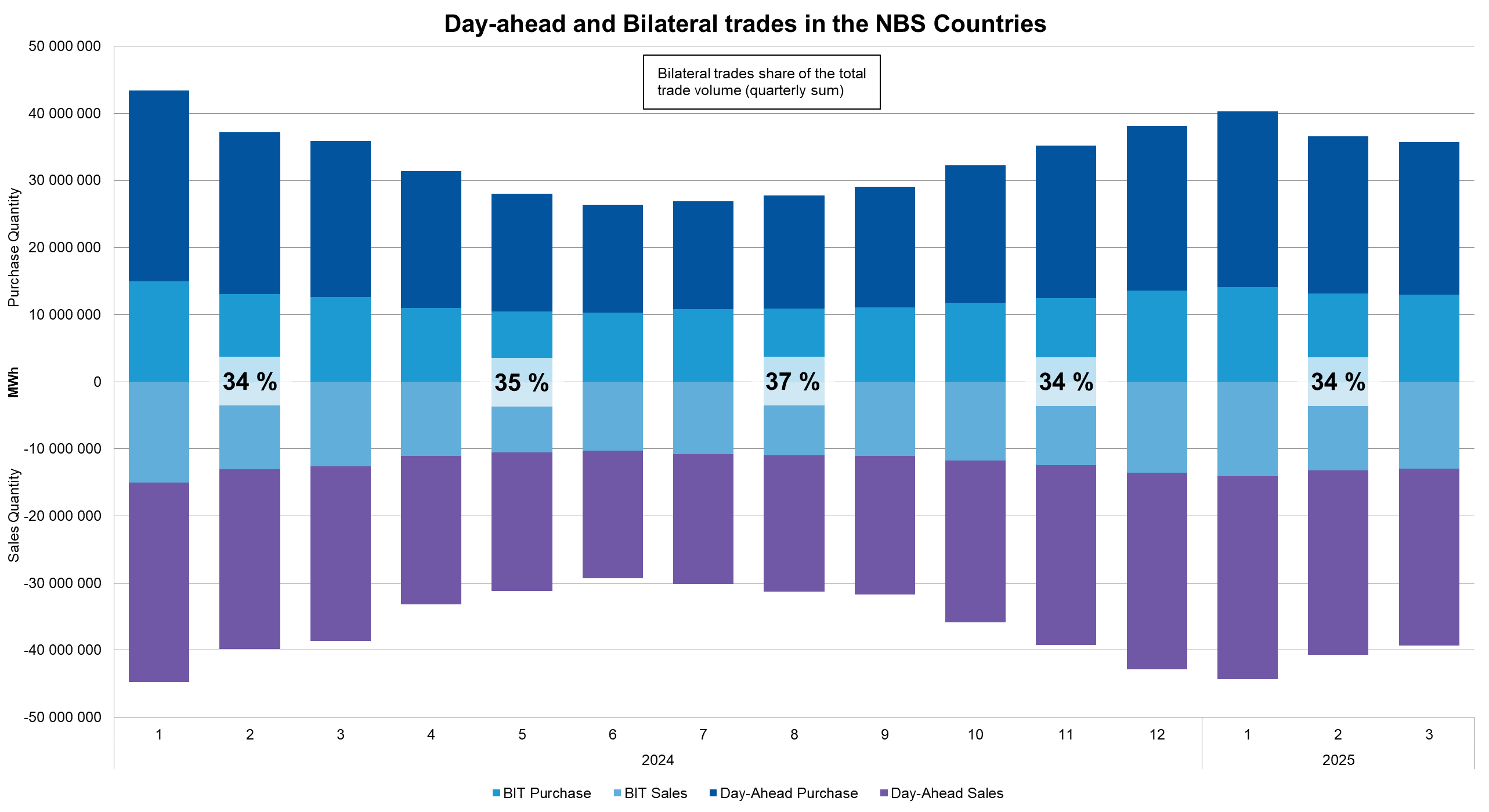

The trading volumes from the start of Q1 2024 to end of Q1 2025 don’t display any significant changes compared to previous years. Absolute trade volumes are highest in January, totalling to about 88 TWh in 2024. In June 2024 the trade volumes reached their lowest point with an absolute total of about 56 TWh being only 63 % of the January’s volumes. The data from Q1 2025 shows that the purchase quantities have decreased a bit from the Q1 2024, but the sales quantities have even increased a bit. Possible reasons are temperate winter, increased wind production capacity and increase of export volume outside the Nordic countries. The share of bilateral trades from the total trade volume appears to be quite constant over different quarters, with the possible exception being Q3 2024. A possible cause is that bilateral trade quantities might be more fixed volume contracts while the day-ahead trading is based more on supply and demand.

Future Outlook

The successful implementation of the 15-minute ISP sets the stage for further advancements in the Nordic energy market. The transition to a 15-minute market time unit in the day-ahead market is planned for June 2025, aligning with European Union regulations. This move is expected to enhance market efficiency and provide more accurate price signals, benefiting both producers and consumers.

In conclusion, Q1 2025 has been marked by the consolidation of the 15-minute ISP across the Nordic countries, leading to more precise imbalance management and fostering greater regional market integration. These developments are poised to support the ongoing evolution of the Nordic energy market towards increased efficiency and sustainability.